Decoding Netflix's Options Activity: What's the Big Picture?

Author: Benzinga Insights | October 07, 2025 10:02am

Deep-pocketed investors have adopted a bullish approach towards Netflix (NASDAQ:NFLX), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in NFLX usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 14 extraordinary options activities for Netflix. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 64% leaning bullish and 21% bearish. Among these notable options, 5 are puts, totaling $437,604, and 9 are calls, amounting to $870,758.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $1070.0 and $1500.0 for Netflix, spanning the last three months.

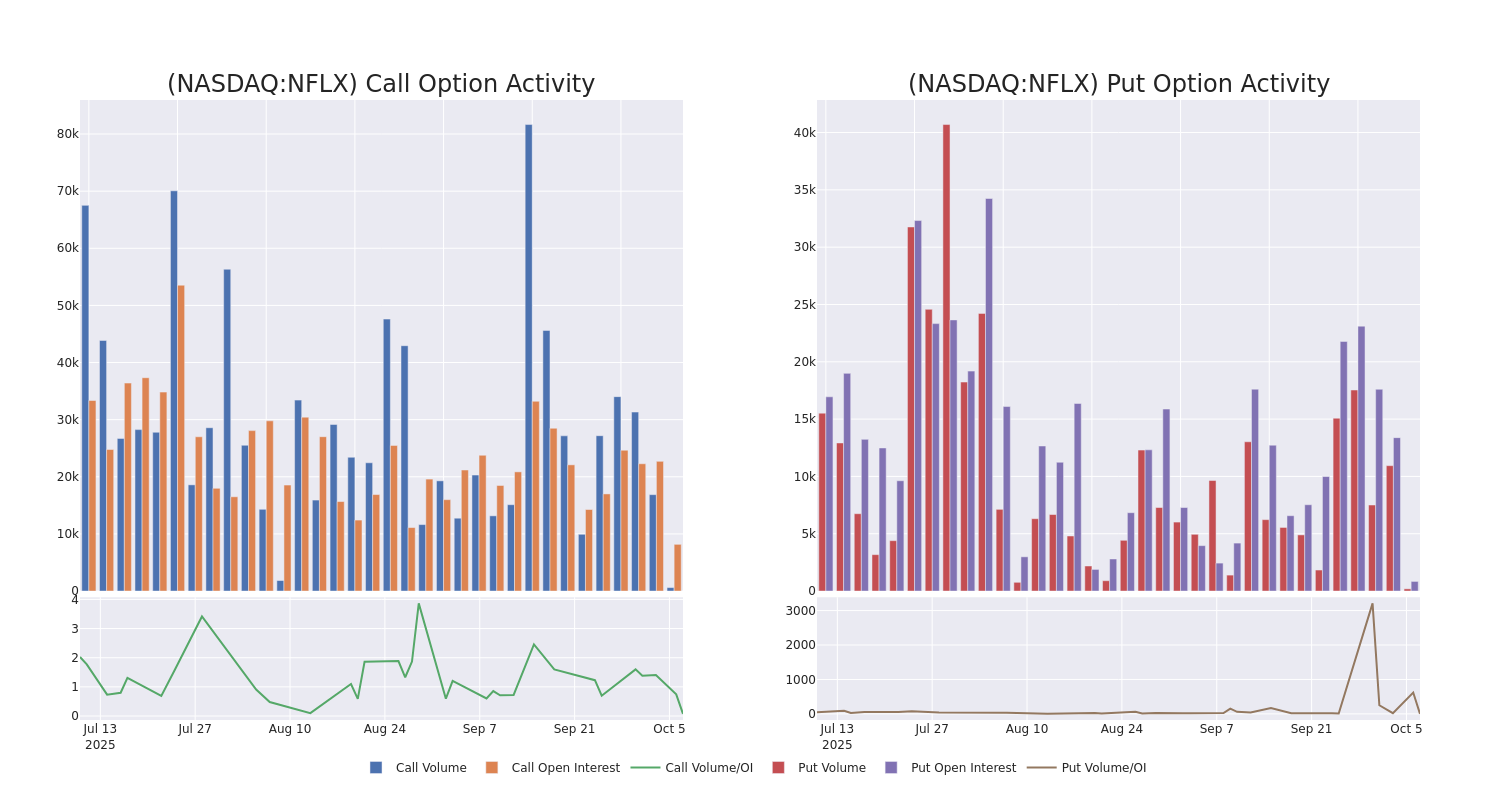

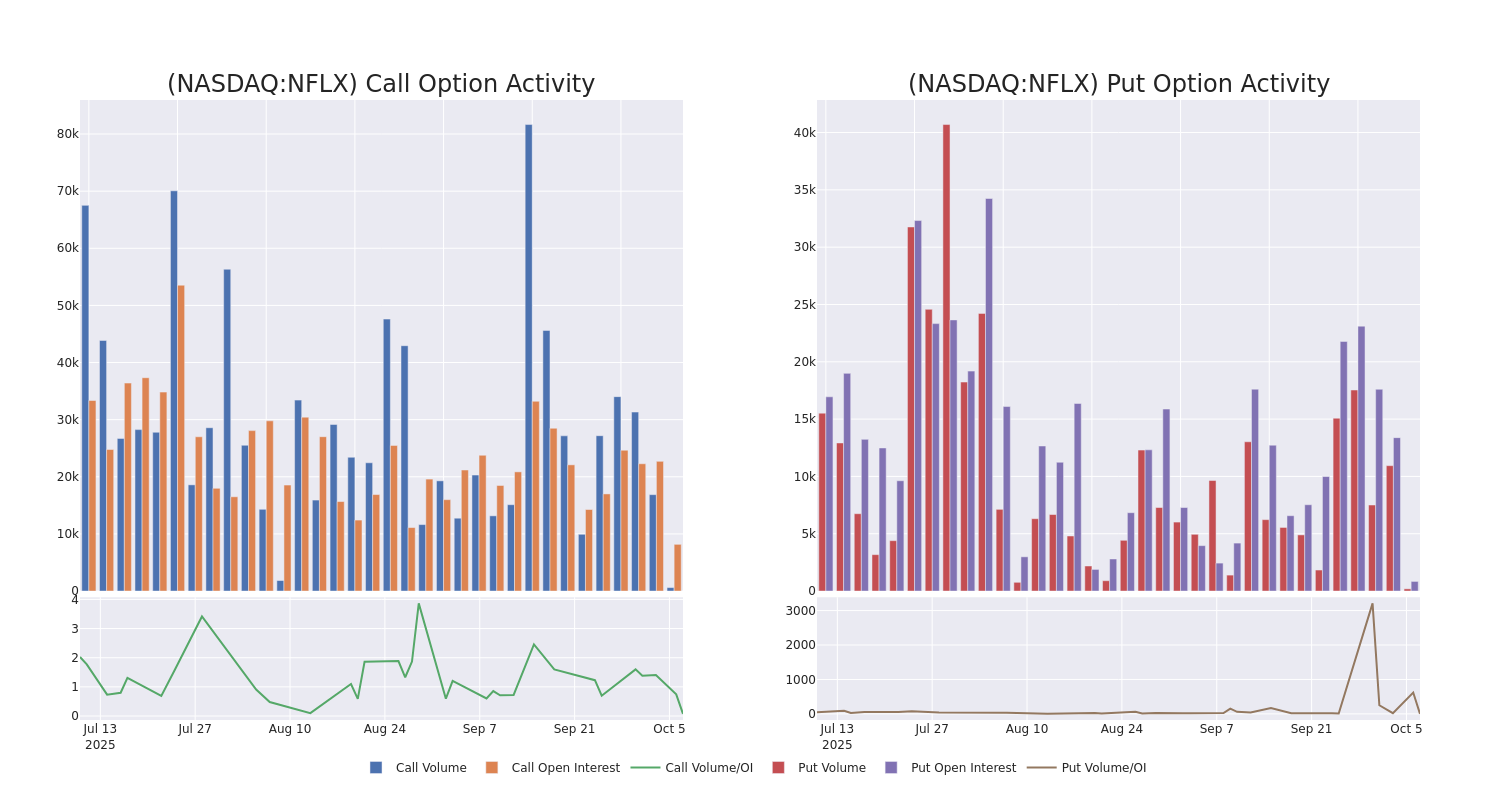

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Netflix's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Netflix's whale activity within a strike price range from $1070.0 to $1500.0 in the last 30 days.

Netflix 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| NFLX |

CALL |

TRADE |

BULLISH |

10/17/25 |

$26.8 |

$24.45 |

$26.8 |

$1185.00 |

$402.0K |

464 |

19 |

| NFLX |

PUT |

SWEEP |

BEARISH |

01/15/27 |

$210.75 |

$205.5 |

$208.85 |

$1280.00 |

$167.0K |

68 |

7 |

| NFLX |

CALL |

SWEEP |

NEUTRAL |

10/10/25 |

$17.9 |

$14.5 |

$15.96 |

$1180.00 |

$161.1K |

882 |

138 |

| NFLX |

CALL |

TRADE |

BEARISH |

11/21/25 |

$81.25 |

$79.25 |

$80.01 |

$1160.00 |

$120.0K |

206 |

59 |

| NFLX |

PUT |

TRADE |

BULLISH |

12/19/25 |

$323.1 |

$321.55 |

$321.55 |

$1500.00 |

$96.4K |

20 |

3 |

About Netflix

