Where Whirlpool Stands With Analysts

Author: Benzinga Insights | October 09, 2025 02:01pm

In the last three months, 4 analysts have published ratings on Whirlpool (NYSE:WHR), offering a diverse range of perspectives from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

0 |

2 |

2 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

0 |

0 |

1 |

2 |

0 |

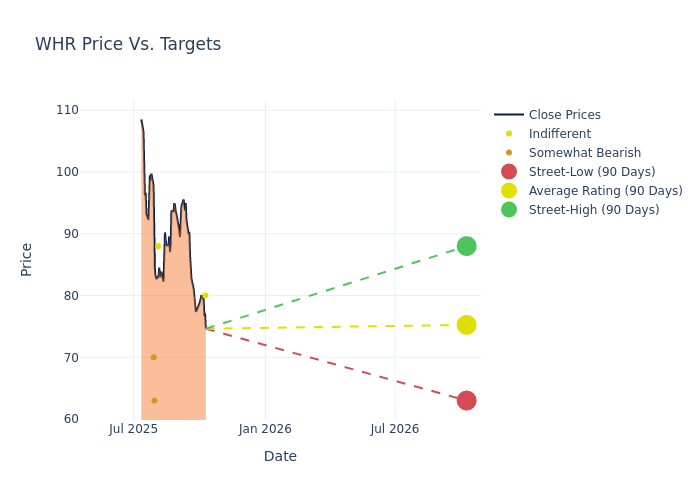

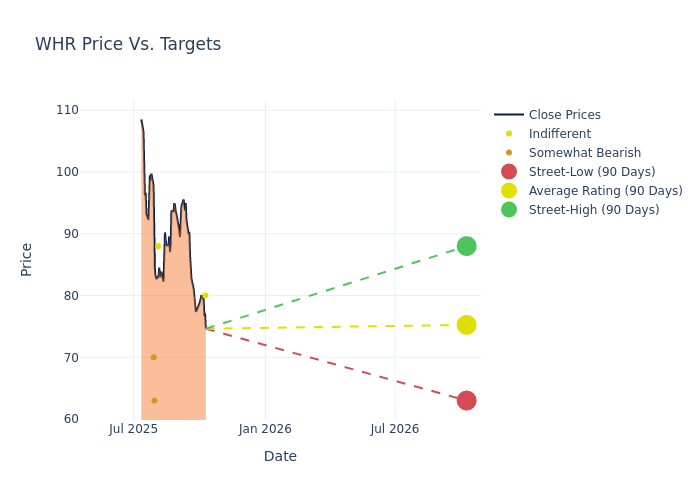

Insights from analysts' 12-month price targets are revealed, presenting an average target of $75.25, a high estimate of $88.00, and a low estimate of $63.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 8.79%.

Understanding Analyst Ratings: A Comprehensive Breakdown

The standing of Whirlpool among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| W. Andrew Carter |

Stifel |

Announces |

Hold |

$80.00 |

- |

| Jeffrey Stevenson |

Loop Capital |

Announces |

Hold |

$88.00 |

- |

| Mike Dahl |

RBC Capital |

Lowers |

Underperform |

$63.00 |

$65.00 |

| Rafe Jadrosich |

B of A Securities |

Lowers |

Underperform |

$70.00 |

$100.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Whirlpool. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Whirlpool compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Whirlpool's stock. This comparison reveals trends in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Whirlpool's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Whirlpool analyst ratings.

About Whirlpool

Whirlpool Corp is a manufacturer and marketer of home appliances and related products. Its reportable segments consist of five operating segments, which consist of Domestic Appliances (MDA) North America; MDA Europe, MDA Latin America; MDA Asia; and Small Domestic Appliances (SDA). Product categories include refrigeration, laundry, cooking, and dishwashing. The company has also a portfolio of small domestic appliances, including the KitchenAid stand mixer. The company's international brands include Whirlpool, KitchenAid, Maytag, Consul, and Brastemp, among others.

Understanding the Numbers: Whirlpool's Finances

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Decline in Revenue: Over the 3M period, Whirlpool faced challenges, resulting in a decline of approximately -5.41% in revenue growth as of 30 June, 2025. This signifies a reduction in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Consumer Discretionary sector.

Net Margin: Whirlpool's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 1.72%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Whirlpool's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.66% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 0.39%, the company showcases effective utilization of assets.

Debt Management: Whirlpool's debt-to-equity ratio is notably higher than the industry average. With a ratio of 3.59, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

How Are Analyst Ratings Determined?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: WHR