Philip Morris Intl's Options Frenzy: What You Need to Know

Author: Benzinga Insights | September 24, 2025 12:01pm

Deep-pocketed investors have adopted a bullish approach towards Philip Morris Intl (NYSE:PM), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in PM usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 8 extraordinary options activities for Philip Morris Intl. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 62% leaning bullish and 25% bearish. Among these notable options, 2 are puts, totaling $242,400, and 6 are calls, amounting to $799,539.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $155.0 and $175.0 for Philip Morris Intl, spanning the last three months.

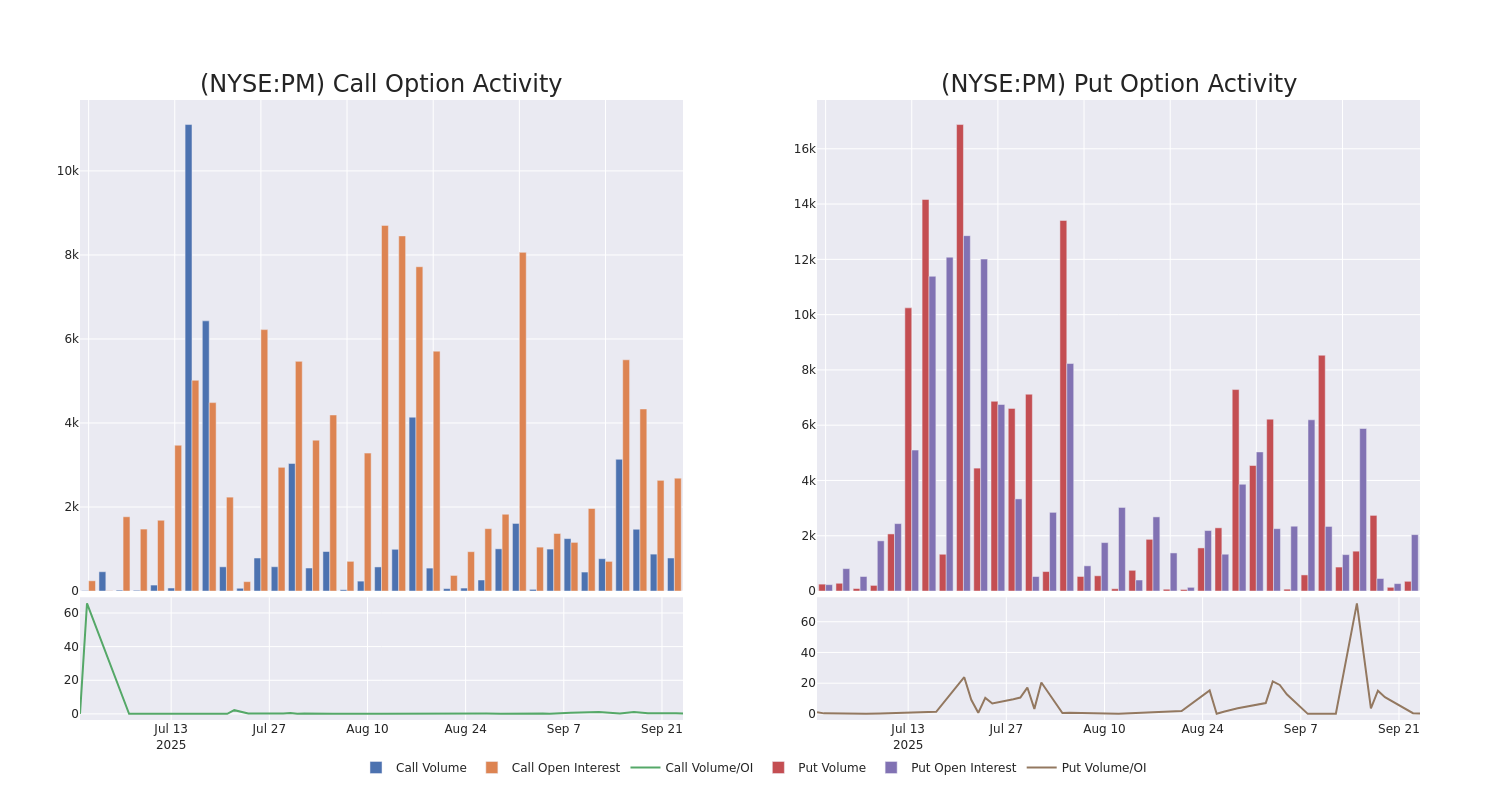

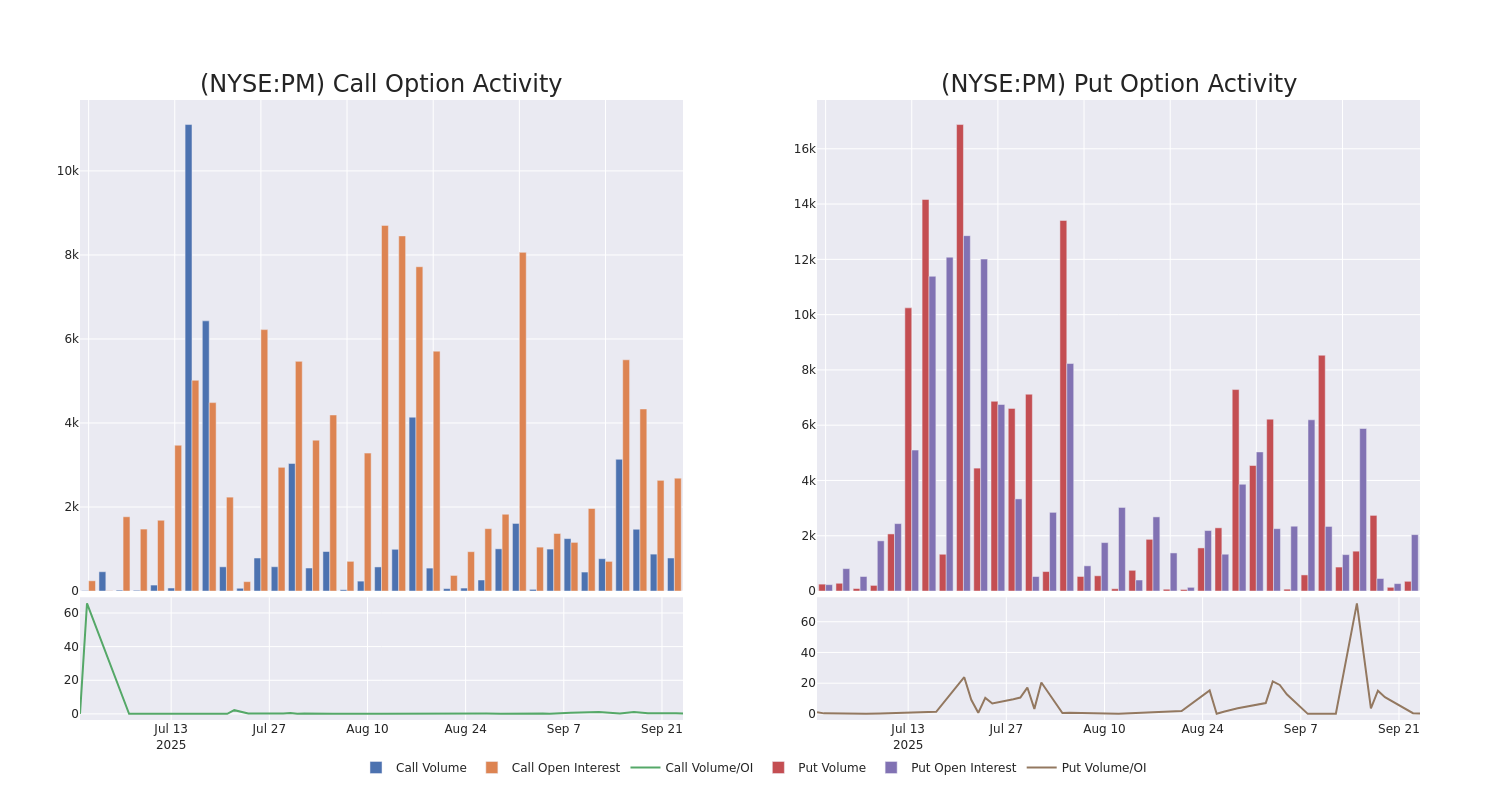

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Philip Morris Intl options trades today is 945.2 with a total volume of 1,138.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Philip Morris Intl's big money trades within a strike price range of $155.0 to $175.0 over the last 30 days.

Philip Morris Intl Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| PM |

CALL |

TRADE |

NEUTRAL |

06/18/26 |

$20.7 |

$20.0 |

$20.4 |

$155.00 |

$640.5K |

378 |

314 |

| PM |

PUT |

TRADE |

BEARISH |

01/16/26 |

$6.4 |

$6.3 |

$6.4 |

$155.00 |

$200.9K |

1.6K |

315 |

| PM |

PUT |

SWEEP |

BEARISH |

11/21/25 |

$11.2 |

$11.1 |

$11.2 |

$170.00 |

$41.4K |

419 |

37 |

| PM |

CALL |

TRADE |

BULLISH |

