A Glimpse Into The Expert Outlook On Humana Through 15 Analysts

Author: Benzinga Insights | October 09, 2025 09:01am

In the preceding three months, 15 analysts have released ratings for Humana (NYSE:HUM), presenting a wide array of perspectives from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

5 |

10 |

0 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

0 |

1 |

2 |

0 |

0 |

| 2M Ago |

0 |

3 |

3 |

0 |

0 |

| 3M Ago |

0 |

0 |

5 |

0 |

0 |

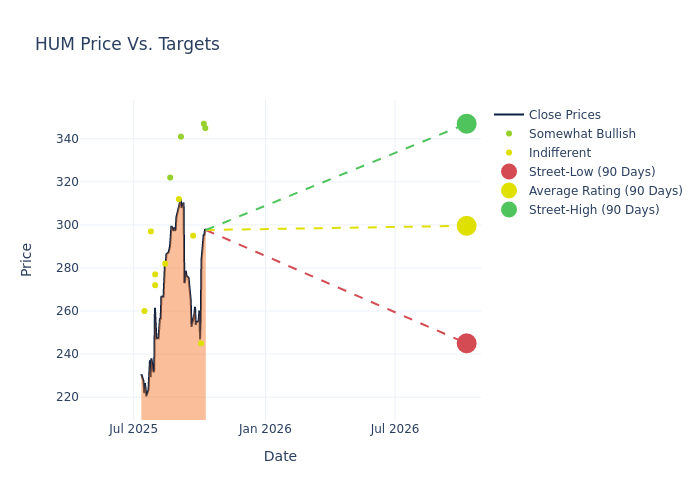

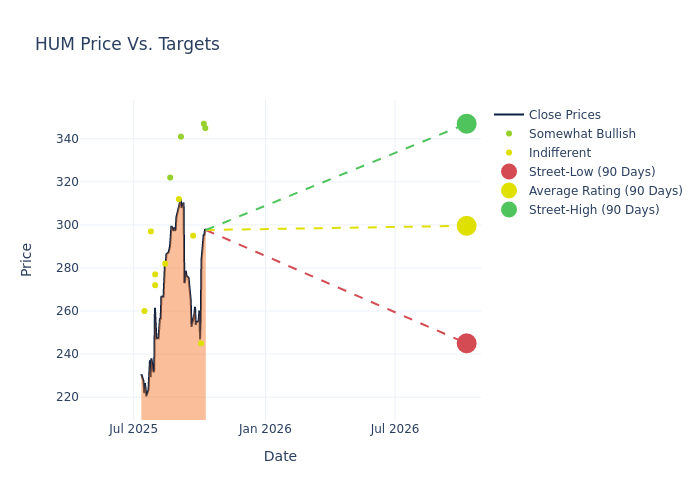

Insights from analysts' 12-month price targets are revealed, presenting an average target of $301.93, a high estimate of $347.00, and a low estimate of $245.00. Witnessing a positive shift, the current average has risen by 2.42% from the previous average price target of $294.79.

Investigating Analyst Ratings: An Elaborate Study

The analysis of recent analyst actions sheds light on the perception of Humana by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Ann Hynes |

Mizuho |

Raises |

Outperform |

$345.00 |

$300.00 |

| Stephen Baxter |

Wells Fargo |

Raises |

Overweight |

$347.00 |

$344.00 |

| Andrew Mok |

Barclays |

Lowers |

Equal-Weight |

$245.00 |

$315.00 |

| Elizabeth Suzuki |

Evercore ISI Group |

Announces |

In-Line |

$295.00 |

- |

| Lance Wilkes |

Bernstein |

Raises |

Outperform |

$341.00 |

$269.00 |

| Andrew Mok |

Barclays |

Raises |

Equal-Weight |

$315.00 |

$275.00 |

| Kevin Fischbeck |

B of A Securities |

Raises |

Neutral |

$312.00 |

$285.00 |

| Ben Hendrix |

RBC Capital |

Raises |

Outperform |

$322.00 |

$283.00 |

| Stephen Baxter |

Wells Fargo |

Lowers |

Overweight |

$344.00 |

$348.00 |

| David Toung |

Argus Research |

Maintains |

Hold |

$281.99 |

$281.99 |

| Andrew Mok |

Barclays |

Raises |

Equal-Weight |

$275.00 |

$268.00 |

| Erin Wright |

Morgan Stanley |

Lowers |

Equal-Weight |

$277.00 |

$290.00 |

| Jessica Tassan |

Piper Sandler |

Lowers |

Neutral |

$272.00 |

$288.00 |

| Michael Ha |

Baird |

Lowers |

Neutral |

$297.00 |

$300.00 |

| David Macdonald |

Truist Securities |

Lowers |

Hold |

$260.00 |

$280.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Humana. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Humana compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Humana's stock. This comparison reveals trends in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Humana's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Humana analyst ratings.

Unveiling the Story Behind Humana

Humana is one of the largest private health insurers in the US, and the firm has built a niche specializing in government-sponsored programs, with nearly all its medical membership stemming from Medicare, Medicaid, and the military's Tricare program. Beyond medical insurance, the company provides other healthcare services, including primary-care services, at-home services, and pharmacy benefit management.

Breaking Down Humana's Financial Performance

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Humana displayed positive results in 3M. As of 30 June, 2025, the company achieved a solid revenue growth rate of approximately 9.64%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 1.68%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 3.03%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Humana's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 1.08%, the company may face hurdles in achieving optimal financial performance.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.69.

The Significance of Analyst Ratings Explained

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: HUM