Deep Dive Into Primerica Stock: Analyst Perspectives (5 Ratings)

Author: Benzinga Insights | September 23, 2025 08:00am

Primerica (NYSE:PRI) has been analyzed by 5 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

1 |

4 |

0 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

3 |

0 |

0 |

| 3M Ago |

0 |

0 |

1 |

0 |

0 |

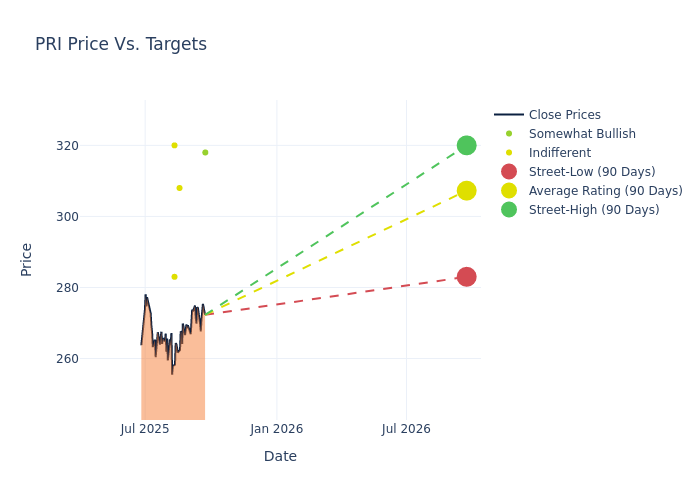

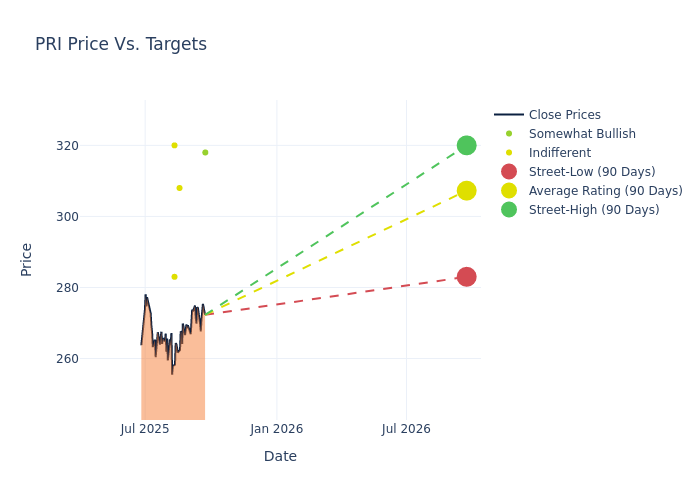

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $304.2, a high estimate of $320.00, and a low estimate of $283.00. This current average reflects an increase of 2.22% from the previous average price target of $297.60.

Decoding Analyst Ratings: A Detailed Look

A comprehensive examination of how financial experts perceive Primerica is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Jack Matten |

BMO Capital |

Raises |

Outperform |

$318.00 |

$292.00 |

| Bob Huang |

Morgan Stanley |

Raises |

Equal-Weight |

$308.00 |

$292.00 |

| Ryan Krueger |

Keefe, Bruyette & Woods |

Raises |

Market Perform |

$320.00 |

$315.00 |

| Suneet Kamath |

Jefferies |

Lowers |

Hold |

$283.00 |

$293.00 |

| Bob Huang |

Morgan Stanley |

Lowers |

Equal-Weight |

$292.00 |

$296.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Primerica. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Primerica compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Primerica's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Primerica's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Primerica analyst ratings.

Unveiling the Story Behind Primerica

Primerica Inc is a provider of financial services to middle-income households in the United States and Canada. The company offers life insurance, mutual funds, annuities, and other financial products, distributed on behalf of third parties. Primerica has three main subsidiaries: Primerica Financial Services, a marketing company; Primerica Life Insurance Company, a principal life insurance underwriting entity; and PFS Investments, which offers investment and savings products, brokerage services, and registered investment advisory. It has three segments Term Life Insurance; Investment and Savings Products; and Corporate and Other Distributed Products. Geogriphically, it derives a majority of its revenue from the United States.

Financial Milestones: Primerica's Journey

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Primerica's remarkable performance in 3M is evident. As of 30 June, 2025, the company achieved an impressive revenue growth rate of 0.29%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Financials sector.

Net Margin: Primerica's net margin is impressive, surpassing industry averages. With a net margin of 22.41%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Primerica's ROE excels beyond industry benchmarks, reaching 7.79%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Primerica's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.21%, the company showcases efficient use of assets and strong financial health.

Debt Management: With a high debt-to-equity ratio of 0.83, Primerica faces challenges in effectively managing its debt levels, indicating potential financial strain.

Analyst Ratings: Simplified

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: PRI