Beyond The Numbers: 5 Analysts Discuss Lemonade Stock

Author: Benzinga Insights | October 07, 2025 04:01pm

Lemonade (NYSE:LMND) underwent analysis by 5 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

0 |

2 |

3 |

0 |

| Last 30D |

0 |

0 |

0 |

1 |

0 |

| 1M Ago |

0 |

0 |

1 |

0 |

0 |

| 2M Ago |

0 |

0 |

1 |

1 |

0 |

| 3M Ago |

0 |

0 |

0 |

1 |

0 |

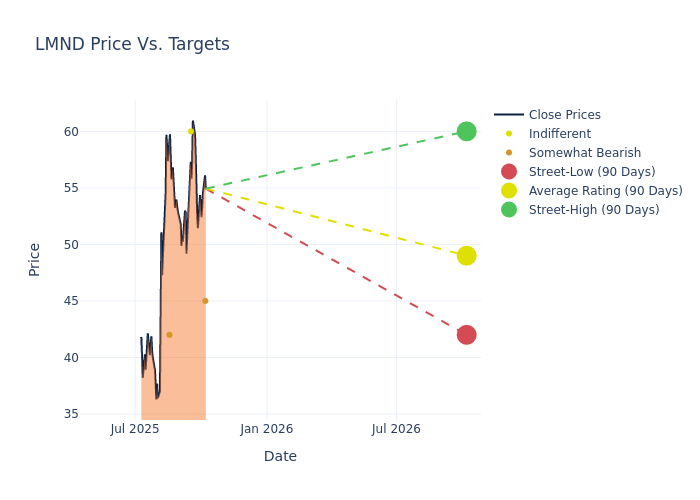

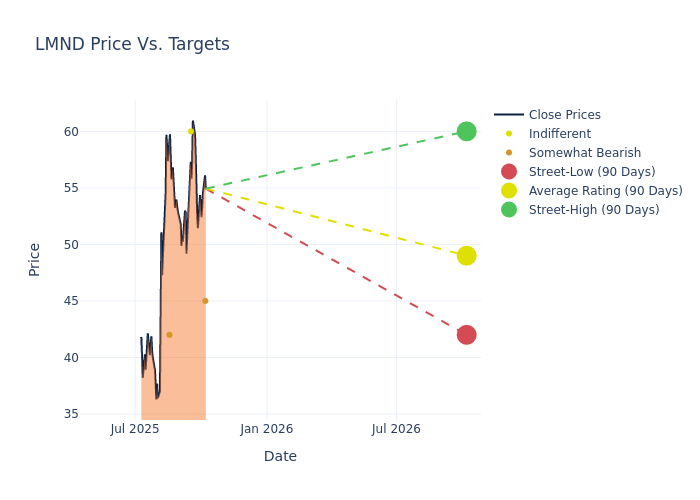

Analysts have set 12-month price targets for Lemonade, revealing an average target of $45.6, a high estimate of $60.00, and a low estimate of $26.00. Surpassing the previous average price target of $36.25, the current average has increased by 25.79%.

Diving into Analyst Ratings: An In-Depth Exploration

An in-depth analysis of recent analyst actions unveils how financial experts perceive Lemonade. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Bob Huang |

Morgan Stanley |

Raises |

Underweight |

$45.00 |

$43.00 |

| John Barnidge |

Piper Sandler |

Raises |

Neutral |

$60.00 |

$55.00 |

| Jack Matten |

BMO Capital |

Raises |

Underperform |

$42.00 |

$23.00 |

| John Barnidge |

Piper Sandler |

Announces |

Neutral |

$55.00 |

- |

| Bob Huang |

Morgan Stanley |

Raises |

Underweight |

$26.00 |

$24.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Lemonade. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Lemonade compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Lemonade's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Lemonade's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Lemonade analyst ratings.

Get to Know Lemonade Better

Lemonade Inc operates in the insurance industry. The company offers digital and artificial intelligence based platform for various insurances and for settling claims and paying premiums. The platform ensures transparency in issuing policies and settling disputes. The company is using technology, data, artificial intelligence, contemporary design, and social impact to deliver delightful and affordable insurances. Geographically, it operates in California, Texas, New York, New Jersey, Illinois, Georgia, Washington, Colorado, Pennsylvania, Oregon and others.

Financial Milestones: Lemonade's Journey

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Over the 3M period, Lemonade showcased positive performance, achieving a revenue growth rate of 34.51% as of 30 June, 2025. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Financials sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Lemonade's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of -26.75%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Lemonade's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of -8.19%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Lemonade's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of -2.32%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Lemonade's debt-to-equity ratio stands notably higher than the industry average, reaching 0.27. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

The Basics of Analyst Ratings

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: LMND