The Analyst Verdict: KeyCorp In The Eyes Of 7 Experts

Author: Benzinga Insights | September 30, 2025 04:01pm

Throughout the last three months, 7 analysts have evaluated KeyCorp (NYSE:KEY), offering a diverse set of opinions from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

2 |

2 |

3 |

0 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

0 |

0 |

1 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

2 |

1 |

2 |

0 |

0 |

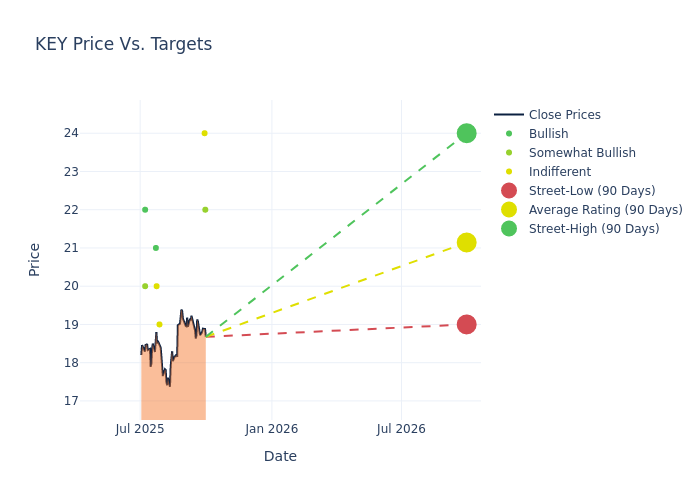

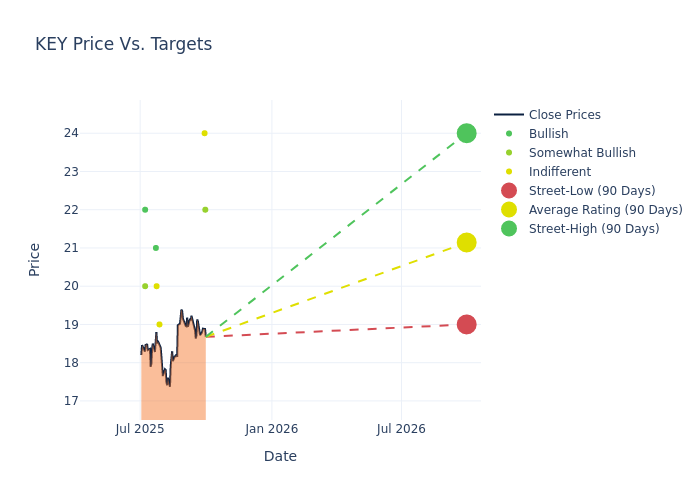

Analysts have set 12-month price targets for KeyCorp, revealing an average target of $21.14, a high estimate of $24.00, and a low estimate of $19.00. Observing a 13.84% increase, the current average has risen from the previous average price target of $18.57.

Investigating Analyst Ratings: An Elaborate Study

The perception of KeyCorp by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| John Pancari |

Evercore ISI Group |

Raises |

Outperform |

$22.00 |

$21.00 |

| Manan Gosalia |

Morgan Stanley |

Raises |

Equal-Weight |

$24.00 |

$20.00 |

| Brian Foran |

Truist Securities |

Raises |

Hold |

$19.00 |

$17.00 |

| Keith Horowitz |

Citigroup |

Raises |

Neutral |

$20.00 |

$19.00 |

| Peter Winter |

DA Davidson |

Raises |

Buy |

$21.00 |

$19.00 |

| Mike Mayo |

Wells Fargo |

Raises |

Overweight |

$20.00 |

$18.00 |

| Erika Najarian |

UBS |

Raises |

Buy |

$22.00 |

$16.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to KeyCorp. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of KeyCorp compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for KeyCorp's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of KeyCorp's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on KeyCorp analyst ratings.

About KeyCorp

With assets of around $185 billion, Ohio-based KeyCorp's bank footprint spans 16 states, but it is predominantly concentrated in its two largest markets: Ohio and New York. KeyCorp is primarily focused on serving middle-market commercial clients through a hybrid community/corporate bank model.

A Deep Dive into KeyCorp's Financials

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Over the 3M period, KeyCorp showcased positive performance, achieving a revenue growth rate of 20.72% as of 30 June, 2025. This reflects a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Financials sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 21.82%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 2.32%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): KeyCorp's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 0.21%, the company may face hurdles in achieving optimal financial returns.

Debt Management: KeyCorp's debt-to-equity ratio is below the industry average at 0.87, reflecting a lower dependency on debt financing and a more conservative financial approach.

Analyst Ratings: Simplified

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: KEY