Netflix's relatively simple business model involves only one business, its streaming service. It has the biggest television entertainment subscriber base in both the United States and the collective international market, with more than 300 million subscribers globally. Netflix has exposure to nearly the entire global population outside of China. The firm has traditionally avoided a regular slate of live programming or sports content, instead focusing on on-demand access to episodic television, movies, and documentaries. The firm introduced ad-supported subscription plans in 2022, giving the firm exposure to the advertising market in addition to the subscription fees that have historically accounted for nearly all its revenue.

Following our analysis of the options activities associated with Netflix, we pivot to a closer look at the company's own performance.

Present Market Standing of Netflix

- With a trading volume of 583,101, the price of NFLX is up by 1.6%, reaching $1181.98.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 14 days from now.

What Analysts Are Saying About Netflix

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $1408.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Needham has revised its rating downward to Buy, adjusting the price target to $1500.

* In a cautious move, an analyst from Itau BBA downgraded its rating to Outperform, setting a price target of $1514.

* In a positive move, an analyst from Seaport Global has upgraded their rating to Buy and adjusted the price target to $1385.

* An analyst from Loop Capital upgraded its action to Buy with a price target of $1350.

* An analyst from Citigroup has decided to maintain their Neutral rating on Netflix, which currently sits at a price target of $1295.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Netflix, Benzinga Pro gives you real-time options trades alerts.

Posted In: NFLX