Demystifying Impinj: Insights From 7 Analyst Reviews

Author: Benzinga Insights | October 06, 2025 10:02am

Providing a diverse range of perspectives from bullish to bearish, 7 analysts have published ratings on Impinj (NASDAQ:PI) in the last three months.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

2 |

5 |

0 |

0 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

1 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

1 |

4 |

0 |

0 |

0 |

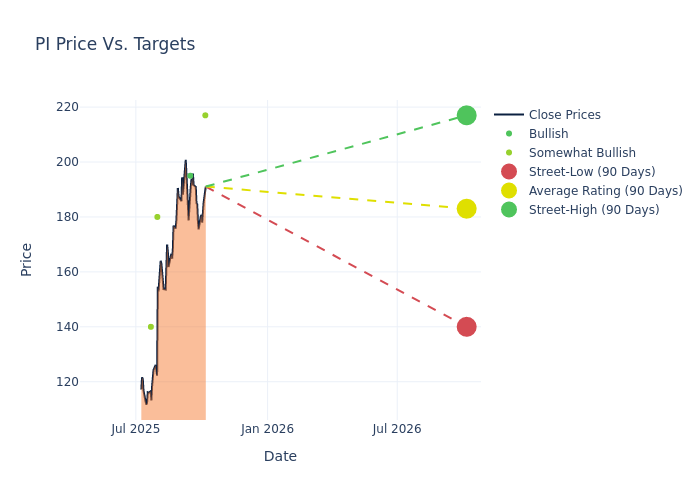

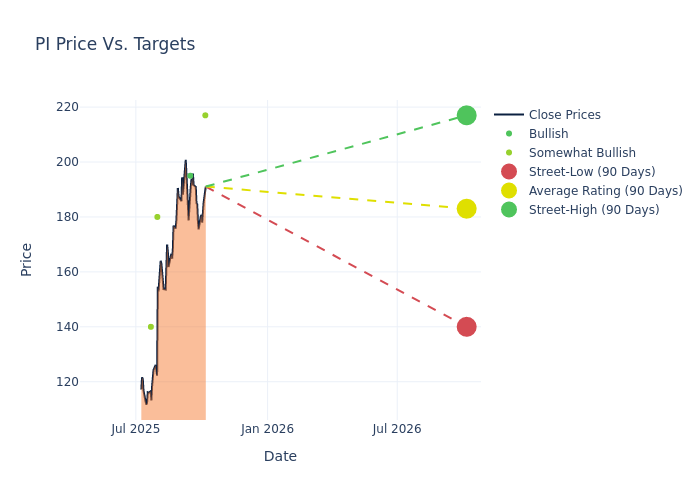

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $170.71, a high estimate of $217.00, and a low estimate of $140.00. Witnessing a positive shift, the current average has risen by 23.07% from the previous average price target of $138.71.

Diving into Analyst Ratings: An In-Depth Exploration

The analysis of recent analyst actions sheds light on the perception of Impinj by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Troy Jensen |

Cantor Fitzgerald |

Raises |

Overweight |

$217.00 |

$158.00 |

| James Ricchiuti |

Needham |

Maintains |

Buy |

$195.00 |

$195.00 |

| Harsh Kumar |

Piper Sandler |

Raises |

Overweight |

$180.00 |

$140.00 |

| Troy Jensen |

Cantor Fitzgerald |

Raises |

Overweight |

$158.00 |

$133.00 |

| James Ricchiuti |

Needham |

Raises |

Buy |

$165.00 |

$115.00 |

| Harsh Kumar |

Piper Sandler |

Raises |

Overweight |

$140.00 |

$100.00 |

| Christopher Rolland |

Susquehanna |

Raises |

Positive |

$140.00 |

$130.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Impinj. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Impinj compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Impinj's stock. This analysis reveals shifts in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Impinj's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Impinj analyst ratings.

Get to Know Impinj Better

Impinj Inc operates a platform that enables wireless connectivity to everyday items by delivering each item's identity, location, and authenticity to business and consumer applications. Its platform includes endpoint integrated circuits (ICs) product, a miniature radios-on-a-chip, which attach to and identify their host items; and connectivity layer that comprises readers, gateways, and reader ICs to wirelessly identify, locate, authenticate, and engage endpoints via RAIN, as well as provide power to and communicate bidirectionally with endpoint ICs. Geographically, the company has a business presence in the Americas, Asia Pacific, Europe, Middle East and Africa, of which key revenue is derived from the operations in the Asia Pacific region.

Impinj's Financial Performance

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Decline in Revenue: Over the 3M period, Impinj faced challenges, resulting in a decline of approximately -4.49% in revenue growth as of 30 June, 2025. This signifies a reduction in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: Impinj's net margin excels beyond industry benchmarks, reaching 11.8%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Impinj's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 6.63%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Impinj's ROA excels beyond industry benchmarks, reaching 2.34%. This signifies efficient management of assets and strong financial health.

Debt Management: Impinj's debt-to-equity ratio surpasses industry norms, standing at 1.56. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

Understanding the Relevance of Analyst Ratings

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: PI