Breaking Down Honeywell Intl: 5 Analysts Share Their Views

Author: Benzinga Insights | October 06, 2025 05:01pm

Across the recent three months, 5 analysts have shared their insights on Honeywell Intl (NASDAQ:HON), expressing a variety of opinions spanning from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

1 |

4 |

0 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

0 |

1 |

3 |

0 |

0 |

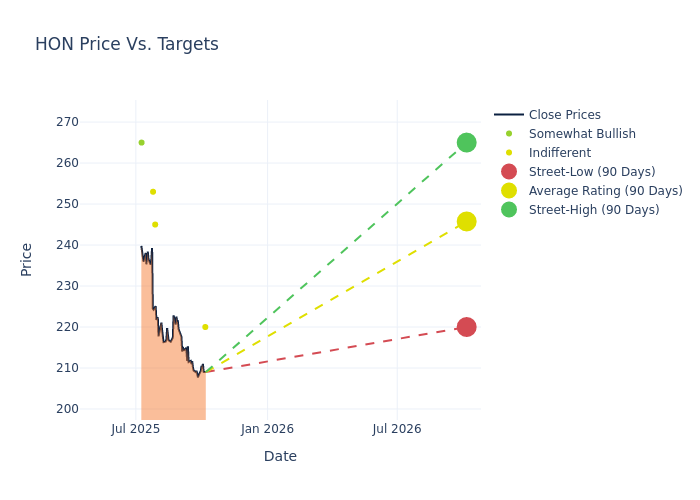

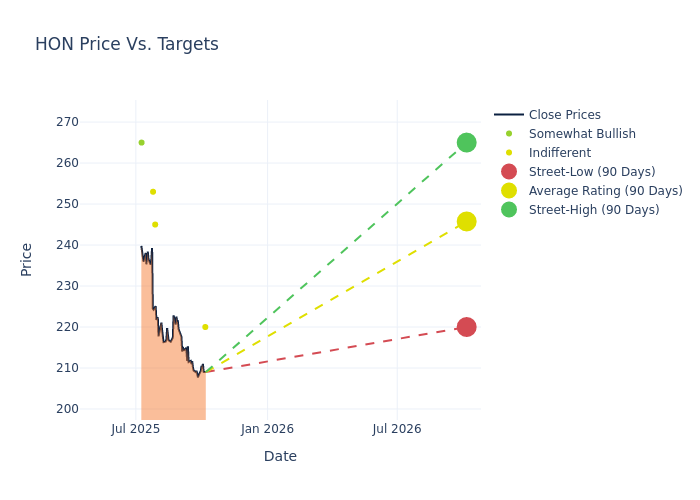

The 12-month price targets, analyzed by analysts, offer insights with an average target of $242.6, a high estimate of $265.00, and a low estimate of $220.00. This current average has increased by 0.5% from the previous average price target of $241.40.

Exploring Analyst Ratings: An In-Depth Overview

The standing of Honeywell Intl among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Joseph O'Dea |

Wells Fargo |

Lowers |

Equal-Weight |

$220.00 |

$230.00 |

| Chris Snyder |

Morgan Stanley |

Raises |

Equal-Weight |

$245.00 |

$225.00 |

| Deane Dray |

RBC Capital |

Lowers |

Sector Perform |

$253.00 |

$254.00 |

| Joseph O'Dea |

Wells Fargo |

Lowers |

Equal-Weight |

$230.00 |

$240.00 |

| Julian Mitchell |

Barclays |

Raises |

Overweight |

$265.00 |

$258.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Honeywell Intl. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Honeywell Intl compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Honeywell Intl's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Honeywell Intl's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Honeywell Intl analyst ratings.

About Honeywell Intl

Honeywell traces its roots to 1885 with Albert Butz's firm, Butz Thermo-Electric Regulator, which produced a predecessor to the modern thermostat. Other inventions by Honeywell include biodegradable detergent and autopilot. Today, Honeywell is a global multi-industry behemoth with one of the largest installed bases of equipment. It operates through four business segments: aerospace technologies (37% of 2023 company revenue), industrial automation (29%), energy and sustainability solutions (17%), and building automation (17%). Recently, Honeywell has made several portfolio changes to focus on fewer end markets and align with a set of secular growth trends. The firm is working diligently to expand its installed base, deriving around 30% of its revenue from recurring aftermarket services.

Honeywell Intl: Delving into Financials

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Growth: Honeywell Intl's remarkable performance in 3M is evident. As of 30 June, 2025, the company achieved an impressive revenue growth rate of 8.09%. This signifies a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Industrials sector.

Net Margin: Honeywell Intl's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 15.17%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Honeywell Intl's ROE excels beyond industry benchmarks, reaching 9.36%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Honeywell Intl's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 2.04%, the company showcases efficient use of assets and strong financial health.

Debt Management: Honeywell Intl's debt-to-equity ratio is below the industry average. With a ratio of 2.27, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

How Are Analyst Ratings Determined?

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: HON