Expert Outlook: Doximity Through The Eyes Of 11 Analysts

Author: Benzinga Insights | September 11, 2025 09:00am

11 analysts have expressed a variety of opinions on Doximity (NYSE:DOCS) over the past quarter, offering a diverse set of opinions from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

1 |

5 |

5 |

0 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

1 |

3 |

4 |

0 |

0 |

| 3M Ago |

0 |

1 |

1 |

0 |

0 |

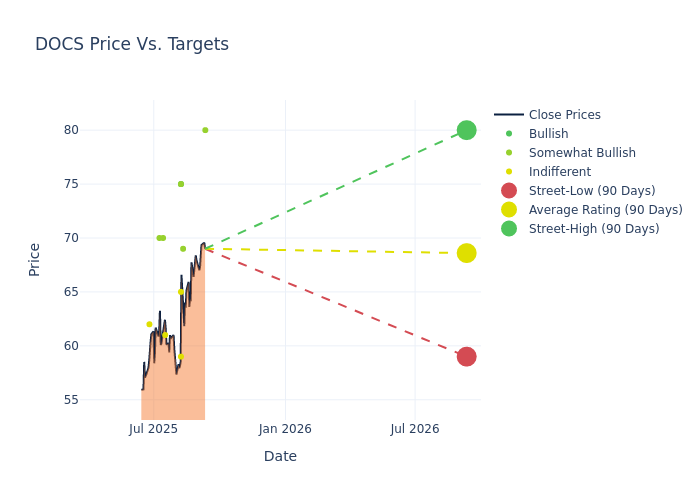

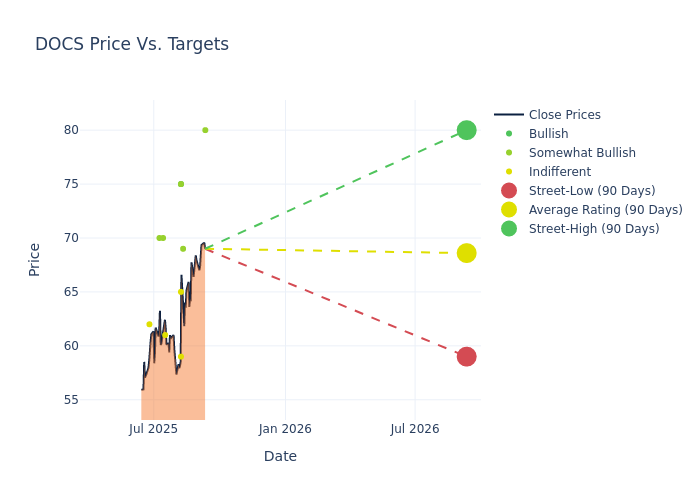

The 12-month price targets, analyzed by analysts, offer insights with an average target of $68.0, a high estimate of $80.00, and a low estimate of $59.00. Observing a 13.16% increase, the current average has risen from the previous average price target of $60.09.

Exploring Analyst Ratings: An In-Depth Overview

The analysis of recent analyst actions sheds light on the perception of Doximity by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Vikram Kesavabhotla |

Baird |

Raises |

Outperform |

$80.00 |

$75.00 |

| Jessica Tassan |

Piper Sandler |

Raises |

Overweight |

$69.00 |

$65.00 |

| Richard Close |

Canaccord Genuity |

Raises |

Hold |

$59.00 |

$50.00 |

| Brian Peterson |

Raymond James |

Raises |

Outperform |

$75.00 |

$65.00 |

| Stan Berenshteyn |

Wells Fargo |

Raises |

Equal-Weight |

$65.00 |

$62.00 |

| Ryan MacDonald |

Needham |

Raises |

Buy |

$75.00 |

$67.00 |

| Stan Berenshteyn |

Wells Fargo |

Raises |

Equal-Weight |

$62.00 |

$55.00 |

| Jailendra Singh |

Truist Securities |

Raises |

Hold |

$61.00 |

$52.00 |

| Scott Schoenhaus |

Keybanc |

Raises |

Overweight |

$70.00 |

$65.00 |

| Elizabeth Anderson |

Evercore ISI Group |

Raises |

Outperform |

$70.00 |

$50.00 |

| Allen Lutz |

B of A Securities |

Raises |

Neutral |

$62.00 |

$55.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Doximity. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Doximity compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Doximity's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Capture valuable insights into Doximity's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Doximity analyst ratings.

Unveiling the Story Behind Doximity

Doximity Inc is a digital platform for U.S. medical professionals. The cloud-based platform provides members with tools specifically built for medical professionals, enabling them to collaborate with their colleagues, securely coordinate patient care, conduct virtual patient visits, stay up-to-date with the latest medical news and research, and manage their careers and on-call schedules.

Key Indicators: Doximity's Financial Health

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Revenue Growth: Over the 3M period, Doximity showcased positive performance, achieving a revenue growth rate of 15.19% as of 30 June, 2025. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Health Care sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 36.54%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Doximity's ROE stands out, surpassing industry averages. With an impressive ROE of 5.06%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 4.32%, the company showcases effective utilization of assets.

Debt Management: Doximity's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.01.

The Basics of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: DOCS