A Closer Look at Oracle's Options Market Dynamics

Author: Benzinga Insights | October 10, 2025 01:01pm

Whales with a lot of money to spend have taken a noticeably bullish stance on Oracle.

Looking at options history for Oracle (NYSE:ORCL) we detected 119 trades.

If we consider the specifics of each trade, it is accurate to state that 42% of the investors opened trades with bullish expectations and 40% with bearish.

From the overall spotted trades, 17 are puts, for a total amount of $1,041,196 and 102, calls, for a total amount of $8,178,418.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $145.0 to $400.0 for Oracle over the recent three months.

Analyzing Volume & Open Interest

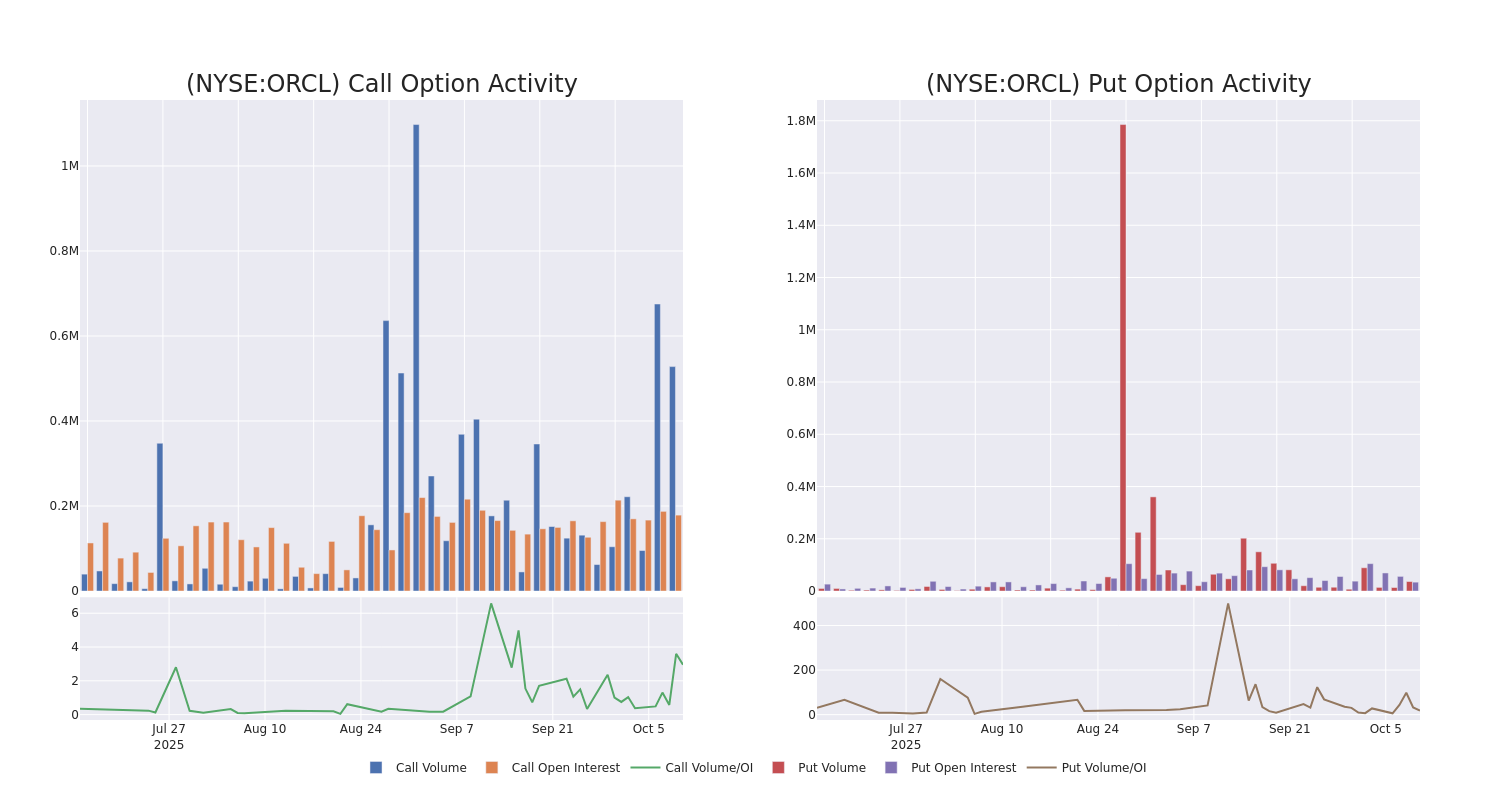

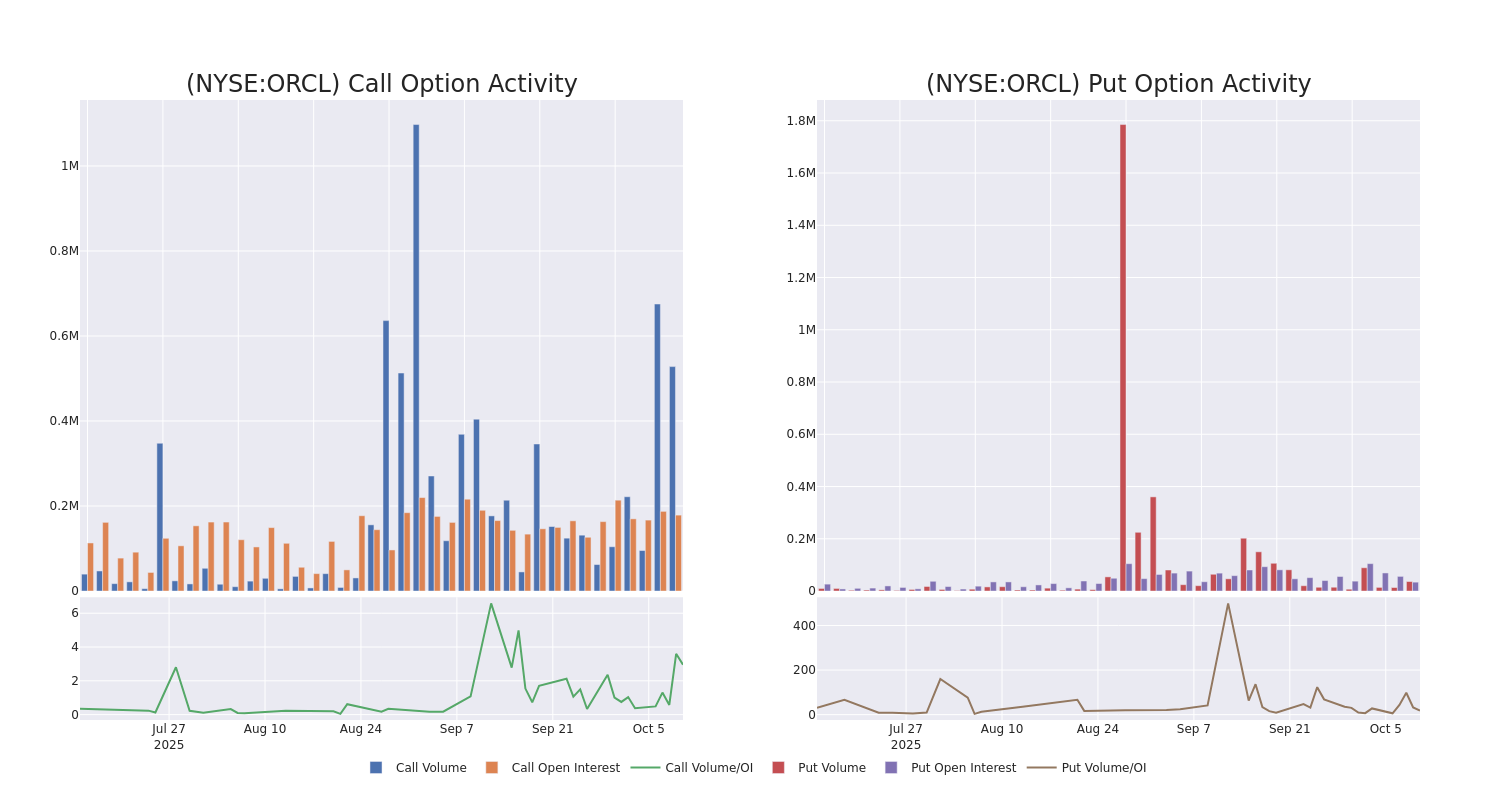

In terms of liquidity and interest, the mean open interest for Oracle options trades today is 3174.12 with a total volume of 564,371.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Oracle's big money trades within a strike price range of $145.0 to $400.0 over the last 30 days.

Oracle Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| ORCL |

CALL |

SWEEP |

BEARISH |

10/17/25 |

$98.0 |

$95.7 |

$95.65 |

$200.00 |

$382.6K |

100 |

46 |

| ORCL |

CALL |

TRADE |

NEUTRAL |

10/17/25 |

$7.25 |

$6.4 |

$6.8 |

$310.00 |

$323.0K |

15.7K |

4.8K |

| ORCL |

CALL |

SWEEP |

BEARISH |

10/24/25 |

$2.04 |

$2.03 |

$2.03 |

$350.00 |

$202.1K |

11.3K |

5.5K |

| ORCL |

CALL |

SWEEP |

BEARISH |

10/24/25 |

$2.01 |

$1.91 |

$1.91 |

$350.00 |

$191.0K |

11.3K |

6.5K |

| ORCL |

CALL |

TRADE |

BULLISH |

11/21/25 |

$20.25 |

$20.25 |

$20.25 |

$300.00 |

$141.7K |

3.9K |

2.9K |

About Oracle

