Where Couchbase Stands With Analysts

Author: Benzinga Insights | September 05, 2025 03:00pm

Throughout the last three months, 11 analysts have evaluated Couchbase (NASDAQ:BASE), offering a diverse set of opinions from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

1 |

10 |

0 |

0 |

| Last 30D |

0 |

0 |

2 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

0 |

1 |

8 |

0 |

0 |

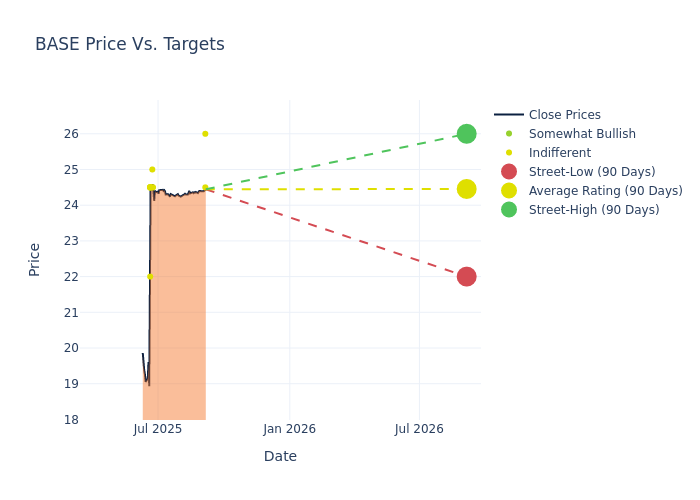

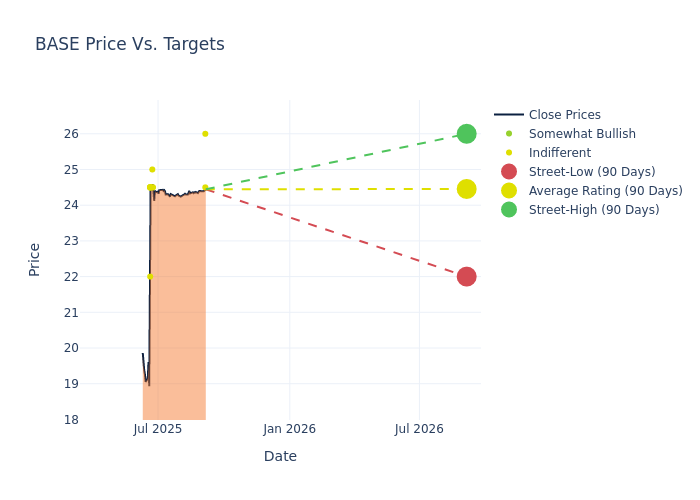

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $24.45, a high estimate of $26.00, and a low estimate of $22.00. Surpassing the previous average price target of $22.00, the current average has increased by 11.14%.

Breaking Down Analyst Ratings: A Detailed Examination

A clear picture of Couchbase's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Austin Dietz |

UBS |

Raises |

Neutral |

$24.50 |

$20.00 |

| Howard Ma |

Guggenheim |

Maintains |

Neutral |

$26.00 |

$26.00 |

| Brad Reback |

Stifel |

Raises |

Hold |

$24.50 |

$22.00 |

| Miller Jump |

Truist Securities |

Raises |

Hold |

$24.50 |

$21.00 |

| Rob Oliver |

Baird |

Raises |

Neutral |

$25.00 |

$22.00 |

| Blair Abernethy |

Rosenblatt |

Raises |

Neutral |

$24.50 |

$22.00 |

| Mike Cikos |

Needham |

Maintains |

Hold |

$22.00 |

$22.00 |

| Brent Bracelin |

Piper Sandler |

Raises |

Neutral |

$24.50 |

$20.00 |

| Andrew Nowinski |

Wells Fargo |

Raises |

Equal-Weight |

$24.50 |

$20.00 |

| Raimo Lenschow |

Barclays |

Raises |

Overweight |

$24.50 |

$22.00 |

| Rudy Kessinger |

DA Davidson |

Lowers |

Neutral |

$24.50 |

$25.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Couchbase. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Couchbase compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Couchbase's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Couchbase's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Couchbase analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Discovering Couchbase: A Closer Look

Couchbase Inc provides a modern cloud database that offers the robust capabilities required for business-critical applications on a scalable and available platform. It empower developers and architects to build, deploy and run mission-critical applications. Couchbase delivers a high-performance, flexible and scalable modern database that runs across the data center and any cloud. Geographically, the company generates a majority of its revenue from the United States.

A Deep Dive into Couchbase's Financials

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Couchbase's revenue growth over a period of 3M has been noteworthy. As of 31 July, 2025, the company achieved a revenue growth rate of approximately 1.85%. This indicates a substantial increase in the company's top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Couchbase's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of -41.32%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of -19.02%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Couchbase's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of -9.56%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Couchbase's debt-to-equity ratio is below the industry average. With a ratio of 0.07, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Significance of Analyst Ratings Explained

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: BASE