Breaking Down Toast: 11 Analysts Share Their Views

Author: Benzinga Insights | October 01, 2025 03:01pm

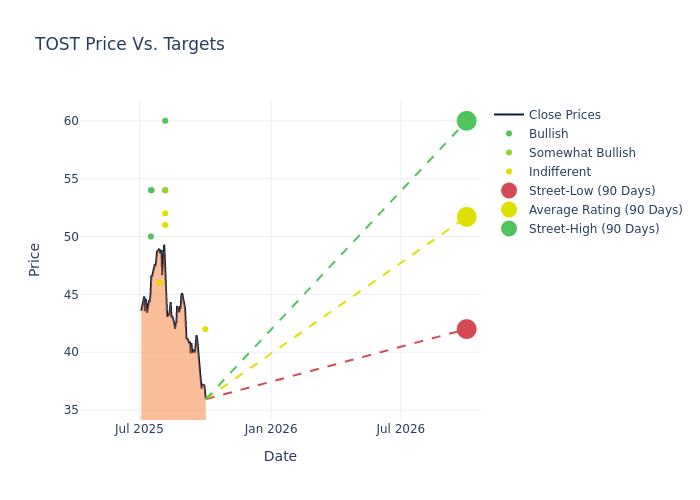

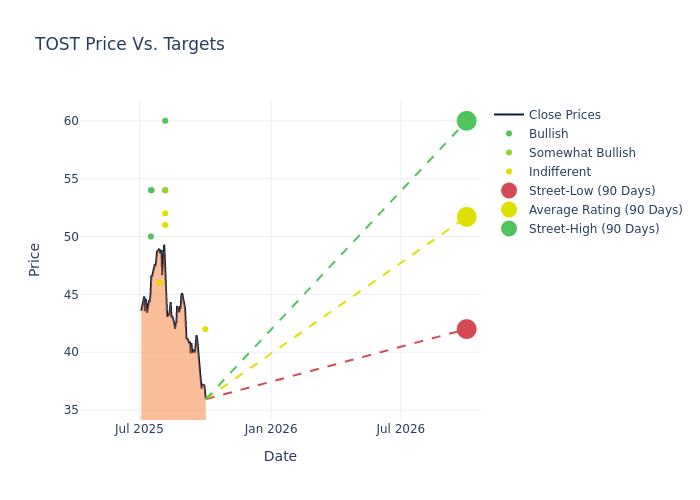

In the preceding three months, 11 analysts have released ratings for Toast (NYSE:TOST), presenting a wide array of perspectives from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

5 |

1 |

5 |

0 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

2 |

1 |

3 |

0 |

0 |

| 3M Ago |

3 |

0 |

1 |

0 |

0 |

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $51.55, along with a high estimate of $60.00 and a low estimate of $42.00. Marking an increase of 9.68%, the current average surpasses the previous average price target of $47.00.

Analyzing Analyst Ratings: A Detailed Breakdown

The perception of Toast by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Sanjay Sakhrani |

Keefe, Bruyette & Woods |

Lowers |

Market Perform |

$42.00 |

$50.00 |

| Tien-Tsin Huang |

JP Morgan |

Raises |

Neutral |

$52.00 |

$42.00 |

| David Hynes |

Canaccord Genuity |

Raises |

Buy |

$54.00 |

$48.00 |

| Sanjay Sakhrani |

Keefe, Bruyette & Woods |

Raises |

Market Perform |

$50.00 |

$47.00 |

| Will Nance |

Goldman Sachs |

Raises |

Neutral |

$51.00 |

$45.00 |

| Mayank Tandon |

Needham |

Raises |

Buy |

$60.00 |

$50.00 |

| Josh Baer |

Morgan Stanley |

Raises |

Overweight |

$54.00 |

$50.00 |

| Peter Heckmann |

DA Davidson |

Raises |

Neutral |

$46.00 |

$40.00 |

| Samad Samana |

Jefferies |

Raises |

Buy |

$54.00 |

$50.00 |

| Matthew Coad |

Truist Securities |

Raises |

Buy |

$50.00 |

$48.00 |

| Nate Svensson |

Deutsche Bank |

Announces |

Buy |

$54.00 |

- |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Toast. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Toast compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Toast's stock. This examination reveals shifts in analysts' expectations over time.

To gain a panoramic view of Toast's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Toast analyst ratings.

Discovering Toast: A Closer Look

Toast is an end-to-end technology platform designed to address the complex needs of the restaurant industry. The company generates point-in-time revenue through sales of its restaurant-grade hardware and recurring revenue in the form of take rates on restaurant transaction volume as well as subscriptions to its software solutions. As of fiscal 2024, the company provided services to 134,000 restaurant locations primarily in the US. Toast's typical customer is a mid-market restaurant generating slightly more than $1 million in revenue annually.

Breaking Down Toast's Financial Performance

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Growth: Toast displayed positive results in 3M. As of 30 June, 2025, the company achieved a solid revenue growth rate of approximately 24.8%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Financials sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Toast's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 5.16%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 4.58%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Toast's ROA excels beyond industry benchmarks, reaching 3.0%. This signifies efficient management of assets and strong financial health.

Debt Management: Toast's debt-to-equity ratio is below the industry average at 0.01, reflecting a lower dependency on debt financing and a more conservative financial approach.

Analyst Ratings: Simplified

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: TOST