4 Analysts Assess CareDx: What You Need To Know

Author: Benzinga Insights | September 23, 2025 10:02am

In the preceding three months, 4 analysts have released ratings for CareDx (NASDAQ:CDNA), presenting a wide array of perspectives from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

3 |

0 |

1 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

1 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

1 |

0 |

0 |

| 3M Ago |

1 |

0 |

0 |

0 |

0 |

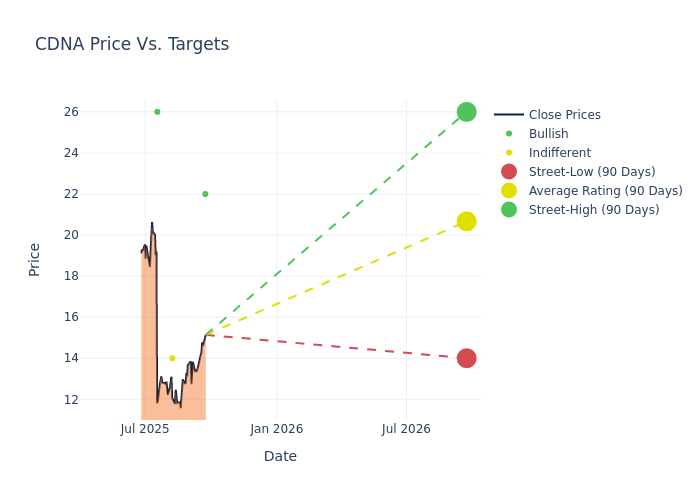

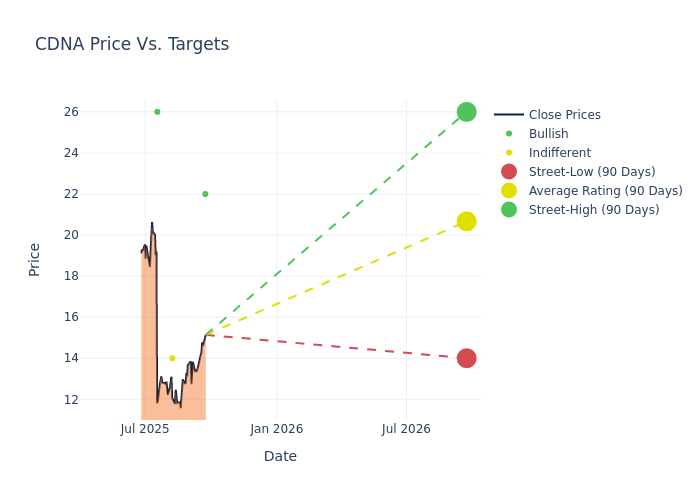

In the assessment of 12-month price targets, analysts unveil insights for CareDx, presenting an average target of $21.0, a high estimate of $26.00, and a low estimate of $14.00. This current average has decreased by 18.45% from the previous average price target of $25.75.

Exploring Analyst Ratings: An In-Depth Overview

An in-depth analysis of recent analyst actions unveils how financial experts perceive CareDx. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Mark Massaro |

BTIG |

Maintains |

Buy |

$22.00 |

$22.00 |

| Mark Massaro |

BTIG |

Maintains |

Buy |

$22.00 |

$22.00 |

| Brandon Couillard |

Wells Fargo |

Lowers |

Equal-Weight |

$14.00 |

$19.00 |

| Connor Chamberlain |

Craig-Hallum |

Lowers |

Buy |

$26.00 |

$40.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to CareDx. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of CareDx compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of CareDx's stock. This examination reveals shifts in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of CareDx's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on CareDx analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

About CareDx

CareDx Inc operates as a precision medicine company focused on the discovery, development, and commercialization of clinically differentiated, high-value healthcare solutions for transplant patients and caregivers. It offers testing services, products, and digital solutions along with the pre- and post-transplant patient journey and is a provider of genomics-based information for transplant patients. The Company's commercially available testing services consist of AlloSure Kidney, AlloMap Heart, AlloSure Heart, a dd-cfDNA solution for heart transplant patients, and AlloSure Lung, a dd-cfDNA solution for lung transplant patients. Geographically the company generates the majority of its revenue from the United States. The company generates the majority of revenue from the Testing services.

CareDx: Delving into Financials

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Decline in Revenue: Over the 3M period, CareDx faced challenges, resulting in a decline of approximately -6.06% in revenue growth as of 30 June, 2025. This signifies a reduction in the company's top-line earnings. When compared to others in the Health Care sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: CareDx's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -9.88% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): CareDx's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -2.42% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): CareDx's ROA stands out, surpassing industry averages. With an impressive ROA of -1.83%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: CareDx's debt-to-equity ratio is below the industry average. With a ratio of 0.09, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

How Are Analyst Ratings Determined?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: CDNA