Check Out What Whales Are Doing With ADBE

Author: Benzinga Insights | September 22, 2025 01:01pm

Financial giants have made a conspicuous bullish move on Adobe. Our analysis of options history for Adobe (NASDAQ:ADBE) revealed 18 unusual trades.

Delving into the details, we found 55% of traders were bullish, while 44% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $233,525, and 14 were calls, valued at $1,303,969.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $200.0 to $500.0 for Adobe during the past quarter.

Insights into Volume & Open Interest

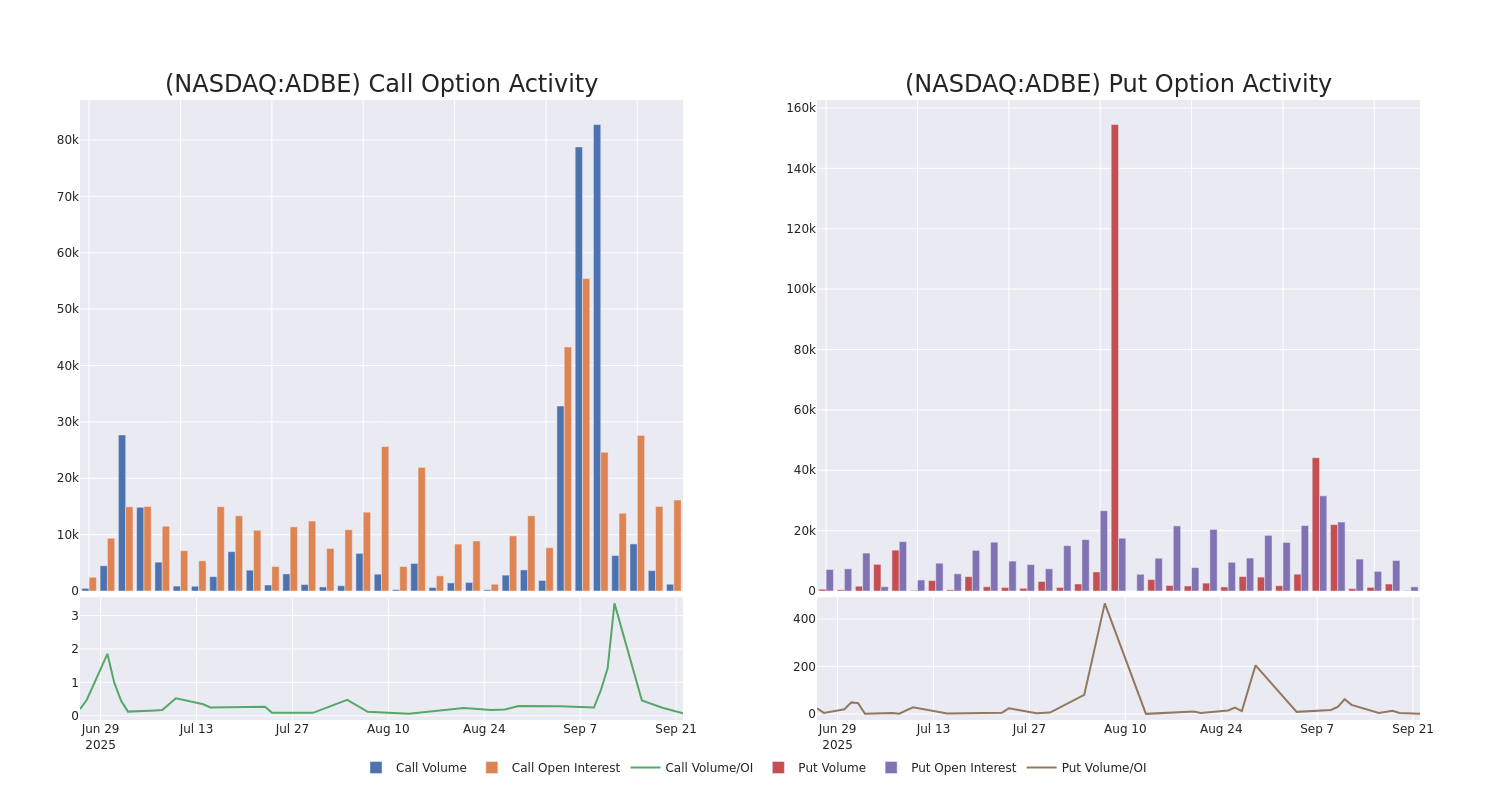

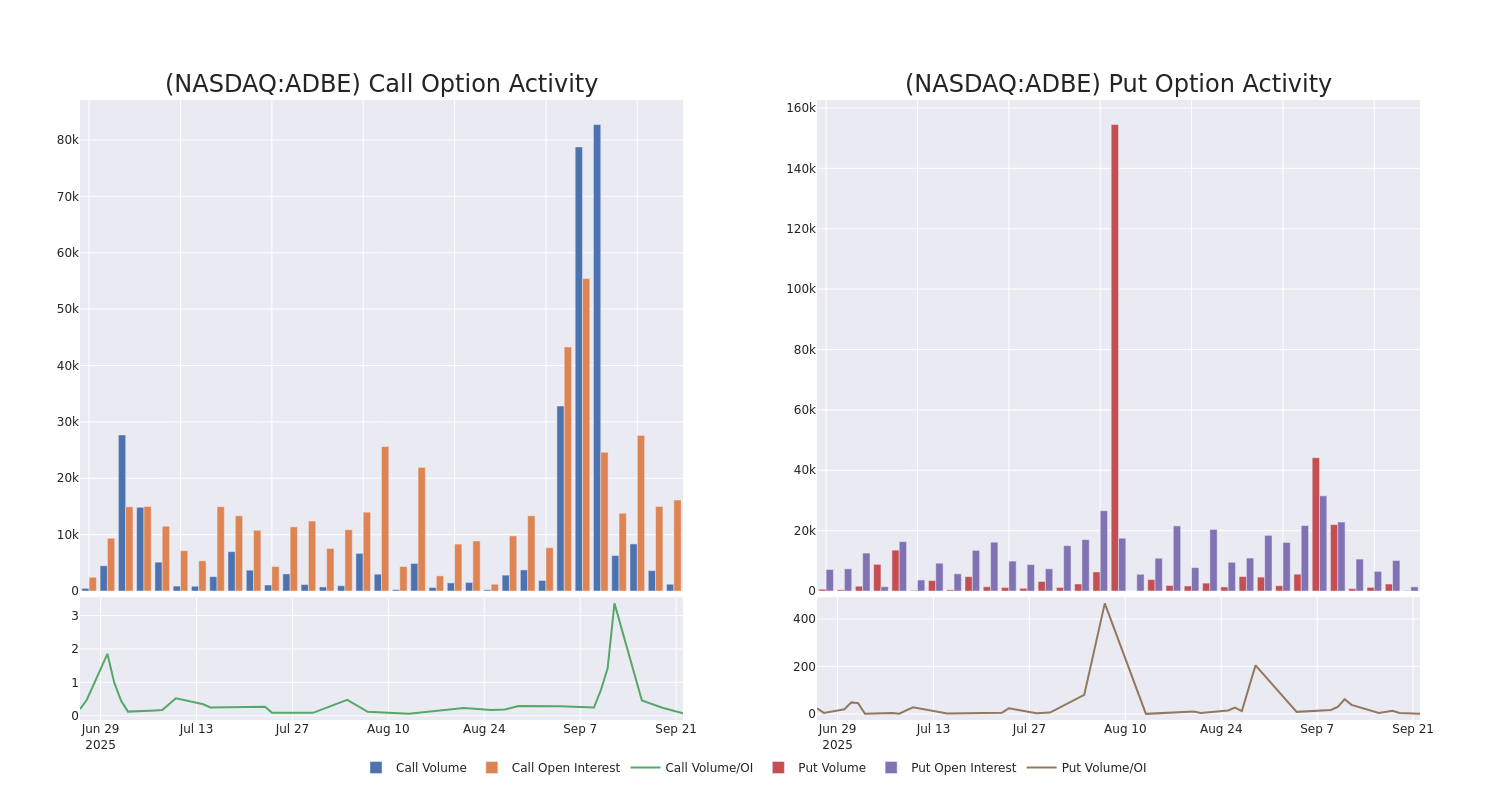

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Adobe's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Adobe's whale trades within a strike price range from $200.0 to $500.0 in the last 30 days.

Adobe 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| ADBE |

CALL |

TRADE |

BEARISH |

01/15/27 |

$24.95 |

$23.65 |

$23.75 |

$500.00 |

$593.7K |

412 |

257 |

| ADBE |

CALL |

TRADE |

BULLISH |

01/16/26 |

$33.7 |

$33.7 |

$33.7 |

$360.00 |

$148.2K |

1.2K |

78 |

| ADBE |

PUT |

SWEEP |

BEARISH |

12/19/25 |

$15.0 |

$14.95 |

$15.0 |

$340.00 |

$106.5K |

432 |

76 |

| ADBE |

CALL |

TRADE |

BULLISH |

08/21/26 |

$41.0 |

$31.35 |

$40.15 |

$400.00 |

$80.3K |

6 |

20 |

| ADBE |

CALL |

TRADE |

BEARISH |

09/26/25 |

$19.9 |

$18.15 |

$18.5 |

$345.00 |

$74.0K |

218 |

181 |

About Adobe

Adobe provides content creation, document management, and digital marketing and advertising software and services to creative professionals and marketers for creating, managing, delivering, measuring, optimizing, and engaging with compelling content multiple operating systems, devices, and media. The company operates with three segments: digital media content creation, digital experience for marketing solutions, and publishing for legacy products (less than 5% of revenue).

Following our analysis of the options activities associated with Adobe, we pivot to a closer look at the company's own performance.

Adobe's Current Market Status

- With a trading volume of 1,920,514, the price of ADBE is down by -1.14%, reaching $361.72.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 79 days from now.

What The Experts Say On Adobe

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $433.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Adobe with a target price of $465.

* An analyst from Evercore ISI Group has decided to maintain their Outperform rating on Adobe, which currently sits at a price target of $450.

* An analyst from TD Cowen persists with their Hold rating on Adobe, maintaining a target price of $420.

* Maintaining their stance, an analyst from RBC Capital continues to hold a Outperform rating for Adobe, targeting a price of $430.

* An analyst from Citigroup persists with their Neutral rating on Adobe, maintaining a target price of $400.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Adobe with Benzinga Pro for real-time alerts.

Posted In: ADBE