Decoding Albemarle's Options Activity: What's the Big Picture?

Author: Benzinga Insights | September 15, 2025 12:01pm

High-rolling investors have positioned themselves bullish on Albemarle (NYSE:ALB), and it's important for retail traders to take note.

\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in ALB often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 14 options trades for Albemarle. This is not a typical pattern.

The sentiment among these major traders is split, with 64% bullish and 28% bearish. Among all the options we identified, there was one put, amounting to $27,662, and 13 calls, totaling $1,163,972.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $65.0 to $90.0 for Albemarle over the recent three months.

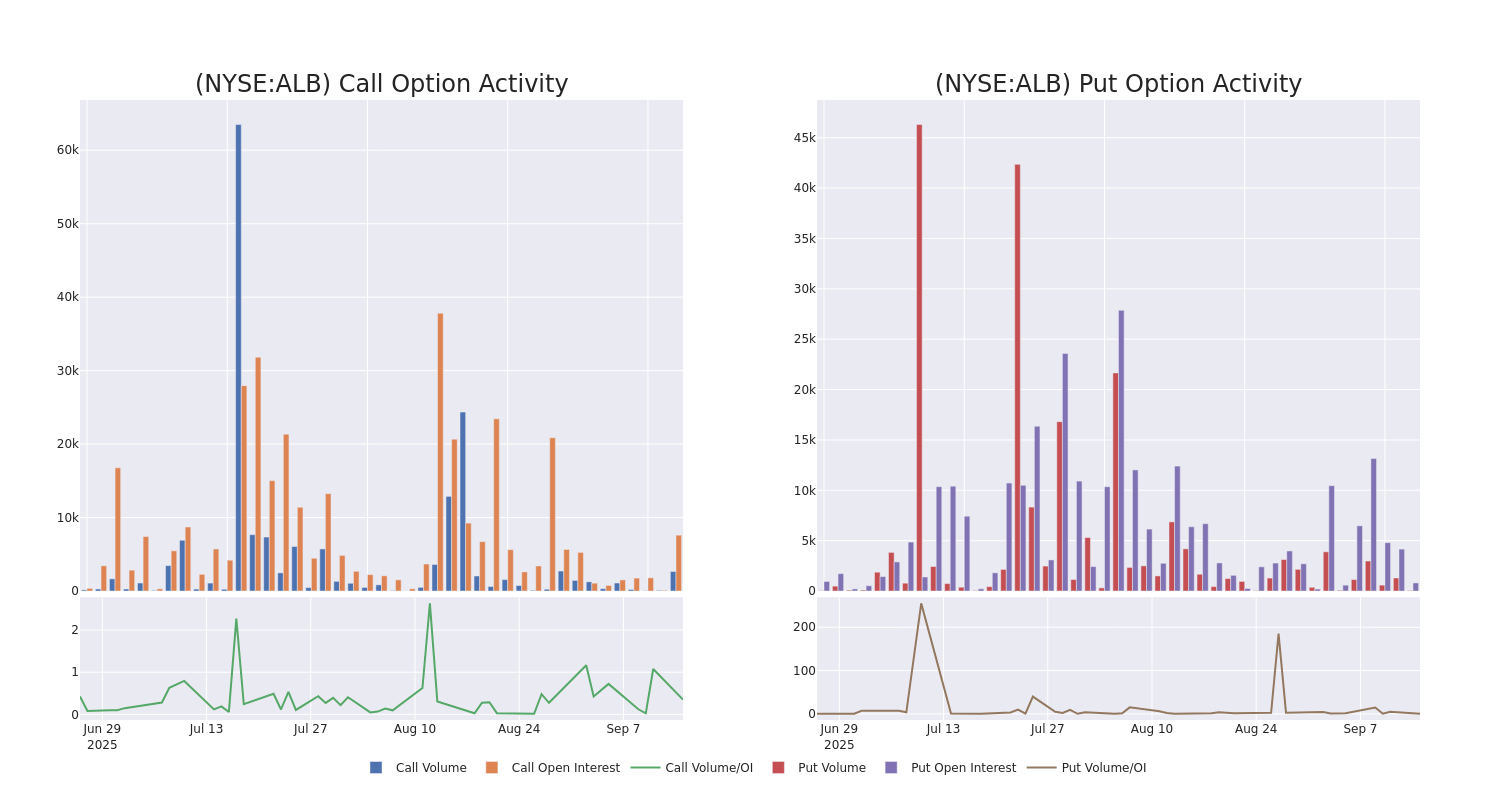

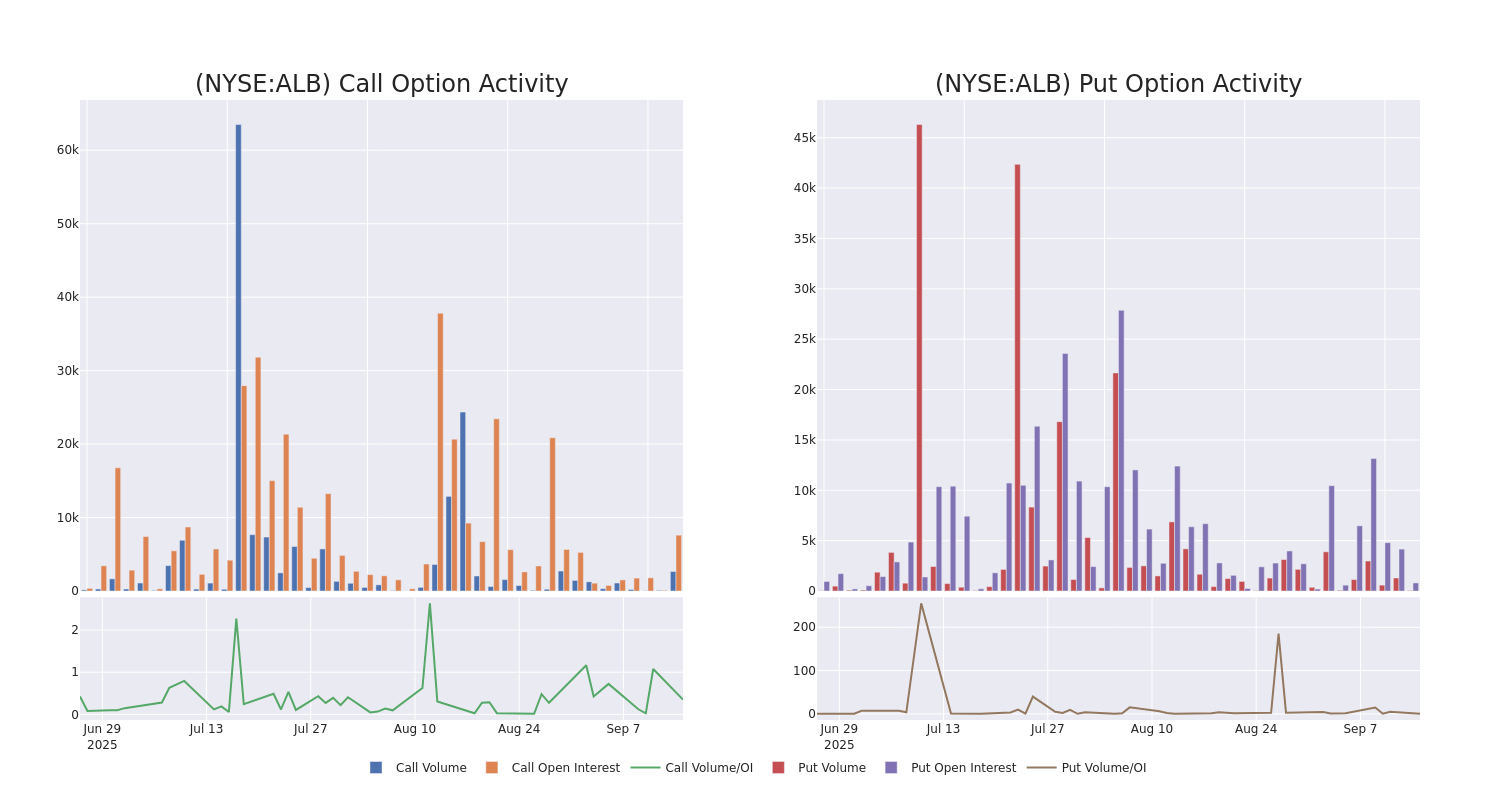

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Albemarle options trades today is 841.2 with a total volume of 2,715.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Albemarle's big money trades within a strike price range of $65.0 to $90.0 over the last 30 days.

Albemarle 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| ALB |

CALL |

TRADE |

BULLISH |

12/19/25 |

$5.8 |

$5.65 |

$5.75 |

$90.00 |

$575.0K |

1.7K |

1.1K |

| ALB |

CALL |

TRADE |

BEARISH |

10/17/25 |

$13.8 |

$12.6 |

$12.8 |

$70.00 |

$58.8K |

722 |

194 |

| ALB |

CALL |

TRADE |

BEARISH |

12/19/25 |

$20.05 |

$19.4 |

$19.53 |

$65.00 |

$58.5K |

828 |

30 |

| ALB |

CALL |

TRADE |

BULLISH |

10/17/25 |

$12.7 |

$12.55 |

$12.7 |

$70.00 |

$58.4K |

722 |

148 |

| ALB |

CALL |

TRADE |

BULLISH |