Oracle provides enterprise applications and infrastructure offerings around the world through a variety of flexible IT deployment models, including on-premises, cloud-based, and hybrid. Founded in 1977, Oracle pioneered the first commercial SQL-based relational database management system, which is commonly used for running online transaction processing and data warehousing workloads. Besides database systems, Oracle also sells enterprise resource planning, or ERP, customer relationship management, or CRM, and human capital management, or HCM, applications. Today, Oracle has more than 159,000 full-time employees in over 170 countries.

Following our analysis of the options activities associated with Oracle, we pivot to a closer look at the company's own performance.

Current Position of Oracle

- Currently trading with a volume of 18,704,636, the ORCL's price is down by -0.19%, now at $296.4.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 59 days.

Expert Opinions on Oracle

In the last month, 5 experts released ratings on this stock with an average target price of $313.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* In a cautious move, an analyst from Baird downgraded its rating to Outperform, setting a price target of $365.

* An analyst from Bernstein persists with their Outperform rating on Oracle, maintaining a target price of $364.

* Reflecting concerns, an analyst from Rothschild & Co lowers its rating to Sell with a new price target of $175.

* An analyst from Morgan Stanley has decided to maintain their Equal-Weight rating on Oracle, which currently sits at a price target of $320.

* In a cautious move, an analyst from JMP Securities downgraded its rating to Market Outperform, setting a price target of $342.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Oracle options trades with real-time alerts from Benzinga Pro.

Posted In: ORCL