15 Analysts Assess PNC Financial Services Gr: What You Need To Know

Author: Benzinga Insights | September 29, 2025 04:01pm

Providing a diverse range of perspectives from bullish to bearish, 15 analysts have published ratings on PNC Financial Services Gr (NYSE: PNC) in the last three months.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

3 |

4 |

6 |

2 |

0 |

| Last 30D |

0 |

0 |

0 |

1 |

0 |

| 1M Ago |

1 |

2 |

3 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

2 |

2 |

3 |

1 |

0 |

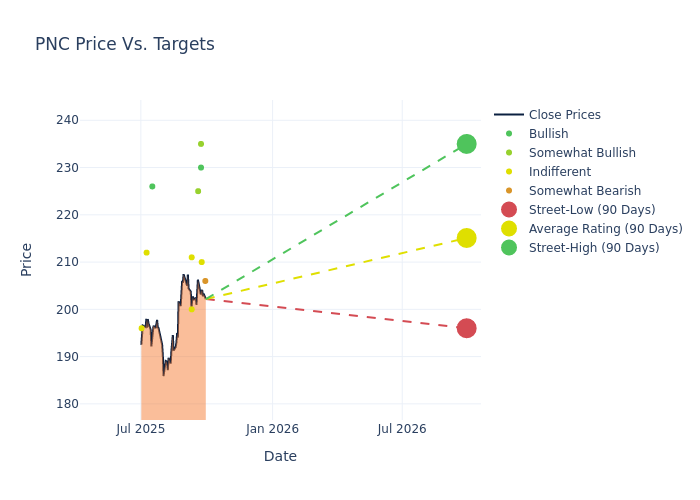

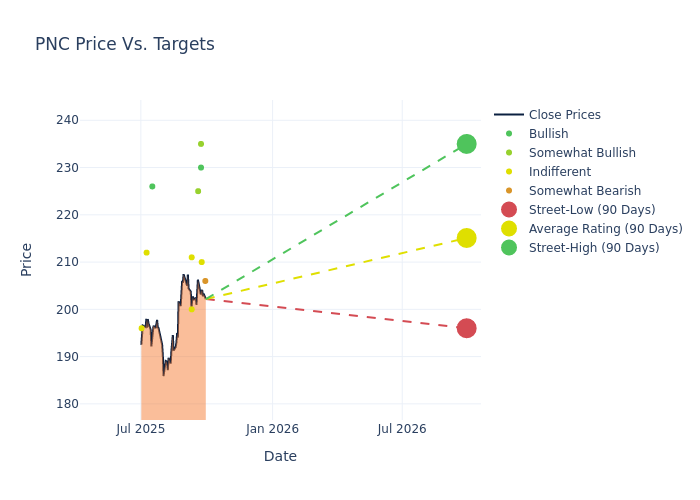

Analysts have recently evaluated PNC Financial Services Gr and provided 12-month price targets. The average target is $214.0, accompanied by a high estimate of $238.00 and a low estimate of $186.00. Surpassing the previous average price target of $201.62, the current average has increased by 6.14%.

Interpreting Analyst Ratings: A Closer Look

The analysis of recent analyst actions sheds light on the perception of PNC Financial Services Gr by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Betsy Graseck |

Morgan Stanley |

Raises |

Underweight |

$206.00 |

$186.00 |

| John McDonald |

Truist Securities |

Raises |

Hold |

$210.00 |

$201.00 |

| Chris Kotowski |

Oppenheimer |

Lowers |

Outperform |

$235.00 |

$238.00 |

| Keith Horowitz |

Citigroup |

Raises |

Buy |

$230.00 |

$217.00 |

| Daniel Tamayo |

Raymond James |

Raises |

Outperform |

$225.00 |

$220.00 |

| Terry McEvoy |

Stephens & Co. |

Maintains |

Equal-Weight |

$200.00 |

$200.00 |

| Scott Siefers |

Piper Sandler |

Raises |

Neutral |

$211.00 |

$200.00 |

| Chris Kotowski |

Oppenheimer |

Announces |

Outperform |

$238.00 |

- |

| Keith Horowitz |

Citigroup |

Raises |

Buy |

$217.00 |

$205.00 |

| Betsy Graseck |

Morgan Stanley |

Raises |

Underweight |

$186.00 |

$179.00 |

| Ebrahim Poonawala |

B of A Securities |

Raises |

Buy |

$226.00 |

$223.00 |

| John McDonald |

Truist Securities |

Raises |

Hold |

$198.00 |

$189.00 |

| David Konrad |

Keefe, Bruyette & Woods |

Raises |

Market Perform |

$212.00 |

$185.00 |

| Daniel Tamayo |

Raymond James |

Announces |

Outperform |

$220.00 |

- |

| Kate McShane |

Goldman Sachs |

Raises |

Neutral |

$196.00 |

$178.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to PNC Financial Services Gr. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of PNC Financial Services Gr compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for PNC Financial Services Gr's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of PNC Financial Services Gr's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on PNC Financial Services Gr analyst ratings.

Delving into PNC Financial Services Gr's Background

PNC Financial Services Group is a diversified financial services company offering retail banking, corporate and institutional banking, asset management, and residential mortgage banking across the United States.

PNC Financial Services Gr: Financial Performance Dissected

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Revenue Growth: Over the 3M period, PNC Financial Services Gr showcased positive performance, achieving a revenue growth rate of 21.22% as of 30 June, 2025. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Financials sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 27.06%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): PNC Financial Services Gr's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 2.69%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): PNC Financial Services Gr's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 0.28%, the company showcases efficient use of assets and strong financial health.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 1.05.

The Core of Analyst Ratings: What Every Investor Should Know

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: PNC