EQT Stock: A Deep Dive Into Analyst Perspectives (14 Ratings)

Author: Benzinga Insights | September 30, 2025 05:01pm

Providing a diverse range of perspectives from bullish to bearish, 14 analysts have published ratings on EQT (NYSE:EQT) in the last three months.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

5 |

4 |

5 |

0 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

3 |

0 |

2 |

0 |

0 |

| 3M Ago |

2 |

3 |

3 |

0 |

0 |

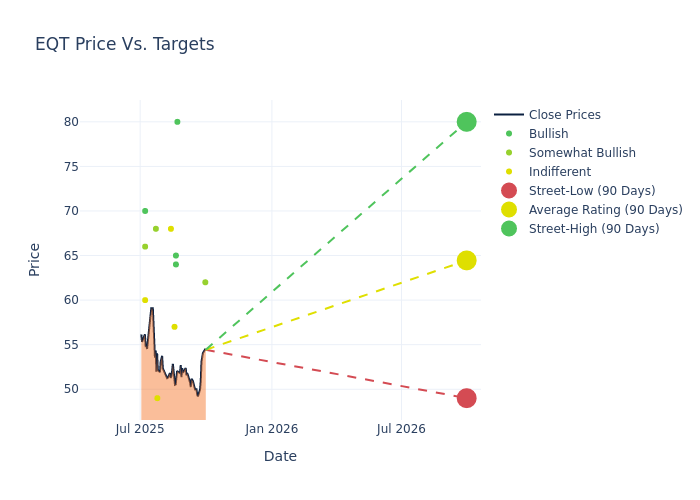

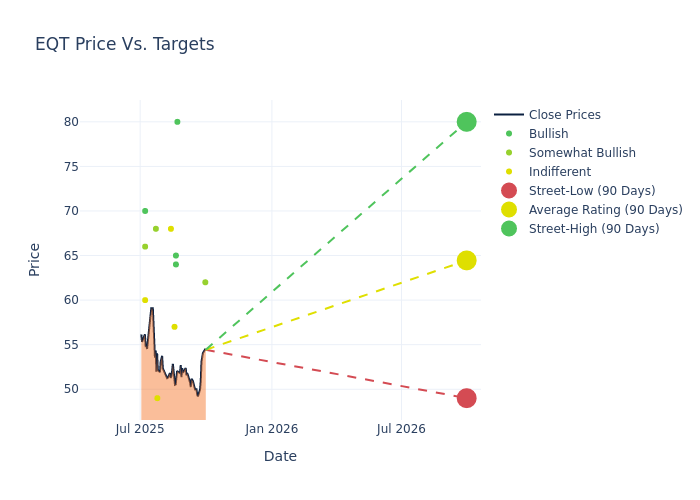

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $65.36, with a high estimate of $80.00 and a low estimate of $49.00. This upward trend is apparent, with the current average reflecting a 3.6% increase from the previous average price target of $63.09.

Deciphering Analyst Ratings: An In-Depth Analysis

The standing of EQT among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Arun Jayaram |

JP Morgan |

Lowers |

Overweight |

$62.00 |

$64.00 |

| Doug Leggate |

B of A Securities |

Raises |

Buy |

$80.00 |

$63.00 |

| Josh Silverstein |

UBS |

Raises |

Buy |

$65.00 |

$64.00 |

| James West |

Melius Research |

Announces |

Buy |

$64.00 |

- |

| Leo Mariani |

Roth Capital |

Lowers |

Neutral |

$57.00 |

$75.00 |

| Cameron Bean |

Scotiabank |

Raises |

Sector Perform |

$68.00 |

$66.00 |

| Mark Lear |

Piper Sandler |

Raises |

Neutral |

$49.00 |

$48.00 |

| Leo Mariani |

Roth Capital |

Raises |

Buy |

$75.00 |

$72.00 |

| Betty Jiang |

Barclays |

Raises |

Overweight |

$68.00 |

$65.00 |

| Cameron Bean |

Scotiabank |

Raises |

Sector Perform |

$66.00 |

$62.00 |

| Lloyd Byrne |

Jefferies |

Raises |

Buy |

$70.00 |

$60.00 |

| Scott Hanold |

RBC Capital |

Raises |

Sector Perform |

$60.00 |

$55.00 |

| Nitin Kumar |

Mizuho |

Announces |

Outperform |

$66.00 |

- |

| Betty Jiang |

Barclays |

Announces |

Overweight |

$65.00 |

- |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to EQT. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of EQT compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of EQT's stock. This comparison reveals trends in analysts' expectations over time.

To gain a panoramic view of EQT's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on EQT analyst ratings.

Get to Know EQT Better

EQT is an independent natural gas production company. It focuses its operations in the cores of the Marcellus and Utica shales, located in the Appalachian Basin in the Eastern United States. Its main customers include marketers, utilities, and industrial operators in the Appalachian Basin. The company has three reportable segments in production, gathering, and its transmission segment, which is now an operated joint venture with Blackstone. All the firm's operating revenue is generated in the US, with most revenue flowing from the Marcellus Shale field and through the sale of natural gas.

EQT's Financial Performance

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Growth: Over the 3M period, EQT showcased positive performance, achieving a revenue growth rate of 106.22% as of 30 June, 2025. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Energy sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: EQT's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 42.67% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): EQT's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 3.72%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): EQT's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 1.98%, the company may face hurdles in achieving optimal financial performance.

Debt Management: EQT's debt-to-equity ratio is below the industry average at 0.39, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Core of Analyst Ratings: What Every Investor Should Know

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: EQT