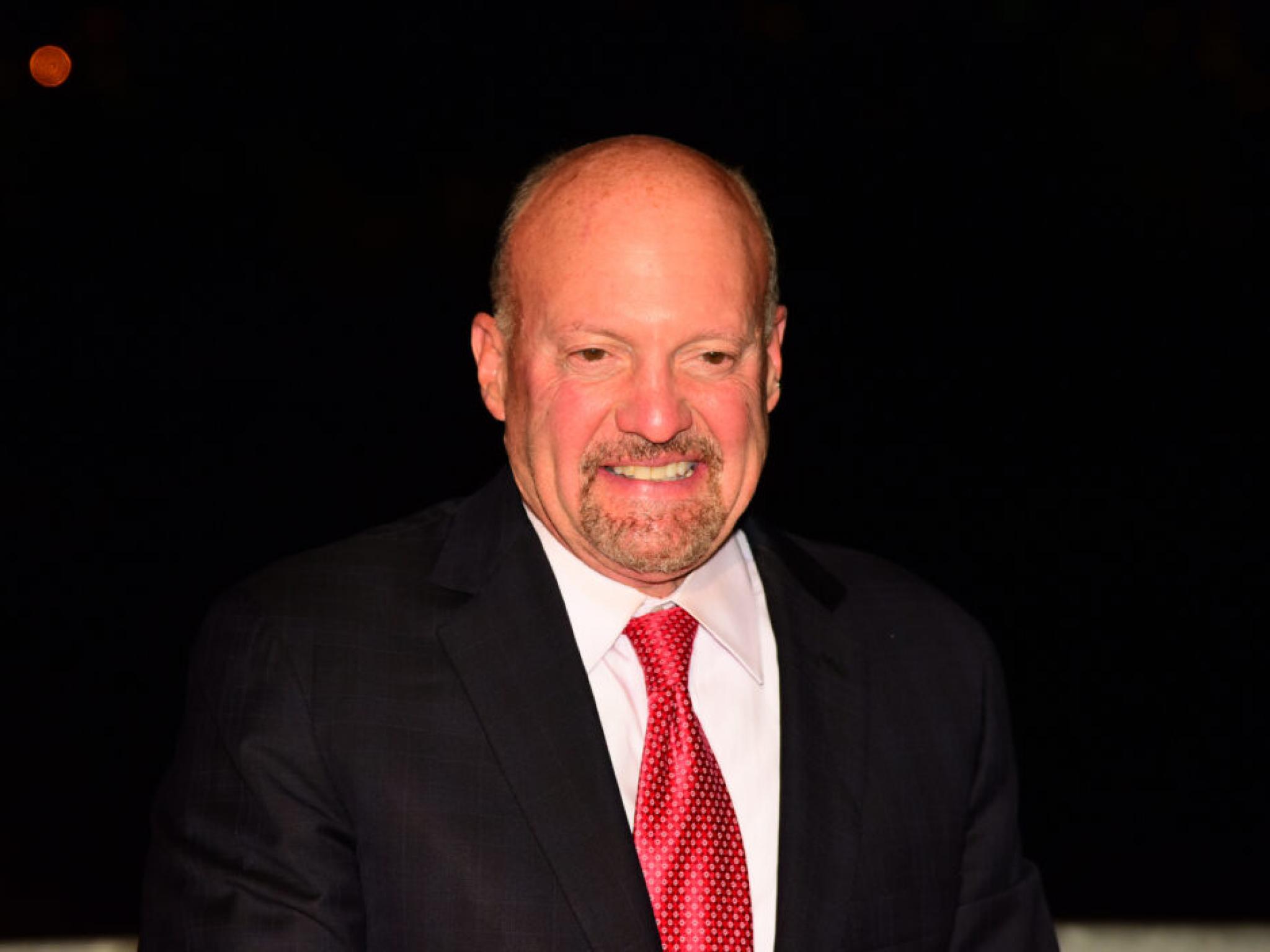

Jim Cramer Spotlights These Undervalued S&P 500 Stocks With Growth Potential Amid Skyrocketing Market

Author: Namrata Sen | September 23, 2025 04:14am

In a recent episode of “Mad Money,” Jim Cramer identified several stocks in the S&P 500 that he believes are undervalued, offering growth potential despite the market’s record highs.

Cramer Highlights Undervalued Stocks Across Key Sectors

Cramer, the host of CNBC’s “Mad Money,” highlighted a range of stocks from different sectors that he believes are currently undervalued, reported CNBC.

He first mentioned T-Mobile US Inc. (NASDAQ:TMUS), expressing confidence in the company’s team despite a recent leadership change. In the consumer sector, he pointed out Royal Caribbean Group (NYSE:RCL), Expedia Group Inc. (NASDAQ:EXPE), and Dollar Tree Inc. (NASDAQ:DLTR) as potential bargains.

Within the financial sector, Cramer highlighted Capital One Financial Corp. (NYSE:COF), American Express Co. (NYSE:AXP), Citigroup Inc. (NYSE:C), and KeyCorp (NYSE:KEY). He also mentioned Charles Schwab Corp. (NYSE:SCHW), Chubb Ltd. (NYSE:CB), and Apollo Global Management Inc. (NYSE:APO).

In the healthcare sector, Cramer recommended Incyte Corp. (NASDAQ:INCY). In the tech industry, he suggested Dell Technologies Inc. (NYSE:DELL) and Jabil Inc. (NYSE:JBL). His favorite industrial stocks were Caterpillar Inc. (NYSE:CAT), Cummins Inc. (NYSE:CMI), and Jacobs Solutions Inc. (NYSE:J). He also mentioned Entergy Corp. (NYSE:ETR) and Boston Properties Inc. (NYSE:BXP) in the utility and real estate sectors, respectively.

He highlighted Dell's involvement in the artificial intelligence infrastructure sector and noted Jabil's growing importance to customers amid tariff-related uncertainties.

See Also: Peter Schiff Slams Republicans For Wanting To ‘Gift’ Tariff Revenue Back To Taxpayers, Calls It ‘One Of The Dumbest Ideas’

Cramer Calls For Halt In Market Rally Of Profitless Assets

Cramer’s focus on undervalued stocks comes amid a market rally that he has previously expressed concerns about. Earlier this week, he called for a “pause in the endless rally of speculation” among risk assets, including “gold, crypto and profitless companies.”

His recent recommendations also include industrial stocks. Earlier in September, he suggested buying Canadian National Railway Company (NYSE:CNI), describing it as “way too cheap.”

These recommendations reflect Cramer’s strategy of identifying undervalued stocks with strong growth potential, even in a market that is hitting record highs.

READ NEXT:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Posted In: APO AXP BXP C CAT CB CMI CNI COF DELL DLTR ETR EXPE INCY J JBL KEY RCL SCHW TMUS