Forecasting The Future: 5 Analyst Projections For Ballard Power Systems

Author: Benzinga Insights | October 13, 2025 09:01am

In the preceding three months, 5 analysts have released ratings for Ballard Power Systems (NASDAQ:BLDP), presenting a wide array of perspectives from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

0 |

3 |

2 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

0 |

0 |

2 |

2 |

0 |

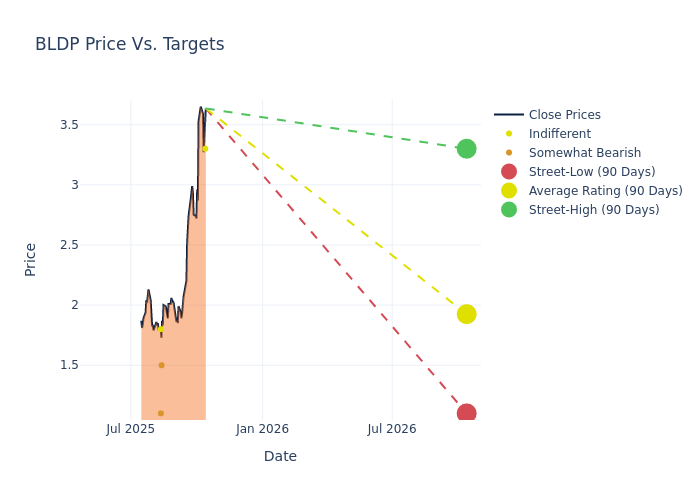

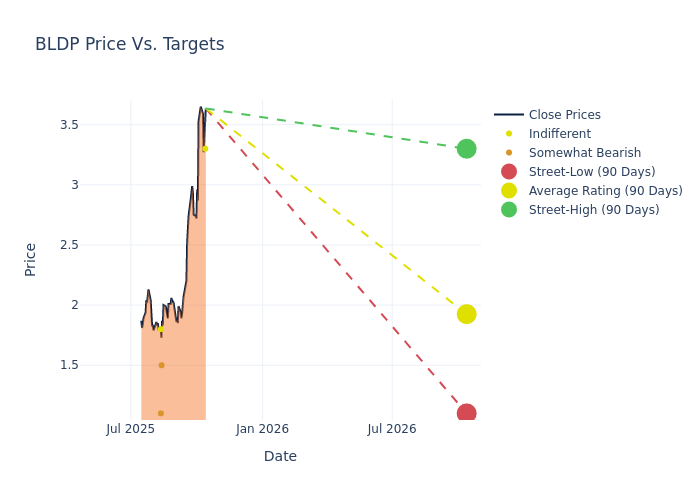

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $1.94, with a high estimate of $3.30 and a low estimate of $1.10. Surpassing the previous average price target of $1.31, the current average has increased by 48.09%.

Investigating Analyst Ratings: An Elaborate Study

The perception of Ballard Power Systems by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Biju Perincheril |

Susquehanna |

Raises |

Neutral |

$3.30 |

$2.00 |

| Praneeth Satish |

Wells Fargo |

Raises |

Underweight |

$1.50 |

$1.00 |

| Craig Irwin |

Roth Capital |

Raises |

Neutral |

$1.80 |

$1.25 |

| Ameet Thakkar |

BMO Capital |

Raises |

Underperform |

$1.10 |

$1.00 |

| Biju Perincheril |

Susquehanna |

Raises |

Neutral |

$2.00 |

$1.30 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Ballard Power Systems. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Ballard Power Systems compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Ballard Power Systems's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Ballard Power Systems's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Ballard Power Systems analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Discovering Ballard Power Systems: A Closer Look

Ballard Power Systems Inc is engaged in design, development, manufacture, sale and service of proton exchange membrane ("PEM") fuel cell products for a variety of applications, focusing on power products for bus, truck, rail, marine, stationary and emerging market (material handling, off-road and other) applications, as well as the delivery of services, including technology solutions, after sales services and training. A fuel cell is an environmentally clean electrochemical device that combines hydrogen fuel with oxygen (from the air) to produce electricity. Key geographical revenue is derived from Poland followed by United States, United Kingdom, and other countries.

A Deep Dive into Ballard Power Systems's Financials

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Ballard Power Systems displayed positive results in 3M. As of 30 June, 2025, the company achieved a solid revenue growth rate of approximately 11.49%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Ballard Power Systems's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of -136.08%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Ballard Power Systems's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -3.77% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Ballard Power Systems's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of -3.25%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Ballard Power Systems's debt-to-equity ratio is below the industry average. With a ratio of 0.04, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Analyst Ratings: What Are They?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: BLDP