Where Atmus Filtration Techs Stands With Analysts

Author: Benzinga Insights | September 18, 2025 08:01am

4 analysts have expressed a variety of opinions on Atmus Filtration Techs (NYSE:ATMU) over the past quarter, offering a diverse set of opinions from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

1 |

3 |

0 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

0 |

0 |

1 |

0 |

0 |

| 2M Ago |

0 |

1 |

0 |

0 |

0 |

| 3M Ago |

0 |

0 |

1 |

0 |

0 |

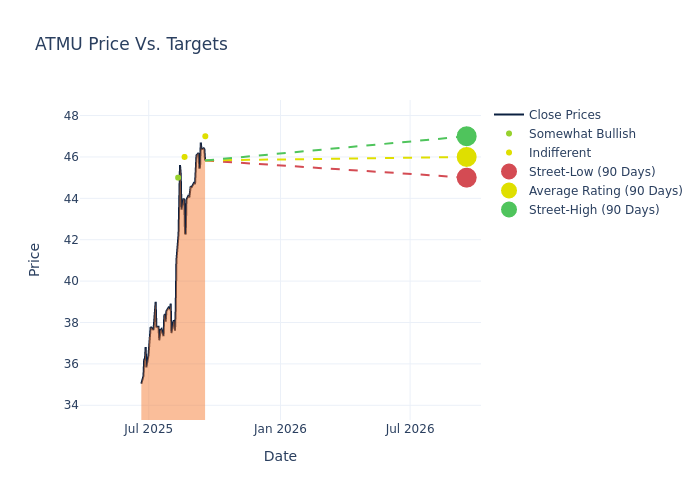

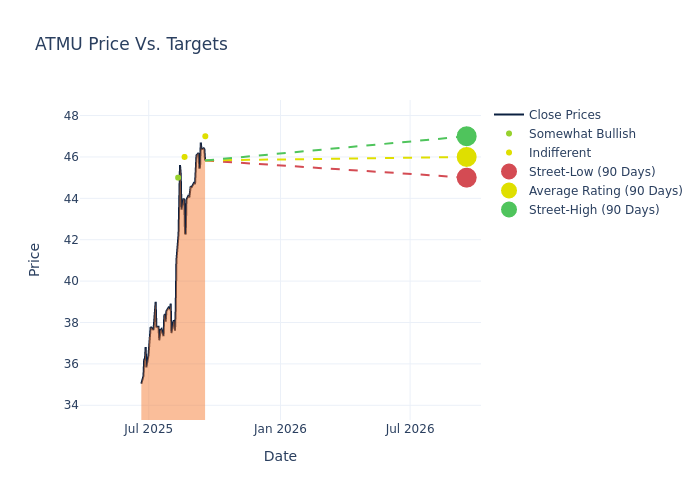

Analysts have set 12-month price targets for Atmus Filtration Techs, revealing an average target of $44.25, a high estimate of $47.00, and a low estimate of $39.00. This upward trend is apparent, with the current average reflecting a 7.93% increase from the previous average price target of $41.00.

Diving into Analyst Ratings: An In-Depth Exploration

The standing of Atmus Filtration Techs among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Joseph O'Dea |

Wells Fargo |

Raises |

Equal-Weight |

$47.00 |

$42.00 |

| Tami Zakaria |

JP Morgan |

Raises |

Neutral |

$46.00 |

$44.00 |

| Robert Mason |

Baird |

Raises |

Outperform |

$45.00 |

$41.00 |

| Joseph O'Dea |

Wells Fargo |

Raises |

Equal-Weight |

$39.00 |

$37.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Atmus Filtration Techs. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Atmus Filtration Techs compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Capture valuable insights into Atmus Filtration Techs's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Atmus Filtration Techs analyst ratings.

Get to Know Atmus Filtration Techs Better

Atmus Filtration Technologies Inc manufactures filtration products for on-highway commercial vehicles and off-highway agriculture, construction, mining, and power generation vehicles and equipment. The company designs and manufactures Developed filtration products, principally under the Fleetguard brand, that enable lower emissions and provide asset protection. The company designs, manufactures, and sells filters, coolants, and chemical products. The company offers products including air filtration, coolants and chemicals, crankcase ventilation, fuel filtration, fuel cells, lube filtration, and others.

A Deep Dive into Atmus Filtration Techs's Financials

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Positive Revenue Trend: Examining Atmus Filtration Techs's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 4.83% as of 30 June, 2025, showcasing a substantial increase in top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Industrials sector.

Net Margin: Atmus Filtration Techs's net margin excels beyond industry benchmarks, reaching 13.21%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Atmus Filtration Techs's ROE excels beyond industry benchmarks, reaching 20.6%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Atmus Filtration Techs's ROA stands out, surpassing industry averages. With an impressive ROA of 4.71%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.97, caution is advised due to increased financial risk.

Understanding the Relevance of Analyst Ratings

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: ATMU