Deep Dive Into Avantor Stock: Analyst Perspectives (11 Ratings)

Author: Benzinga Insights | October 02, 2025 06:00pm

Throughout the last three months, 11 analysts have evaluated Avantor (NYSE:AVTR), offering a diverse set of opinions from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

9 |

2 |

0 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

7 |

2 |

0 |

0 |

| 3M Ago |

0 |

1 |

0 |

0 |

0 |

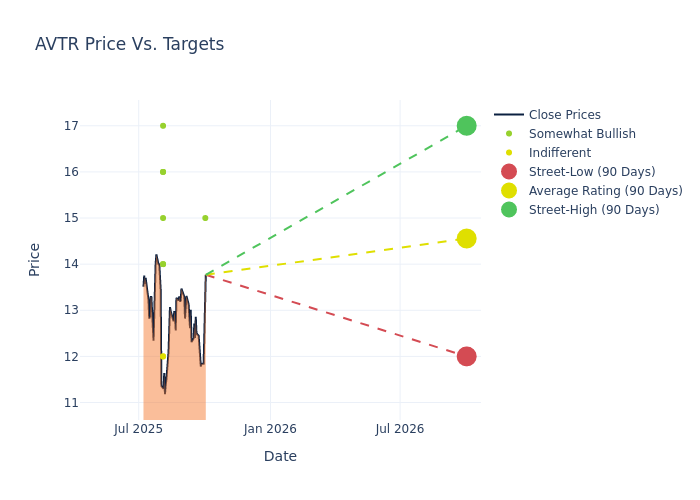

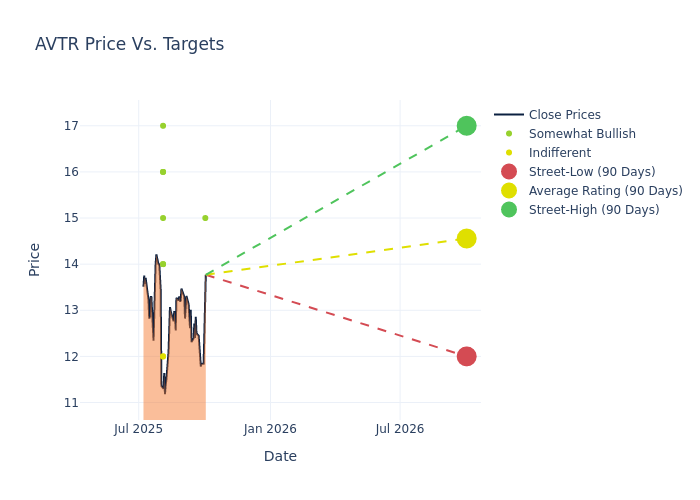

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $14.73, along with a high estimate of $18.00 and a low estimate of $12.00. Experiencing a 11.0% decline, the current average is now lower than the previous average price target of $16.55.

Interpreting Analyst Ratings: A Closer Look

The standing of Avantor among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Luke Sergott |

Barclays |

Raises |

Overweight |

$15.00 |

$13.00 |

| Daniel Arias |

Stifel |

Lowers |

Hold |

$12.00 |

$14.00 |

| Rachel Vatnsdal |

JP Morgan |

Lowers |

Overweight |

$14.00 |

$17.00 |

| Vijay Kumar |

Evercore ISI Group |

Lowers |

Outperform |

$16.00 |

$18.00 |

| Tejas Savant |

Morgan Stanley |

Lowers |

Equal-Weight |

$12.00 |

$15.00 |

| Luke Sergott |

Barclays |

Lowers |

Overweight |

$13.00 |

$15.00 |

| Brandon Couillard |

Wells Fargo |

Lowers |

Overweight |

$16.00 |

$19.00 |

| Conor McNamara |

RBC Capital |

Lowers |

Outperform |

$17.00 |

$20.00 |

| Andrew Cooper |

Raymond James |

Lowers |

Outperform |

$14.00 |

$16.00 |

| Catherine Schulte |

Baird |

Lowers |

Outperform |

$15.00 |

$18.00 |

| Catherine Schulte |

Baird |

Raises |

Outperform |

$18.00 |

$17.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Avantor. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Avantor compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Avantor's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Avantor's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Avantor analyst ratings.

Delving into Avantor's Background

Avantor Inc provider of products and services to customers in the biopharma, healthcare, education & government, and advanced technologies & applied materials industries. The company has three geographic segments: the Americas, Europe, and AMEA. The company's product group consists of Equipment & instrumentation, Services & specialty procurement, Proprietary materials & consumables, and Third-party materials & consumables. Materials & consumables include high-purity chemicals and reagents, lab products and supplies, specialized formulated silicone materials, customized excipients, customized single-use assemblies, process chromatography resins and columns, analytical sample prep kits, and education and microbiology and clinical trial kits, peristaltic pumps and fluid handling tips.

Key Indicators: Avantor's Financial Health

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Avantor's revenue growth over a period of 3M has faced challenges. As of 30 June, 2025, the company experienced a revenue decline of approximately -1.14%. This indicates a decrease in the company's top-line earnings. When compared to others in the Health Care sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Avantor's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 3.84% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Avantor's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 1.04%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Avantor's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.52%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: With a below-average debt-to-equity ratio of 0.67, Avantor adopts a prudent financial strategy, indicating a balanced approach to debt management.

How Are Analyst Ratings Determined?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: AVTR