7 Analysts Assess Regenxbio: What You Need To Know

Author: Benzinga Insights | October 07, 2025 08:04am

Throughout the last three months, 7 analysts have evaluated Regenxbio (NASDAQ:RGNX), offering a diverse set of opinions from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

5 |

2 |

0 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

2 |

0 |

0 |

0 |

0 |

| 2M Ago |

2 |

2 |

0 |

0 |

0 |

| 3M Ago |

0 |

0 |

0 |

0 |

0 |

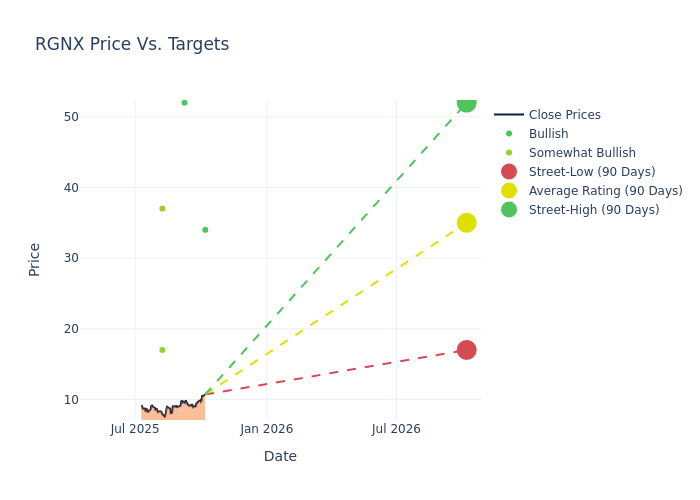

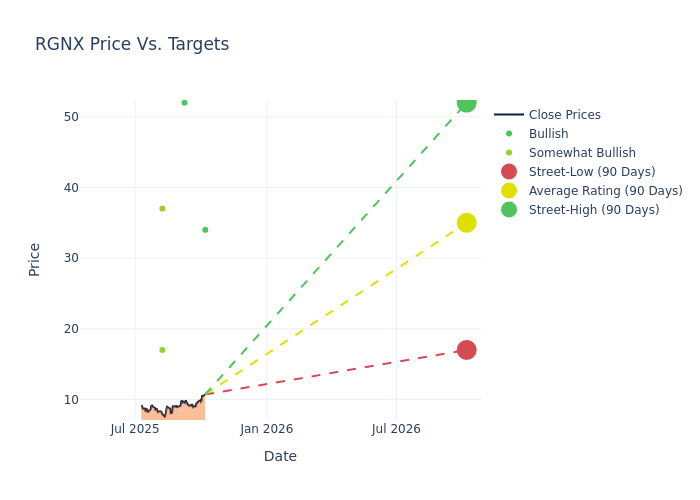

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $37.14, a high estimate of $52.00, and a low estimate of $17.00. Experiencing a 6.14% decline, the current average is now lower than the previous average price target of $39.57.

Analyzing Analyst Ratings: A Detailed Breakdown

An in-depth analysis of recent analyst actions unveils how financial experts perceive Regenxbio. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Yi Chen |

HC Wainwright & Co. |

Maintains |

Buy |

$34.00 |

$34.00 |

| Yi Chen |

HC Wainwright & Co. |

Maintains |

Buy |

$34.00 |

$34.00 |

| Daniil Gataulin |

Chardan Capital |

Maintains |

Buy |

$52.00 |

$52.00 |

| Yi Chen |

HC Wainwright & Co. |

Maintains |

Buy |

$34.00 |

$34.00 |

| Luca Issi |

RBC Capital |

Lowers |

Outperform |

$17.00 |

$21.00 |

| Gena Wang |

Barclays |

Lowers |

Overweight |

$37.00 |

$50.00 |

| Daniil Gataulin |

Chardan Capital |

Maintains |

Buy |

$52.00 |

$52.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Regenxbio. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Regenxbio compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Regenxbio's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Regenxbio's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Regenxbio analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Delving into Regenxbio's Background

Regenxbio Inc is a biotechnology company. Its main activity is the development and commercialization of recombinant adeno associated virus gene therapy to correct an underlying genetic defect. The diseases that the Regenxbio platform targets are metabolic (homozygous familial hypercholesterolemia), neurodegenerative conditions (mucopolysaccharidosis), and retinal diseases (wet age-related macular degeneration, X-linked retinitis pigmentosa). The company derives the majority of its revenue from the United States.

Unraveling the Financial Story of Regenxbio

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Growth: Regenxbio's revenue growth over a period of 3M has faced challenges. As of 30 June, 2025, the company experienced a revenue decline of approximately -4.2%. This indicates a decrease in the company's top-line earnings. When compared to others in the Health Care sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Regenxbio's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of -331.81%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of -29.05%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Regenxbio's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of -13.22%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Regenxbio's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.36.

How Are Analyst Ratings Determined?

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: RGNX