What 46 Analyst Ratings Have To Say About CrowdStrike Holdings

Author: Benzinga Insights | October 09, 2025 08:03am

In the preceding three months, 46 analysts have released ratings for CrowdStrike Holdings (NASDAQ:CRWD), presenting a wide array of perspectives from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

16 |

15 |

15 |

0 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

9 |

8 |

4 |

0 |

0 |

| 2M Ago |

6 |

6 |

9 |

0 |

0 |

| 3M Ago |

1 |

0 |

2 |

0 |

0 |

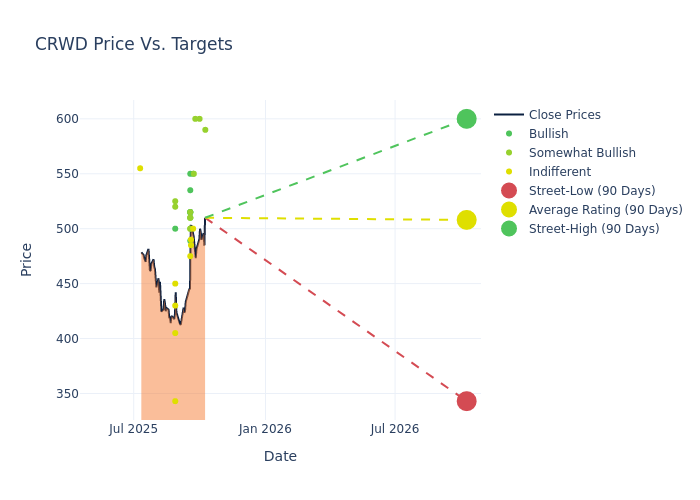

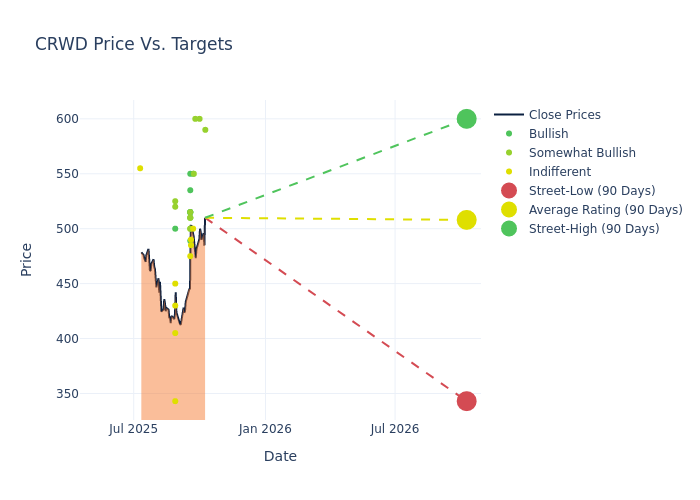

In the assessment of 12-month price targets, analysts unveil insights for CrowdStrike Holdings, presenting an average target of $493.07, a high estimate of $600.00, and a low estimate of $343.00. Surpassing the previous average price target of $486.44, the current average has increased by 1.36%.

Exploring Analyst Ratings: An In-Depth Overview

The standing of CrowdStrike Holdings among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Todd Weller |

