Insights into Tsakos Energy Navigation's Upcoming Earnings

Author: Benzinga Insights | September 09, 2025 10:01am

Tsakos Energy Navigation (NYSE:TEN) is gearing up to announce its quarterly earnings on Wednesday, 2025-09-10. Here's a quick overview of what investors should know before the release.

Analysts are estimating that Tsakos Energy Navigation will report an earnings per share (EPS) of $0.60.

The announcement from Tsakos Energy Navigation is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

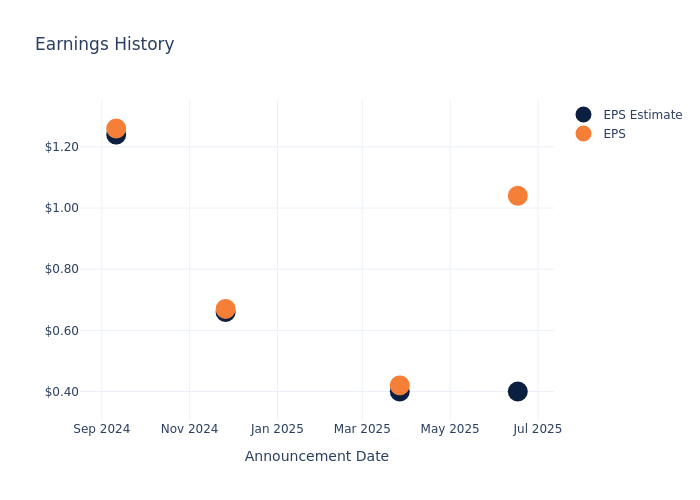

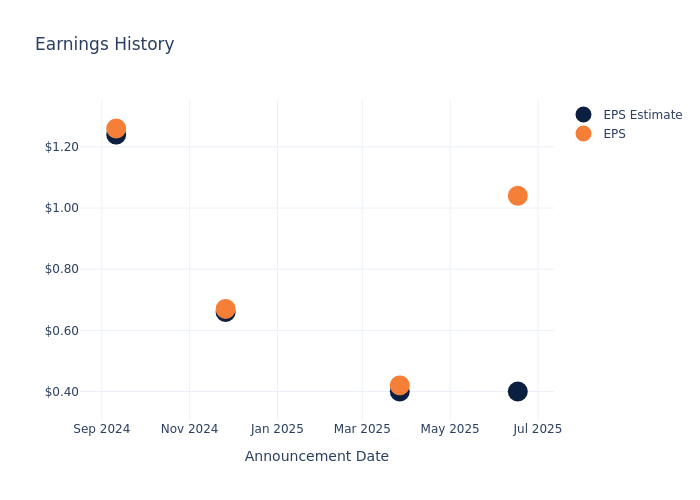

Overview of Past Earnings

During the last quarter, the company reported an EPS beat by $0.64, leading to a 3.41% increase in the share price on the subsequent day.

Here's a look at Tsakos Energy Navigation's past performance and the resulting price change:

| Quarter |

Q1 2025 |

Q4 2024 |

Q3 2024 |

Q2 2024 |

| EPS Estimate |

0.40 |

0.40 |

0.66 |

1.24 |

| EPS Actual |

1.04 |

0.42 |

0.67 |

1.26 |

| Price Change % |

3.0% |

2.0% |

-1.0% |

0.0% |

Stock Performance

Shares of Tsakos Energy Navigation were trading at $22.91 as of September 08. Over the last 52-week period, shares are down 7.1%. Given that these returns are generally negative, long-term shareholders are likely a little upset going into this earnings release.

Insights Shared by Analysts on Tsakos Energy Navigation

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Tsakos Energy Navigation.

Analysts have given Tsakos Energy Navigation a total of 1 ratings, with the consensus rating being Neutral. The average one-year price target is $21.0, indicating a potential 8.34% downside.

Analyzing Ratings Among Peers

In this analysis, we delve into the analyst ratings and average 1-year price targets of Nordic American Tankers, Excelerate Energy and Ardmore Shipping, three key industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Nordic American Tankers, with an average 1-year price target of $3.0, suggesting a potential 86.91% downside.

- Analysts currently favor an Neutral trajectory for Excelerate Energy, with an average 1-year price target of $26.0, suggesting a potential 13.49% upside.

- Analysts currently favor an Buy trajectory for Ardmore Shipping, with an average 1-year price target of $14.0, suggesting a potential 38.89% downside.

Analysis Summary for Peers

In the peer analysis summary, key metrics for Nordic American Tankers, Excelerate Energy and Ardmore Shipping are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company |

Consensus |

Revenue Growth |

Gross Profit |

Return on Equity |

| Tsakos Energy Navigation |

Neutral |

-2.25% |

$66.97M |

1.78% |

| Nordic American Tankers |

Neutral |

-39.25% |

$6.81M |

-0.17% |

| Excelerate Energy |

Neutral |

11.58% |

$92.59M |

0.81% |

| Ardmore Shipping |

Buy |

-40.62% |

$20.80M |

1.46% |

Key Takeaway:

Tsakos Energy Navigation ranks highest in Gross Profit among its peers. It is in the middle for Revenue Growth and Return on Equity.

Get to Know Tsakos Energy Navigation Better

Tsakos Energy Navigation Ltd is a seaborne transportation service provider for crude oil and petroleum products. The company's carriers cater to national and international independent oil companies and refiners. It generates revenue through charter contracts with its clients, which include time, bareboat, and voyage charters, contracts of affreightment, and pool arrangements.

Tsakos Energy Navigation: Financial Performance Dissected

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Negative Revenue Trend: Examining Tsakos Energy Navigation's financials over 3 months reveals challenges. As of 31 March, 2025, the company experienced a decline of approximately -2.25% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Energy sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Tsakos Energy Navigation's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 15.61%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Tsakos Energy Navigation's ROE excels beyond industry benchmarks, reaching 1.78%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Tsakos Energy Navigation's ROA excels beyond industry benchmarks, reaching 0.83%. This signifies efficient management of assets and strong financial health.

Debt Management: Tsakos Energy Navigation's debt-to-equity ratio is below the industry average. With a ratio of 0.98, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for Tsakos Energy Navigation visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: TEN