Philip Morris Intl Options Trading: A Deep Dive into Market Sentiment

Author: Benzinga Insights | October 03, 2025 04:01pm

Investors with a lot of money to spend have taken a bearish stance on Philip Morris Intl (NYSE:PM).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with PM, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 47 uncommon options trades for Philip Morris Intl.

This isn't normal.

The overall sentiment of these big-money traders is split between 38% bullish and 48%, bearish.

Out of all of the special options we uncovered, 37 are puts, for a total amount of $2,872,770, and 10 are calls, for a total amount of $451,088.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $90.0 and $180.0 for Philip Morris Intl, spanning the last three months.

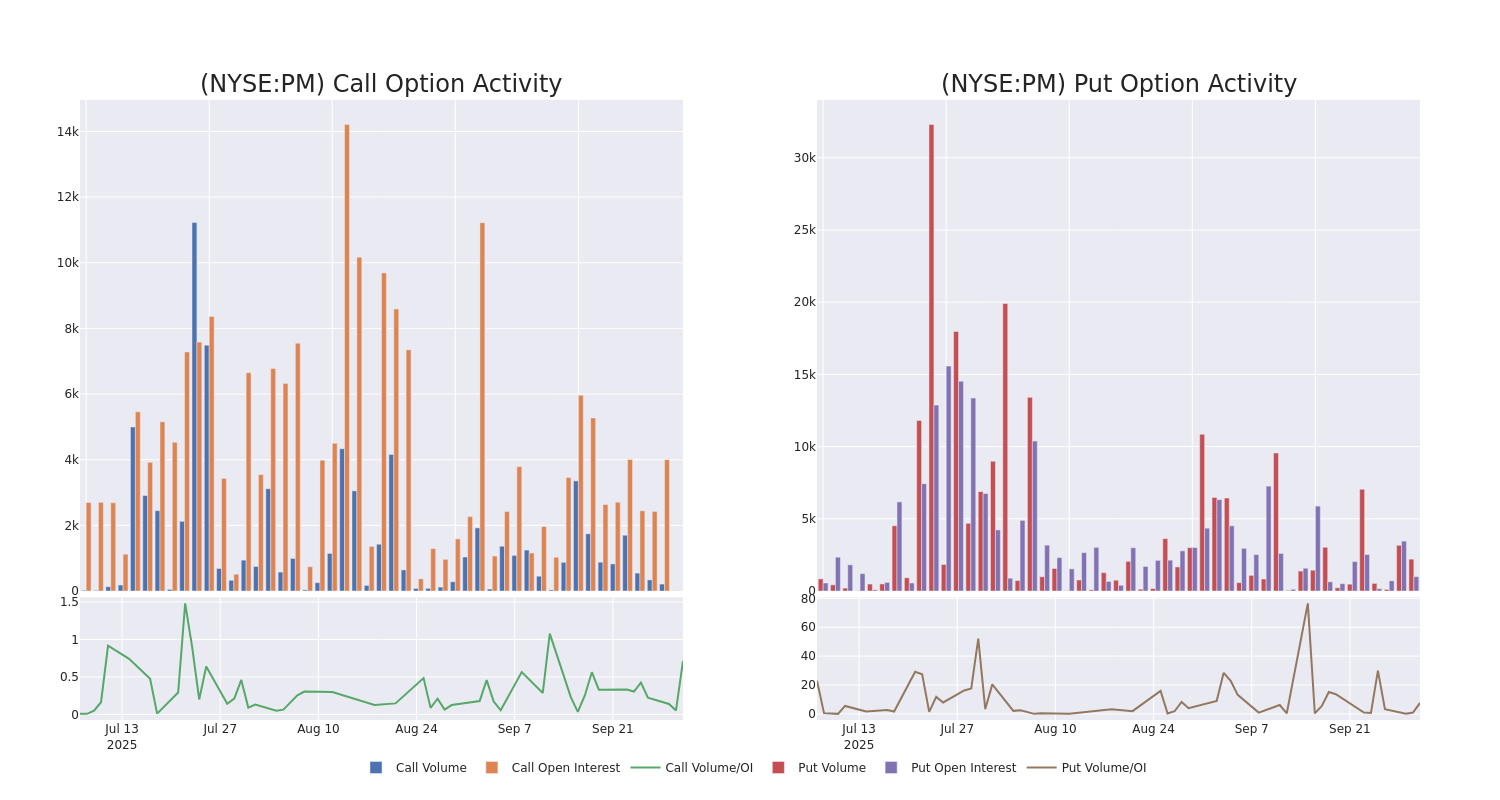

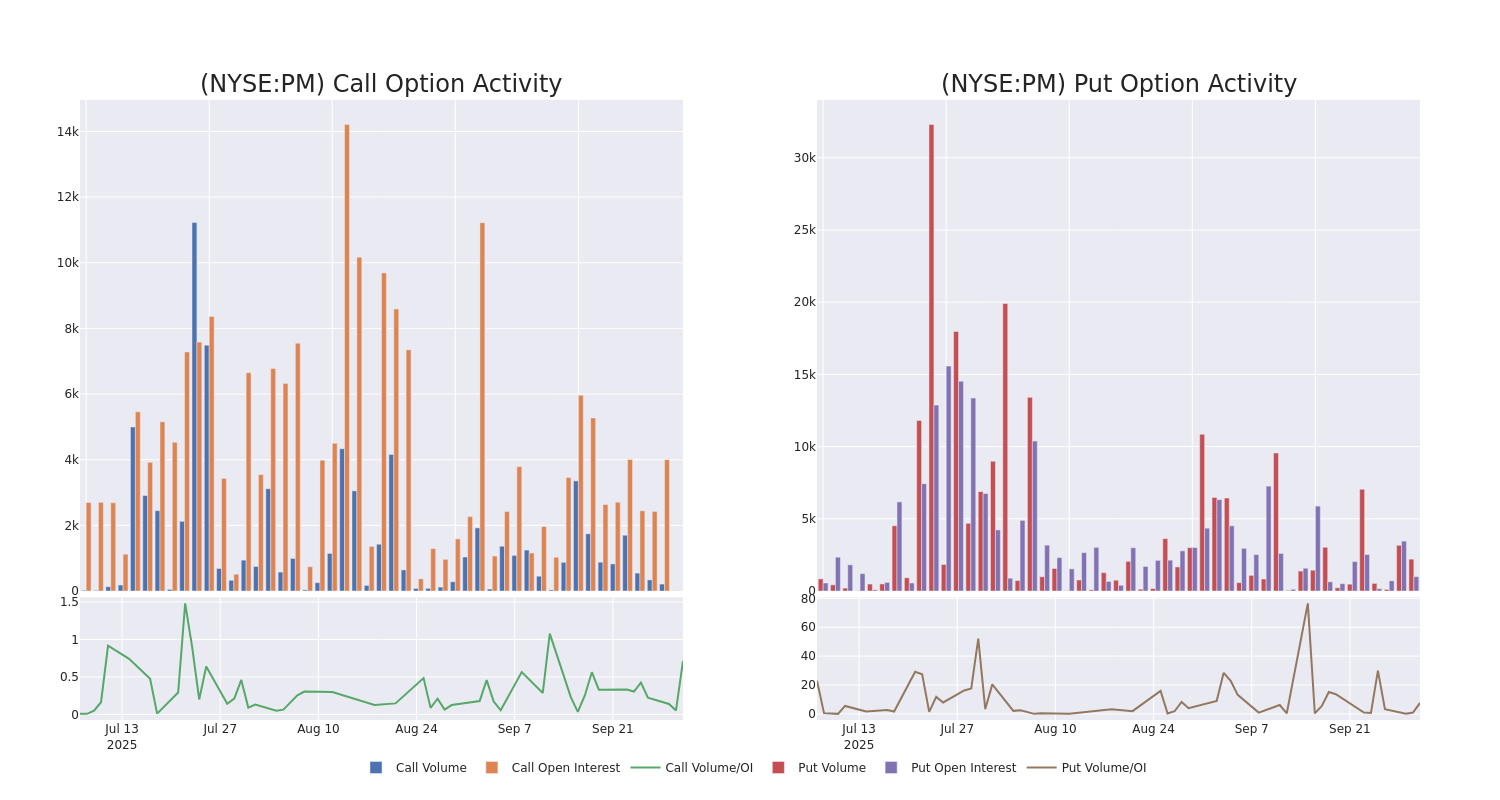

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Philip Morris Intl's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Philip Morris Intl's substantial trades, within a strike price spectrum from $90.0 to $180.0 over the preceding 30 days.

Philip Morris Intl Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| PM |

PUT |

TRADE |

BULLISH |

03/20/26 |

$18.3 |

$17.7 |

$17.72 |

$165.00 |

$708.8K |

337 |

601 |

| PM |

PUT |

SWEEP |

BEARISH |

03/20/26 |

$18.8 |

$18.4 |

$18.68 |

$165.00 |

$151.3K |

337 |

168 |

| PM |

PUT |

SWEEP |

BULLISH |

12/19/25 |

$15.8 |

$15.1 |

