Deep Dive Into QXO Stock: Analyst Perspectives (8 Ratings)

Author: Benzinga Insights | October 09, 2025 05:01pm

8 analysts have shared their evaluations of QXO (NYSE:QXO) during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

3 |

5 |

0 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

0 |

1 |

0 |

0 |

0 |

| 2M Ago |

1 |

2 |

0 |

0 |

0 |

| 3M Ago |

1 |

2 |

0 |

0 |

0 |

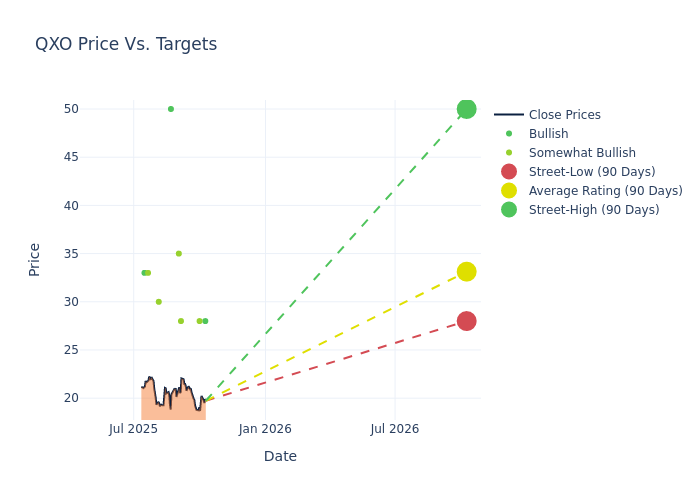

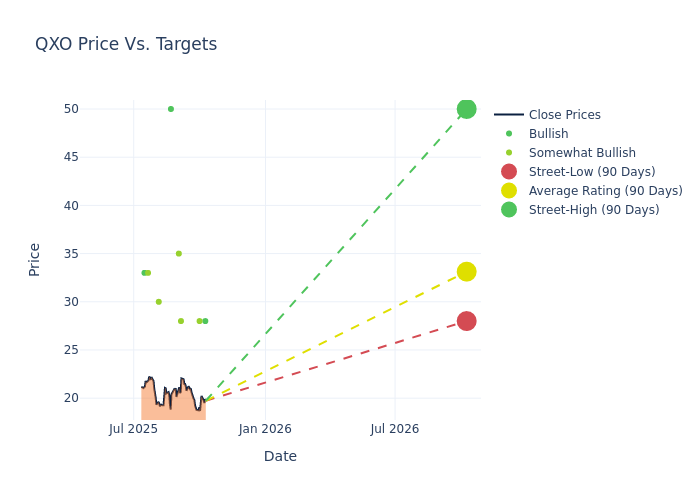

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $33.12, with a high estimate of $50.00 and a low estimate of $28.00. Surpassing the previous average price target of $30.00, the current average has increased by 10.4%.

Diving into Analyst Ratings: An In-Depth Exploration

The standing of QXO among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Keith Hughes |

Truist Securities |

Lowers |

Buy |

$28.00 |

$30.00 |

| Jeffrey D. Hammond |

Keybanc |

Announces |

Overweight |

$28.00 |

- |

| Sam Darkatsh |

Raymond James |

Announces |

Outperform |

$28.00 |

- |

| Christopher Snyder |

Morgan Stanley |

Announces |

Overweight |

$35.00 |

- |

| Reuben Garner |

Benchmark |

Announces |

Buy |

$50.00 |

- |

| Sam Reid |

Wells Fargo |

Announces |

Overweight |

$30.00 |

- |

| Mike Dahl |

RBC Capital |

Announces |

Outperform |

$33.00 |

- |

| Anthony Pettinari |

Citigroup |

Announces |

Buy |

$33.00 |

- |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to QXO. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of QXO compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of QXO's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into QXO's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on QXO analyst ratings.

About QXO

QXO Inc is a building products distribution company engaged in the distribution of roofing, waterproofing and complementary building products in North America. It offers a full suite of business applications, including ERP, warehouse management, accounting, CRM, and business intelligence solutions.

Key Indicators: QXO's Financial Health

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: QXO's revenue growth over a period of 3M has been noteworthy. As of 30 June, 2025, the company achieved a revenue growth rate of approximately 13047.59%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Industrials sector.

Net Margin: QXO's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of -4.41%, the company may face hurdles in effective cost management.

Return on Equity (ROE): QXO's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of -1.25%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): QXO's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of -0.76%, the company may face hurdles in achieving optimal financial performance.

Debt Management: With a below-average debt-to-equity ratio of 0.46, QXO adopts a prudent financial strategy, indicating a balanced approach to debt management.

Analyst Ratings: What Are They?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: QXO