Snap-on Stock: A Deep Dive Into Analyst Perspectives (7 Ratings)

Author: Benzinga Insights | September 23, 2025 04:01pm

Ratings for Snap-on (NYSE:SNA) were provided by 7 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

1 |

4 |

1 |

1 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

1 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

0 |

3 |

1 |

1 |

0 |

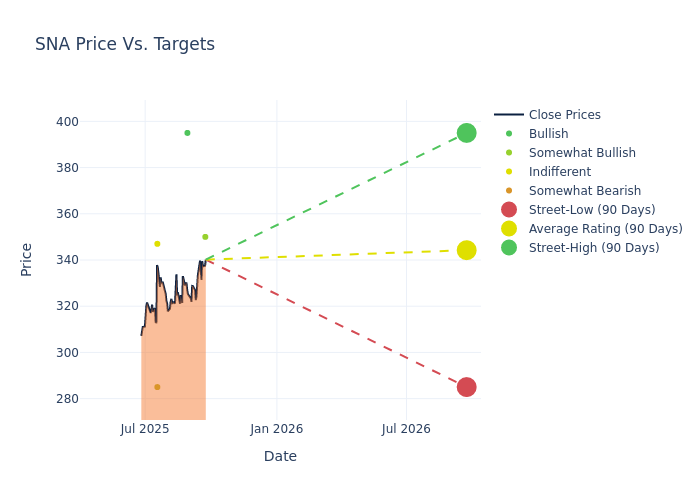

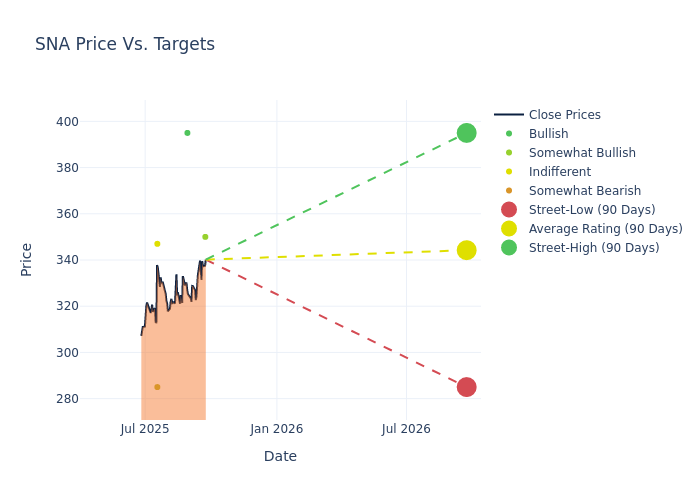

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $346.71, with a high estimate of $395.00 and a low estimate of $285.00. This upward trend is evident, with the current average reflecting a 1.8% increase from the previous average price target of $340.57.

Decoding Analyst Ratings: A Detailed Look

The standing of Snap-on among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Gary Prestopino |

Barrington Research |

Maintains |

Outperform |

$350.00 |

$350.00 |

| Ivan Feinseth |

Tigress Financial |

Raises |

Buy |

$395.00 |

$390.00 |

| Gary Prestopino |

Barrington Research |

Maintains |

Outperform |

$350.00 |

$350.00 |

| Elizabeth Suzuki |

B of A Securities |

Raises |

Underperform |

$285.00 |

$265.00 |

| Luke Junk |

Baird |

Raises |

Neutral |

$347.00 |

$329.00 |

| Gary Prestopino |

Barrington Research |

Maintains |

Outperform |

$350.00 |

$350.00 |

| Gary Prestopino |

Barrington Research |

Maintains |

Outperform |

$350.00 |

$350.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Snap-on. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Snap-on compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Snap-on's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

For valuable insights into Snap-on's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Snap-on analyst ratings.

Delving into Snap-on's Background

Snap-on is a manufacturer of premium tools, equipment, and diagnostics for professional technicians, primarily involved in the repair of passenger cars, but has expanded into other industrial applications. The company's legacy business is selling hand tools through franchisee-operated mobile vans to technicians who purchase the tools at their own expense. The company also operates a commercial and industrial business, focusing on repair facilities that serve other industries. The third segment, repair systems and information, targets auto OEMs and large dealerships more directly, also offering substantial diagnostic solutions to aid in repairs. The company's finance arm provides financing to franchisees to support their operations, as well as underwrites end-customer purchases.

Unraveling the Financial Story of Snap-on

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Over the 3M period, Snap-on showcased positive performance, achieving a revenue growth rate of 0.09% as of 30 June, 2025. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Snap-on's net margin excels beyond industry benchmarks, reaching 19.54%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Snap-on's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 4.46%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Snap-on's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 3.08%, the company showcases efficient use of assets and strong financial health.

Debt Management: Snap-on's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.22.

How Are Analyst Ratings Determined?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: SNA