Forecasting The Future: 5 Analyst Projections For WillScot Holdings

Author: Benzinga Insights | September 30, 2025 04:01pm

WillScot Holdings (NASDAQ:WSC) has been analyzed by 5 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

2 |

1 |

2 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

0 |

0 |

2 |

0 |

0 |

| 2M Ago |

1 |

1 |

0 |

0 |

0 |

| 3M Ago |

0 |

0 |

0 |

0 |

0 |

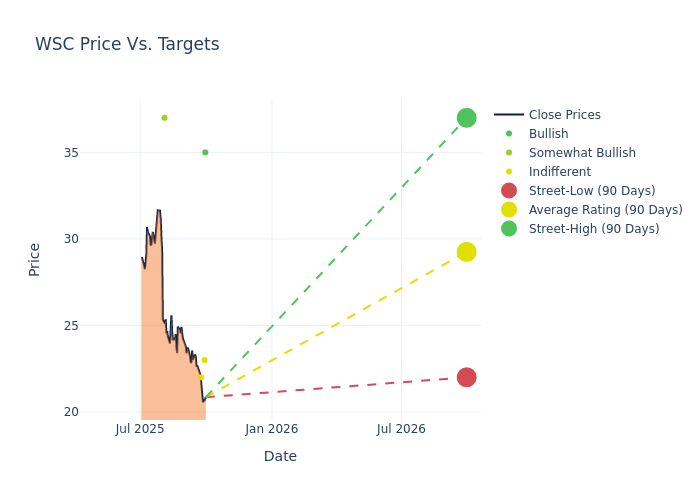

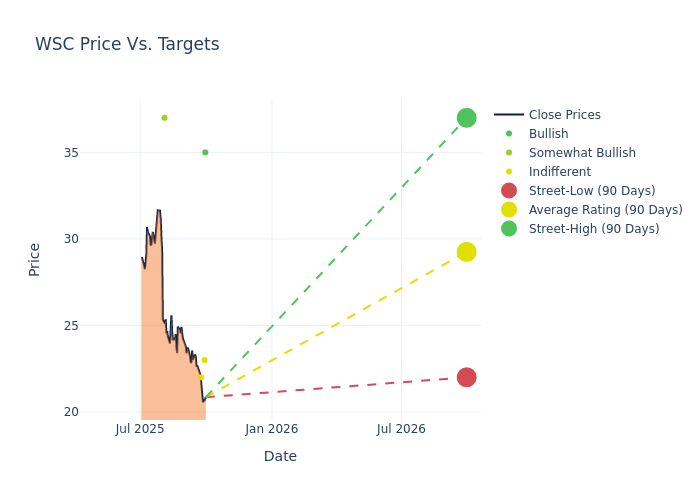

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $31.4, a high estimate of $40.00, and a low estimate of $22.00. This current average has decreased by 17.37% from the previous average price target of $38.00.

Decoding Analyst Ratings: A Detailed Look

The standing of WillScot Holdings among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Brent Thielman |

DA Davidson |

Lowers |

Buy |

$35.00 |

$40.00 |

| Philip Ng |

Jefferies |

Lowers |

Hold |

$23.00 |

$32.00 |

| Manav Patnaik |

Barclays |

Lowers |

Equal-Weight |

$22.00 |

$34.00 |

| Angel Castillo |

Morgan Stanley |

Lowers |

Overweight |

$37.00 |

$39.00 |

| Brent Thielman |

DA Davidson |

Lowers |

Buy |

$40.00 |

$45.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to WillScot Holdings. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of WillScot Holdings compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of WillScot Holdings's stock. This comparison reveals trends in analysts' expectations over time.

Capture valuable insights into WillScot Holdings's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on WillScot Holdings analyst ratings.

All You Need to Know About WillScot Holdings

WillScot Holdings Corp designs, delivers, and services onsite, on-demand space solutions for clients. The company offers turnkey solutions in construction, education, manufacturing, retail, healthcare, and entertainment sectors. The products of the company includes modular office complexes, mobile offices, portable storage containers, and others.

A Deep Dive into WillScot Holdings's Financials

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Decline in Revenue: Over the 3M period, WillScot Holdings faced challenges, resulting in a decline of approximately -2.56% in revenue growth as of 30 June, 2025. This signifies a reduction in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: WillScot Holdings's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of 8.14%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): WillScot Holdings's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 4.69%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): WillScot Holdings's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 0.79%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: WillScot Holdings's debt-to-equity ratio surpasses industry norms, standing at 3.83. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

How Are Analyst Ratings Determined?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: WSC