Smart Money Is Betting Big In Coca-Cola Options

Author: Benzinga Insights | October 01, 2025 03:02pm

Investors with a lot of money to spend have taken a bearish stance on Coca-Cola (NYSE:KO).

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with KO, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 8 options trades for Coca-Cola.

This isn't normal.

The overall sentiment of these big-money traders is split between 12% bullish and 75%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $26,740, and 7, calls, for a total amount of $320,279.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $67.5 to $105.0 for Coca-Cola over the last 3 months.

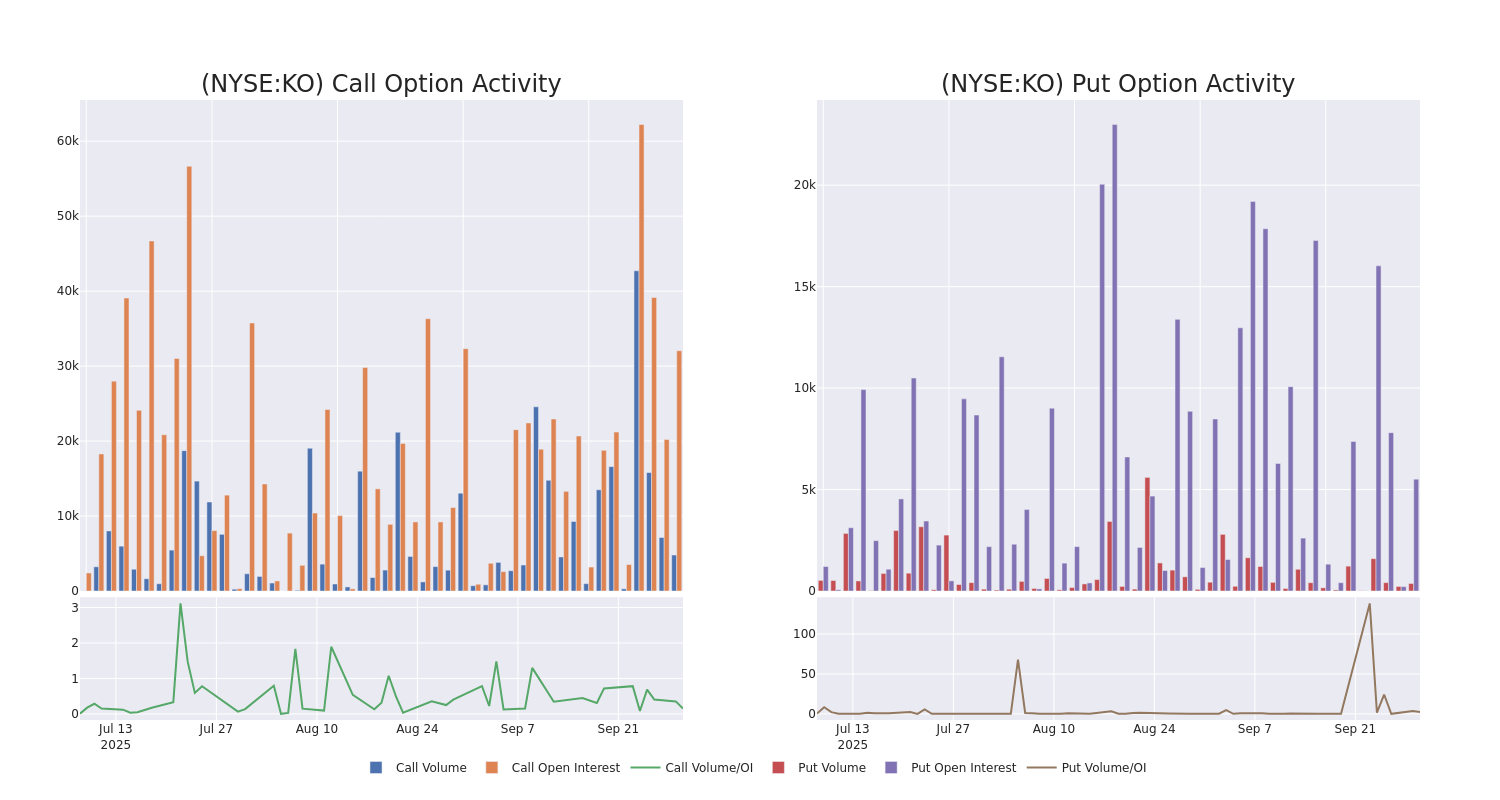

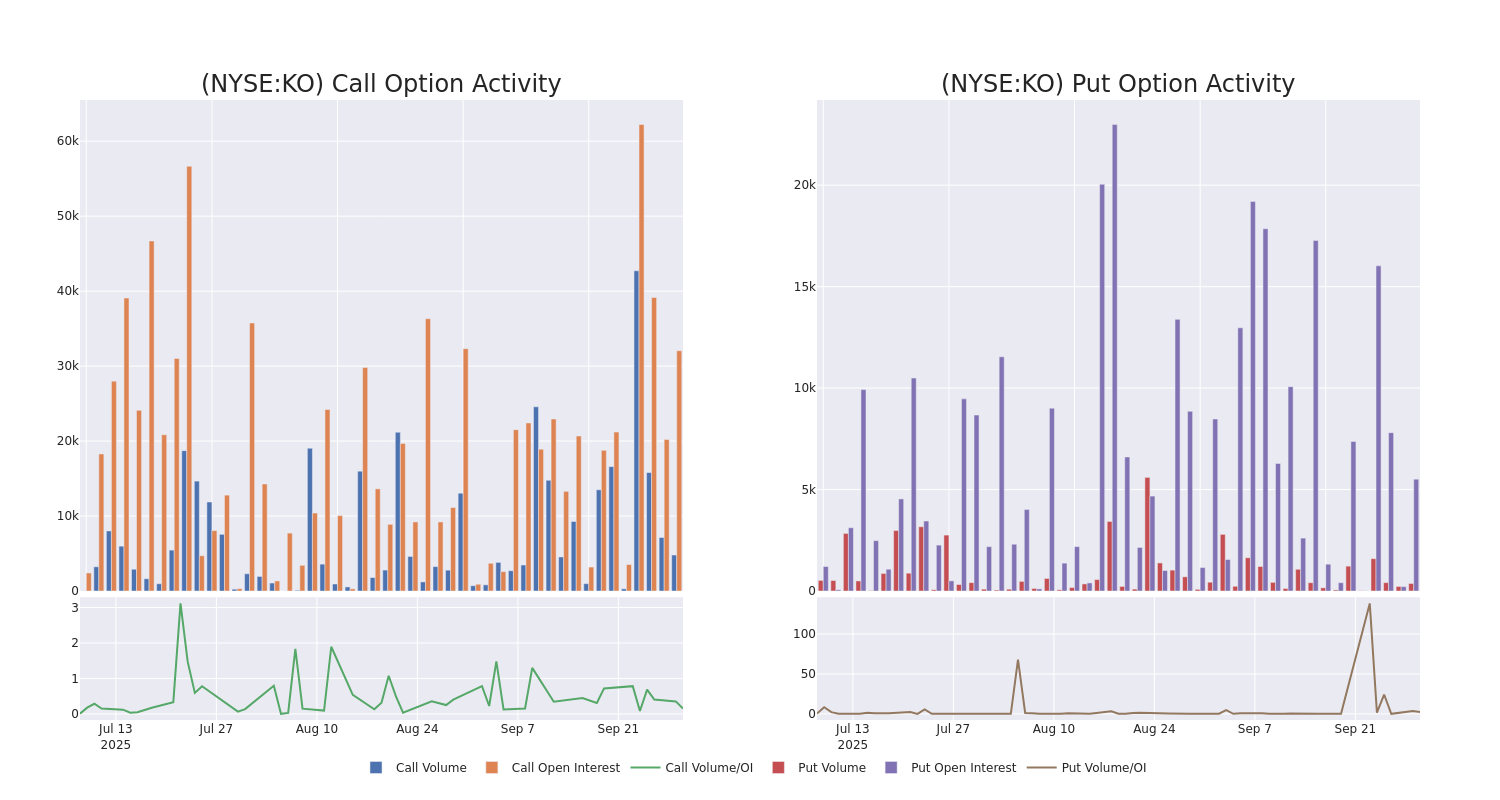

Analyzing Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Coca-Cola's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Coca-Cola's whale activity within a strike price range from $67.5 to $105.0 in the last 30 days.

Coca-Cola 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| KO |

CALL |

SWEEP |

NEUTRAL |

03/20/26 |

$2.04 |

$2.03 |

$2.03 |

$70.00 |

$79.6K |

2.9K |

523 |

| KO |

CALL |

SWEEP |

BEARISH |

03/20/26 |

$2.06 |

$2.03 |

$2.04 |

$70.00 |

$50.5K |

2.9K |

1.2K |

| KO |

CALL |

TRADE |

BEARISH |

12/19/25 |

$1.99 |

$1.98 |

$1.98 |

$67.50 |

$44.3K |

1.6K |

231 |

| KO |

CALL |

SWEEP |

BEARISH |

01/16/26 |

$1.36 |

$1.35 |

$1.35 |

$70.00 |

$42.6K |

10.0K |

3.3K |

| KO |

CALL |

SWEEP |

BEARISH |

03/20/26 |

$2.07 |

$2.03 |

$2.03 |

$70.00 |

$39.1K |

2.9K |

493 |

About Coca-Cola

Founded in 1886, Atlanta-headquartered Coca-Cola is the world's largest nonalcoholic beverage company, with a strong portfolio of 200 brands covering key categories including carbonated soft drinks, water, sports, energy, juice, and coffee. Together with bottlers and distribution partners, the company sells finished beverage products bearing Coca-Cola and licensed brands through retailers and food-service locations in more than 200 countries and regions globally. Coca-Cola generates around two thirds of its total revenue overseas, with a significant portion from emerging economies in Latin America and Asia-Pacific.

In light of the recent options history for Coca-Cola, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Coca-Cola

- Currently trading with a volume of 8,418,142, the KO's price is up by 0.36%, now at $66.56.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 20 days.

What The Experts Say On Coca-Cola

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $77.5.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from UBS keeps a Buy rating on Coca-Cola with a target price of $80.

* Consistent in their evaluation, an analyst from Wells Fargo keeps a Overweight rating on Coca-Cola with a target price of $75.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Coca-Cola with Benzinga Pro for real-time alerts.

Posted In: KO