$15.17 |

$165.00 |

$116.5K |

1.3K |

404 |

| PM |

CALL |

SWEEP |

BULLISH |

12/19/25 |

$4.3 |

$4.1 |

$4.3 |

$165.00 |

$98.9K |

1.3K |

234 |

| PM |

PUT |

TRADE |

NEUTRAL |

11/21/25 |

$17.6 |

$17.4 |

$17.5 |

$170.00 |

$87.5K |

644 |

62 |

About Philip Morris Intl

Created from the international operations of Altria in 2008, Philip Morris International sells cigarettes and reduced-risk products, including heat sticks, vapes, and oral nicotine offerings, primarily outside of the US. With the 2023 acquisition of Swedish Match, a leading manufacturer of traditional oral tobacco products and nicotine pouches primarily in the US and Scandinavia, PMI has not only diversified away from smokable products but also gained a toehold in the US to sell its Iqos heated tobacco product.

In light of the recent options history for Philip Morris Intl, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Philip Morris Intl

- Currently trading with a volume of 8,721,208, the PM's price is down by -3.26%, now at $152.75.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 18 days.

Expert Opinions on Philip Morris Intl

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $166.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from UBS keeps a Neutral rating on Philip Morris Intl with a target price of $166.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Philip Morris Intl options trades with real-time alerts from Benzinga Pro.

Posted In: PM