4 Analysts Have This To Say About ANI Pharmaceuticals

Author: Benzinga Insights | September 08, 2025 03:00pm

In the last three months, 4 analysts have published ratings on ANI Pharmaceuticals (NASDAQ:ANIP), offering a diverse range of perspectives from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

3 |

0 |

1 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

0 |

0 |

1 |

0 |

0 |

| 2M Ago |

2 |

0 |

0 |

0 |

0 |

| 3M Ago |

0 |

0 |

0 |

0 |

0 |

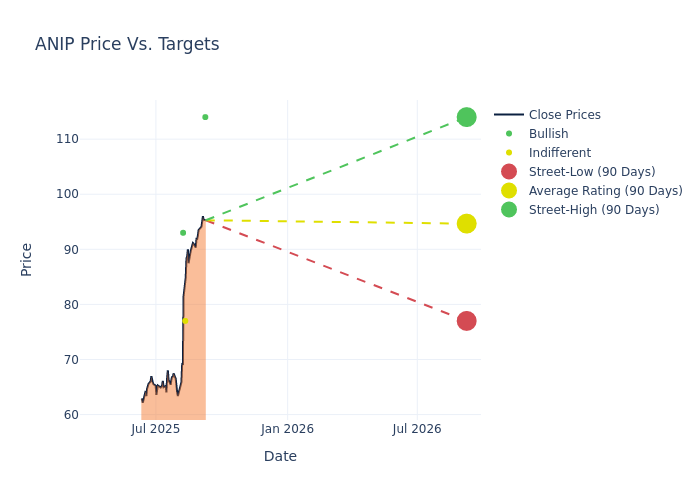

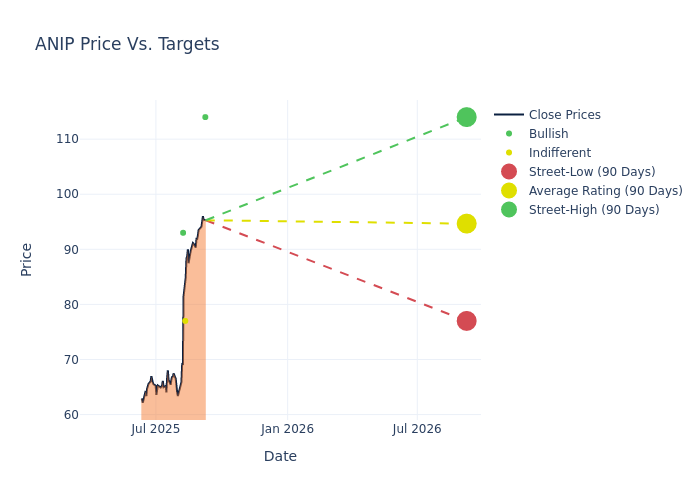

Analysts have recently evaluated ANI Pharmaceuticals and provided 12-month price targets. The average target is $92.0, accompanied by a high estimate of $114.00 and a low estimate of $77.00. This upward trend is evident, with the current average reflecting a 17.45% increase from the previous average price target of $78.33.

Interpreting Analyst Ratings: A Closer Look

The standing of ANI Pharmaceuticals among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Vamil Divan |

Guggenheim |

Raises |

Buy |

$114.00 |

$86.00 |

| Gregory Fraser |

Truist Securities |

Raises |

Hold |

$77.00 |

$65.00 |

| Brandon Folkes |

HC Wainwright & Co. |

Raises |

Buy |

$93.00 |

$84.00 |

| Brandon Folkes |

HC Wainwright & Co. |

Announces |

Buy |

$84.00 |

- |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to ANI Pharmaceuticals. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of ANI Pharmaceuticals compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for ANI Pharmaceuticals's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

For valuable insights into ANI Pharmaceuticals's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on ANI Pharmaceuticals analyst ratings.

Discovering ANI Pharmaceuticals: A Closer Look

ANI Pharmaceuticals Inc develops, manufactures, and markets generic prescription pharmaceuticals. It manufactures liquid, powder, and oral solid-dose products. Its areas of product development include narcotics, oncolytics, hormones and steroids, and complex formulations involving extended-release and combination products. Some of its generic products include Erythromycin ethyl succinate, Esterified Estrogen with Methyltestosterone (EEMT), Etodolac Fenofibrate, Fluvoxamine, Hydrocortisone Enema and Vancomycin. The company operates in two segments which include Rare Diseases and Brands, Generics, and Others. Its geographical segments are the United States and Canada, of which the majority of its revenue comes from the United States.

A Deep Dive into ANI Pharmaceuticals's Financials

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Positive Revenue Trend: Examining ANI Pharmaceuticals's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 53.12% as of 30 June, 2025, showcasing a substantial increase in top-line earnings. When compared to others in the Health Care sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: ANI Pharmaceuticals's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 3.85% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 1.9%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): ANI Pharmaceuticals's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 0.62%, the company showcases efficient use of assets and strong financial health.

Debt Management: ANI Pharmaceuticals's debt-to-equity ratio is below the industry average at 1.42, reflecting a lower dependency on debt financing and a more conservative financial approach.

Understanding the Relevance of Analyst Ratings

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: ANIP