Expert Outlook: Gen Digital Through The Eyes Of 7 Analysts

Author: Benzinga Insights | October 03, 2025 08:02am

Across the recent three months, 7 analysts have shared their insights on Gen Digital (NASDAQ:GEN), expressing a variety of opinions spanning from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

1 |

1 |

5 |

0 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

1 |

3 |

0 |

0 |

| 3M Ago |

1 |

0 |

1 |

0 |

0 |

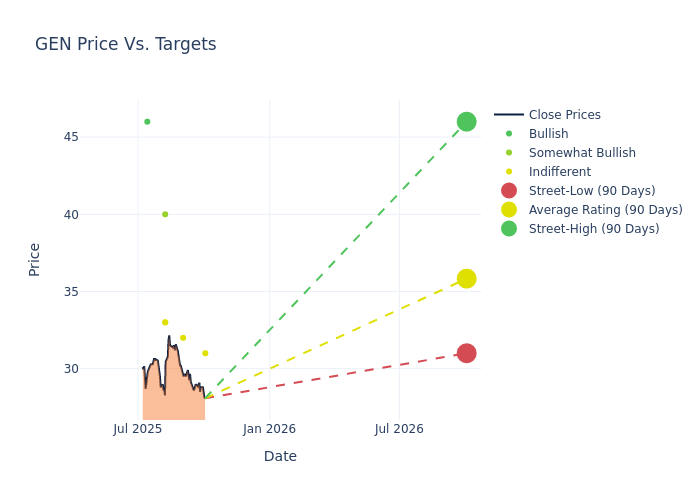

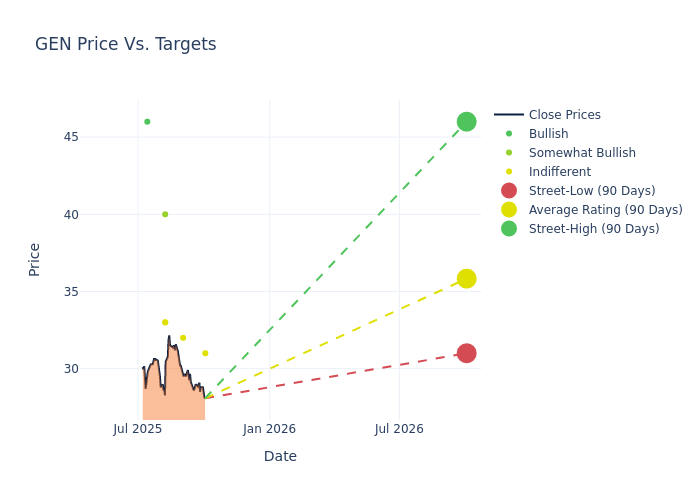

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $35.29, with a high estimate of $46.00 and a low estimate of $31.00. This current average reflects an increase of 13.11% from the previous average price target of $31.20.

Breaking Down Analyst Ratings: A Detailed Examination

A clear picture of Gen Digital's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Joseph Gallo |

Jefferies |

Announces |

Hold |

$31.00 |

- |

| Hamza Fodderwala |

Morgan Stanley |

Raises |

Equal-Weight |

$32.00 |

$25.00 |

| Matthew Hedberg |

RBC Capital |

Raises |

Sector Perform |

$33.00 |

$32.00 |

| Andrew Nowinski |

Wells Fargo |

Raises |

Overweight |

$40.00 |

$37.00 |

| Saket Kalia |

Barclays |

Raises |

Equal-Weight |

$33.00 |

$32.00 |

| Hal Goetsch |

B. Riley Securities |

Announces |

Buy |

$46.00 |

- |

| Saket Kalia |

Barclays |

Raises |

Equal-Weight |

$32.00 |

$30.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Gen Digital. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Gen Digital compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Gen Digital's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of Gen Digital's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Gen Digital analyst ratings.

Unveiling the Story Behind Gen Digital

Gen is a cybersecurity pure-play that offers security, identity protection, and privacy solutions to individual consumers. The firm's cyber safety offerings, via brands such as Norton, Avast, and LifeLock, have long maintained their positions as some of the most recognizable consumer-focused security and identity-protection products.

Gen Digital: Financial Performance Dissected

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Gen Digital's revenue growth over a period of 3M has been noteworthy. As of 30 June, 2025, the company achieved a revenue growth rate of approximately 30.26%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: Gen Digital's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 10.74%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Gen Digital's ROE stands out, surpassing industry averages. With an impressive ROE of 5.83%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Gen Digital's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 0.85%, the company may face hurdles in achieving optimal financial performance.

Debt Management: With a high debt-to-equity ratio of 3.75, Gen Digital faces challenges in effectively managing its debt levels, indicating potential financial strain.

Analyst Ratings: What Are They?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: GEN