Stephens & Co. |

Raises |

Overweight |

$590.00 |

$525.00 |

| Andrew Nowinski |

Wells Fargo |

Raises |

Overweight |

$600.00 |

$550.00 |

| Patrick Colville |

Scotiabank |

Raises |

Sector Outperform |

$600.00 |

$440.00 |

| Trevor Walsh |

JMP Securities |

Raises |

Market Outperform |

$550.00 |

$500.00 |

| Kingsley Crane |

Canaccord Genuity |

Raises |

Hold |

$500.00 |

$430.00 |

| Catharine Trebnick |

Rosenblatt |

Raises |

Buy |

$550.00 |

$490.00 |

| Shrenik Kothari |

Baird |

Raises |

Neutral |

$490.00 |

$460.00 |

| Steve Koenig |

Macquarie |

Raises |

Neutral |

$485.00 |

$465.00 |

| Taz Koujalgi |

Roth Capital |

Raises |

Buy |

$510.00 |

$410.00 |

| Keith Bachman |

BMO Capital |

Raises |

Outperform |

$500.00 |

$450.00 |

| Joseph Gallo |

Jefferies |

Raises |

Buy |

$515.00 |

$500.00 |

| Rudy Kessinger |

DA Davidson |

Raises |

Buy |

$515.00 |

$490.00 |

| Adam Borg |

Stifel |

Raises |

Buy |

$515.00 |

$495.00 |

| Joel Fishbein |

Truist Securities |

Raises |

Buy |

$550.00 |

$500.00 |

| Matthew Hedberg |

RBC Capital |

Maintains |

Outperform |

$510.00 |

$510.00 |

| Jonathan Ruykhaver |

Cantor Fitzgerald |

Raises |

Overweight |

$500.00 |

$475.00 |

| Eric Heath |

Keybanc |

Raises |

Overweight |

$510.00 |

$495.00 |

| Saket Kalia |

Barclays |

Raises |

Overweight |

$515.00 |

$500.00 |

| Catharine Trebnick |

Rosenblatt |

Maintains |

Buy |

$490.00 |

$490.00 |

| Keith Weiss |

Morgan Stanley |

Raises |

Equal-Weight |

$475.00 |

$460.00 |

| Mike Cikos |

Needham |

Raises |

Buy |

$535.00 |

$475.00 |

| Gray Powell |

BTIG |

Maintains |

Buy |

$489.00 |

$489.00 |

| Steve Koenig |

Macquarie |

Maintains |

Neutral |

$465.00 |

$465.00 |

| Joseph Gallo |

Jefferies |

Lowers |

Buy |

$500.00 |

$530.00 |

| Rudy Kessinger |

DA Davidson |

Lowers |

Buy |

$490.00 |

$530.00 |

| Kingsley Crane |

Canaccord Genuity |

Lowers |

Hold |

$430.00 |

$475.00 |

| Ittai Kidron |

Oppenheimer |

Maintains |

Outperform |

$520.00 |

$520.00 |

| Gregg Moskowitz |

Mizuho |

Lowers |

Neutral |

$430.00 |

$450.00 |

| Hamza Fodderwala |

Morgan Stanley |

Lowers |

Equal-Weight |

$460.00 |

$495.00 |

| Patrick Colville |

Scotiabank |

Lowers |

Sector Perform |

$440.00 |

$480.00 |

| Rob Owens |

Piper Sandler |

Lowers |

Neutral |

$450.00 |

$505.00 |

| Roger Boyd |

UBS |

Lowers |

Buy |

$500.00 |

$545.00 |

| Peter Weed |

Bernstein |

Lowers |

Market Perform |

$343.00 |

$371.00 |

| Gray Powell |

BTIG |

Lowers |

Buy |

$489.00 |

$520.00 |

| Daniel Ives |

Wedbush |

Lowers |

Outperform |

$525.00 |

$575.00 |

| Keith Bachman |

BMO Capital |

Lowers |

Outperform |

$450.00 |

$460.00 |

| Jonathan Ruykhaver |

Cantor Fitzgerald |

Maintains |

Overweight |

$475.00 |

$475.00 |

| Peter Levine |

Evercore ISI Group |

Lowers |

In-Line |

$405.00 |

$425.00 |

| Catharine Trebnick |

Rosenblatt |

Lowers |

Buy |

$490.00 |

$515.00 |

| Mike Cikos |

Needham |

Lowers |

Buy |

$475.00 |

$530.00 |

| Jonathan Ruykhaver |

Cantor Fitzgerald |

Maintains |

Overweight |

$475.00 |

$475.00 |

| Keith Bachman |

BMO Capital |

Lowers |

Outperform |

$460.00 |

$500.00 |

| Peter Levine |

Evercore ISI Group |

Lowers |

In-Line |

$425.00 |

$440.00 |

| Joseph Gallo |

Jefferies |

Raises |

Buy |

$530.00 |

$520.00 |

| Steve Koenig |

Macquarie |

Announces |

Neutral |

$465.00 |

- |

| Hamza Fodderwala |

Morgan Stanley |

Raises |

Equal-Weight |

$495.00 |

$490.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to CrowdStrike Holdings. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of CrowdStrike Holdings compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for CrowdStrike Holdings's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of CrowdStrike Holdings's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on CrowdStrike Holdings analyst ratings.

All You Need to Know About CrowdStrike Holdings

CrowdStrike is a cloud-based cybersecurity company specializing in next-generation security verticals such as endpoint, cloud workload, identity, and security operations. CrowdStrike's primary offering is its Falcon platform that offers a proverbial single pane of glass for an enterprise to detect and respond to security threats attacking its IT infrastructure. The Texas-based firm was founded in 2011 and went public in 2019.

CrowdStrike Holdings: Financial Performance Dissected

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Over the 3M period, CrowdStrike Holdings showcased positive performance, achieving a revenue growth rate of 21.28% as of 31 July, 2025. This reflects a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of -6.64%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): CrowdStrike Holdings's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of -2.16%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): CrowdStrike Holdings's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of -0.86%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: CrowdStrike Holdings's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.22.

The Basics of Analyst Ratings

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: CRWD