Deep Dive Into CuriosityStream Stock: Analyst Perspectives (4 Ratings)

Author: Benzinga Insights | September 25, 2025 03:00pm

In the latest quarter, 4 analysts provided ratings for CuriosityStream (NASDAQ: CURI), showcasing a mix of bullish and bearish perspectives.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

2 |

2 |

0 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

0 |

1 |

0 |

0 |

0 |

| 2M Ago |

1 |

1 |

0 |

0 |

0 |

| 3M Ago |

0 |

0 |

0 |

0 |

0 |

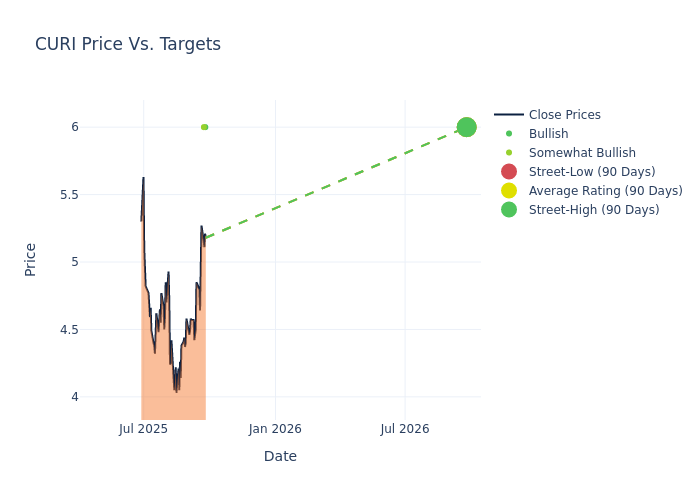

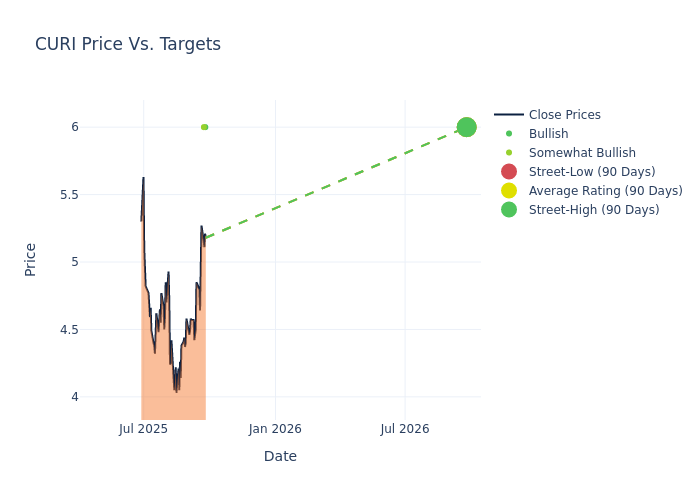

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $5.88, with a high estimate of $6.00 and a low estimate of $5.50. This current average reflects an increase of 5.38% from the previous average price target of $5.58.

Investigating Analyst Ratings: An Elaborate Study

A clear picture of CuriosityStream's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Laura Martin |

Needham |

Raises |

Buy |

$6.00 |

$5.50 |

| Patrick Sholl |

Barrington Research |

Maintains |

Outperform |

$6.00 |

$6.00 |

| James Goss |

Barrington Research |

Maintains |

Outperform |

$6.00 |

$6.00 |

| Laura Martin |

Needham |

Raises |

Buy |

$5.50 |

$4.80 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to CuriosityStream. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of CuriosityStream compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of CuriosityStream's stock. This comparison reveals trends in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of CuriosityStream's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on CuriosityStream analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Discovering CuriosityStream: A Closer Look

CuriosityStream Inc is a media and entertainment company. It offers premium video programming across the principal categories of factual entertainment, including science, history, society, nature, lifestyle, and technology. Its mission is to provide premium real entertainment that informs, enchants, and inspires. Its product and services are Direct to Consumer Business, Partner Direct Business, Bundled Distribution, Content Licensing, Enterprise Subscriptions and Others. The majority of the revenue comes from the Direct to direct-to-consumer business.

Understanding the Numbers: CuriosityStream's Finances

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Positive Revenue Trend: Examining CuriosityStream's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 53.38% as of 30 June, 2025, showcasing a substantial increase in top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Communication Services sector.

Net Margin: CuriosityStream's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 4.12% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): CuriosityStream's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.45% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): CuriosityStream's ROA excels beyond industry benchmarks, reaching 0.96%. This signifies efficient management of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 0.08, CuriosityStream adopts a prudent financial strategy, indicating a balanced approach to debt management.

What Are Analyst Ratings?

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: CURI