03/20/26 |

$14.5 |

$14.35 |

$14.5 |

$75.00 |

$58.0K |

259 |

40 |

About Albemarle

Albemarle is one of the world's largest lithium producers. In the lithium industry, the majority of demand comes from batteries, where lithium is used as the energy storage material, particularly in electric vehicles. Albemarle is a fully integrated lithium producer. Its upstream resources include salt brine deposits in Chile and the US and two hard rock mines in Australia, both of which are joint ventures. The company operates lithium refining plants in Chile, the US, Australia, and China. Albemarle is a global leader in the production of bromine, used in flame retardants. It is also a major producer of oil refining catalysts.

In light of the recent options history for Albemarle, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Albemarle

- Currently trading with a volume of 2,485,918, the ALB's price is up by 3.4%, now at $78.56.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 51 days.

What Analysts Are Saying About Albemarle

3 market experts have recently issued ratings for this stock, with a consensus target price of $79.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Baird continues to hold a Underperform rating for Albemarle, targeting a price of $68.

* Consistent in their evaluation, an analyst from JP Morgan keeps a Neutral rating on Albemarle with a target price of $80.

* In a positive move, an analyst from UBS has upgraded their rating to Neutral and adjusted the price target to $89.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Albemarle options trades with real-time alerts from Benzinga Pro.

Posted In: ALB