11/21/25 |

$7.2 |

$7.0 |

$7.13 |

$165.00 |

$35.6K |

1.2K |

52 |

| PM |

CALL |

TRADE |

BULLISH |

11/21/25 |

$7.2 |

$7.0 |

$7.12 |

$165.00 |

$35.6K |

1.2K |

102 |

About Philip Morris Intl

Created from the international operations of Altria in 2008, Philip Morris International sells cigarettes and reduced-risk products, including heat sticks, vapes, and oral nicotine offerings, primarily outside of the US. With the 2023 acquisition of Swedish Match, a leading manufacturer of traditional oral tobacco products and nicotine pouches primarily in the US and Scandinavia, PMI has not only diversified away from smokable products but also gained a toehold in the US to sell its Iqos heated tobacco product.

Following our analysis of the options activities associated with Philip Morris Intl, we pivot to a closer look at the company's own performance.

Present Market Standing of Philip Morris Intl

- Trading volume stands at 889,982, with PM's price down by -0.08%, positioned at $163.64.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 27 days.

Expert Opinions on Philip Morris Intl

1 market experts have recently issued ratings for this stock, with a consensus target price of $166.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from UBS has decided to maintain their Neutral rating on Philip Morris Intl, which currently sits at a price target of $166.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Philip Morris Intl with Benzinga Pro for real-time alerts.

Posted In: PM