Where Vertiv Holdings Stands With Analysts

Author: Benzinga Insights | September 25, 2025 03:01pm

In the preceding three months, 14 analysts have released ratings for Vertiv Holdings (NYSE: VRT), presenting a wide array of perspectives from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

6 |

5 |

2 |

0 |

1 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

2 |

3 |

1 |

0 |

1 |

| 3M Ago |

3 |

2 |

1 |

0 |

0 |

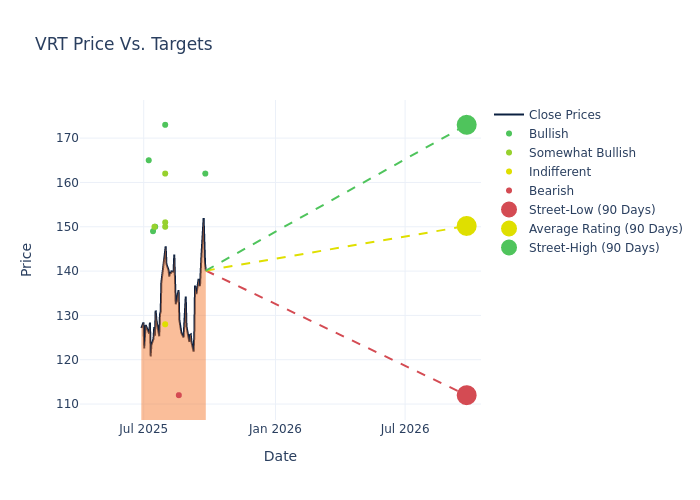

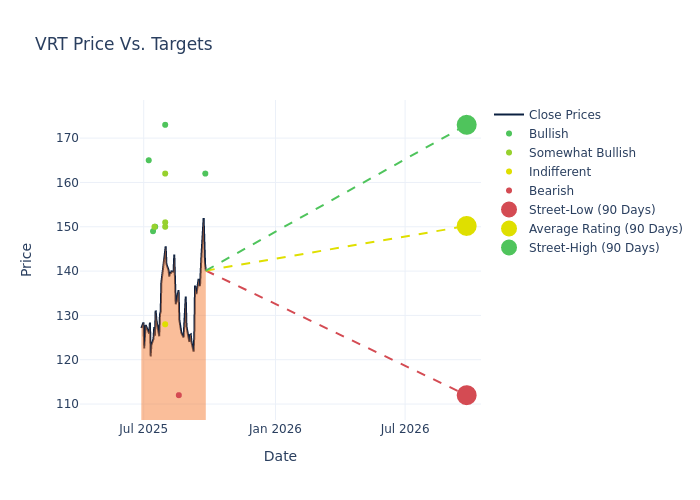

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $147.07, a high estimate of $173.00, and a low estimate of $110.00. Surpassing the previous average price target of $128.31, the current average has increased by 14.62%.

Exploring Analyst Ratings: An In-Depth Overview

The perception of Vertiv Holdings by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Justin Clare |

Roth Capital |

Maintains |

Buy |

$162.00 |

$162.00 |

| Austin Wang |

GLJ Research |

Announces |

Sell |

$112.00 |

- |

| Amit Mehrotra |

UBS |

Raises |

Buy |

$173.00 |

$135.00 |

| Julian Mitchell |

Barclays |

Raises |

Equal-Weight |

$128.00 |

$110.00 |

| Stephen Tusa |

JP Morgan |

Raises |

Overweight |

$150.00 |

$127.00 |

| Deane Dray |

RBC Capital |

Raises |

Outperform |

$162.00 |

$143.00 |

| Noah Kaye |

Oppenheimer |

Raises |

Outperform |

$151.00 |

$140.00 |

| Justin Clare |

Roth Capital |

Raises |

Buy |

$157.00 |

$100.00 |

| Noah Kaye |

Oppenheimer |

Raises |

Outperform |

$140.00 |

$132.00 |

| Andrew Obin |

B of A Securities |

Raises |

Buy |

$150.00 |

$140.00 |

| Brett Linzey |

Mizuho |

Raises |

Outperform |

$150.00 |

$125.00 |

| Andrew Kaplowitz |

Citigroup |

Raises |

Buy |

$149.00 |

$130.00 |

| Julian Mitchell |

Barclays |

Raises |

Equal-Weight |

$110.00 |

$90.00 |

| Scott Davis |

Melius Research |

Raises |

Buy |

$165.00 |

$134.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Vertiv Holdings. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Vertiv Holdings compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Vertiv Holdings's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Vertiv Holdings's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Vertiv Holdings analyst ratings.

Delving into Vertiv Holdings's Background

Vertiv has roots tracing back to 1946 when its founder, Ralph Liebert, developed an air-cooling system for mainframe data rooms. As computers started making their way into commercial applications in 1965, Liebert developed one of the first computer room air conditioning, or CRAC, units, enabling the precise control of temperature and humidity. The firm has slowly expanded its data center portfolio through internal product development and the acquisition of thermal and power management products like condensers, busways, and switches. Vertiv has global operations today; its products can be found in data centers in most regions throughout the world.

Vertiv Holdings's Financial Performance

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: Vertiv Holdings's remarkable performance in 3M is evident. As of 30 June, 2025, the company achieved an impressive revenue growth rate of 35.09%. This signifies a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Industrials sector.

Net Margin: Vertiv Holdings's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 12.29%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 11.2%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Vertiv Holdings's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 3.27%, the company showcases efficient use of assets and strong financial health.

Debt Management: Vertiv Holdings's debt-to-equity ratio surpasses industry norms, standing at 1.02. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

The Significance of Analyst Ratings Explained

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: VRT