Assessing Doximity: Insights From 12 Financial Analysts

Author: Benzinga Insights | October 01, 2025 06:01pm

Across the recent three months, 12 analysts have shared their insights on Doximity (NYSE:DOCS), expressing a variety of opinions spanning from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

1 |

5 |

5 |

0 |

1 |

| Last 30D |

0 |

0 |

0 |

0 |

1 |

| 1M Ago |

0 |

1 |

1 |

0 |

0 |

| 2M Ago |

1 |

2 |

3 |

0 |

0 |

| 3M Ago |

0 |

2 |

1 |

0 |

0 |

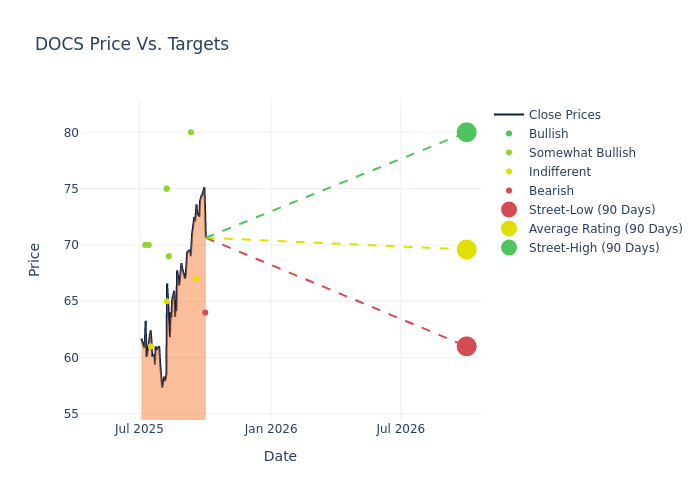

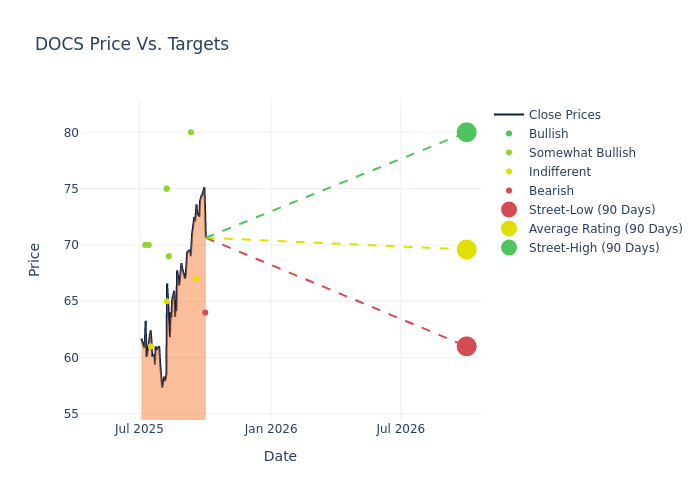

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $68.08, a high estimate of $80.00, and a low estimate of $59.00. This upward trend is evident, with the current average reflecting a 13.15% increase from the previous average price target of $60.17.

Diving into Analyst Ratings: An In-Depth Exploration

The perception of Doximity by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| David Roman |

Goldman Sachs |

Raises |

Sell |

$64.00 |

$57.00 |

| Richard Close |

Canaccord Genuity |

Raises |

Hold |

$67.00 |

$59.00 |

| Vikram Kesavabhotla |

Baird |

Raises |

Outperform |

$80.00 |

$75.00 |

| Jessica Tassan |

Piper Sandler |

Raises |

Overweight |

$69.00 |

$65.00 |

| Richard Close |

Canaccord Genuity |

Raises |

Hold |

$59.00 |

$50.00 |

| Brian Peterson |

Raymond James |

Raises |

Outperform |

$75.00 |

$65.00 |

| Stan Berenshteyn |

Wells Fargo |

Raises |

Equal-Weight |

$65.00 |

$62.00 |

| Ryan MacDonald |

Needham |

Raises |

Buy |

$75.00 |

$67.00 |

| Stan Berenshteyn |

Wells Fargo |

Raises |

Equal-Weight |

$62.00 |

$55.00 |

| Jailendra Singh |

Truist Securities |

Raises |

Hold |

$61.00 |

$52.00 |

| Scott Schoenhaus |

Keybanc |

Raises |

Overweight |

$70.00 |

$65.00 |

| Elizabeth Anderson |

Evercore ISI Group |

Raises |

Outperform |

$70.00 |

$50.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Doximity. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Doximity compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Doximity's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Doximity's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Doximity analyst ratings.

All You Need to Know About Doximity

Doximity Inc is a digital platform for U.S. medical professionals. The cloud-based platform provides members with tools specifically built for medical professionals, enabling them to collaborate with their colleagues, securely coordinate patient care, conduct virtual patient visits, stay up-to-date with the latest medical news and research, and manage their careers and on-call schedules.

Doximity's Economic Impact: An Analysis

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: Doximity's remarkable performance in 3M is evident. As of 30 June, 2025, the company achieved an impressive revenue growth rate of 15.19%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Health Care sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Doximity's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 36.54% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Doximity's ROE excels beyond industry benchmarks, reaching 5.06%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Doximity's ROA excels beyond industry benchmarks, reaching 4.32%. This signifies efficient management of assets and strong financial health.

Debt Management: Doximity's debt-to-equity ratio is below the industry average at 0.01, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Significance of Analyst Ratings Explained

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: DOCS