Deep Dive Into Venture Global Stock: Analyst Perspectives (6 Ratings)

Author: Benzinga Insights | October 10, 2025 08:00am

In the last three months, 6 analysts have published ratings on Venture Global (NYSE:VG), offering a diverse range of perspectives from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

2 |

1 |

3 |

0 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

2 |

0 |

1 |

0 |

0 |

| 3M Ago |

0 |

1 |

1 |

0 |

0 |

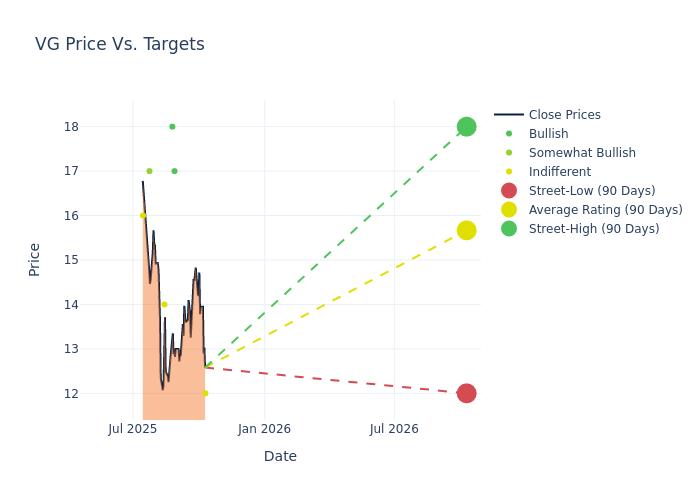

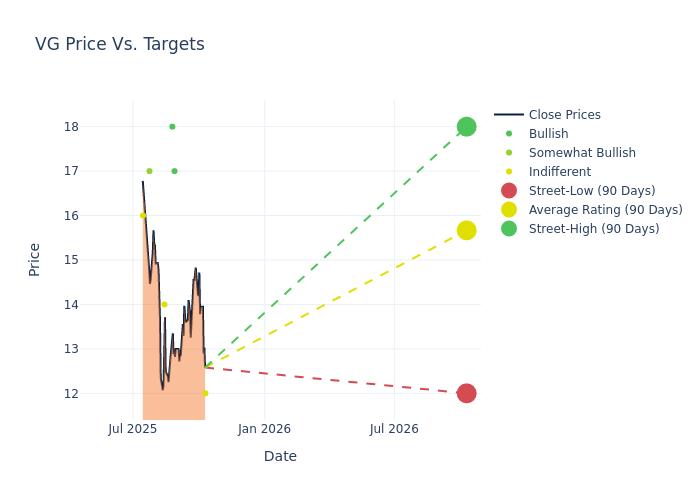

Analysts have recently evaluated Venture Global and provided 12-month price targets. The average target is $15.67, accompanied by a high estimate of $18.00 and a low estimate of $12.00. Witnessing a positive shift, the current average has risen by 4.47% from the previous average price target of $15.00.

Diving into Analyst Ratings: An In-Depth Exploration

The standing of Venture Global among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Gabriel Moreen |

Mizuho |

Lowers |

Neutral |

$12.00 |

$17.00 |

| Chris Robertson |

Deutsche Bank |

Announces |

Buy |

$17.00 |

- |

| Manav Gupta |

UBS |

Maintains |

Buy |

$18.00 |

$18.00 |

| Michael Blum |

Wells Fargo |

Raises |

Equal-Weight |

$14.00 |

$12.00 |

| Jeremy Tonet |

JP Morgan |

Raises |

Overweight |

$17.00 |

$15.00 |

| Brandon Bingham |

Scotiabank |

Raises |

Sector Perform |

$16.00 |

$13.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Venture Global. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Venture Global compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

For valuable insights into Venture Global's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Venture Global analyst ratings.

Delving into Venture Global's Background

Venture Global operates two liquefied natural gas production facilities in Louisiana. It has pioneered the use of modular, factory-built equipment producing high yields. With a substantial development plan, it seeks to become a vertically integrated LNG producer and supplier to end consumers around the world.

Financial Insights: Venture Global

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: Venture Global's revenue growth over a period of 3M has been noteworthy. As of 30 June, 2025, the company achieved a revenue growth rate of approximately 179.87%. This indicates a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Energy sector.

Net Margin: Venture Global's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 11.87%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Venture Global's ROE stands out, surpassing industry averages. With an impressive ROE of 7.25%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Venture Global's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 0.8%, the company may face hurdles in achieving optimal financial returns.

Debt Management: Venture Global's debt-to-equity ratio stands notably higher than the industry average, reaching 5.79. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Understanding the Relevance of Analyst Ratings

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: VG