What 15 Analyst Ratings Have To Say About MercadoLibre

Author: Benzinga Insights | October 13, 2025 10:01am

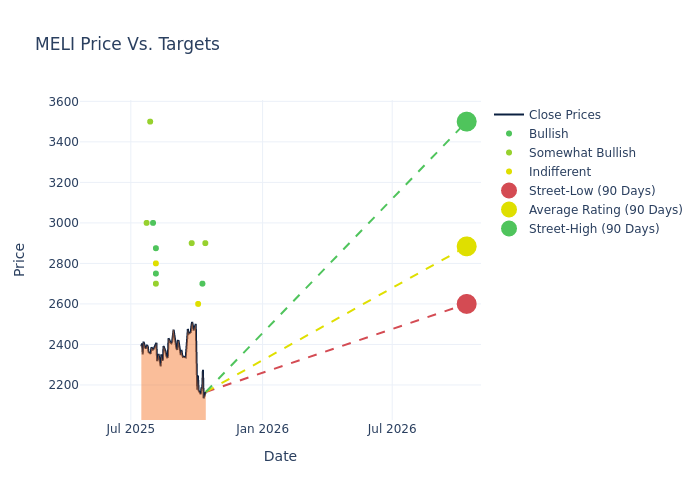

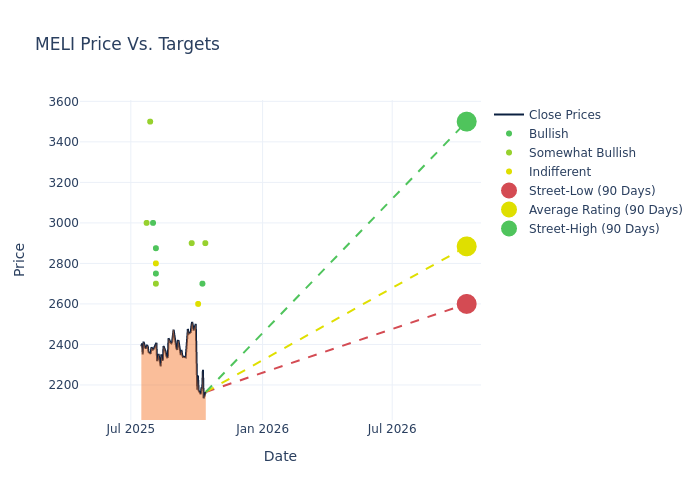

In the last three months, 15 analysts have published ratings on MercadoLibre (NASDAQ:MELI), offering a diverse range of perspectives from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

6 |

6 |

3 |

0 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

1 |

1 |

1 |

0 |

0 |

| 2M Ago |

1 |

0 |

0 |

0 |

0 |

| 3M Ago |

4 |

4 |

2 |

0 |

0 |

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $2858.33, a high estimate of $3500.00, and a low estimate of $2600.00. This current average has increased by 1.11% from the previous average price target of $2826.92.

Diving into Analyst Ratings: An In-Depth Exploration

The standing of MercadoLibre among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| James Friedman |

Susquehanna |

Lowers |

Positive |

$2900.00 |

$2975.00 |

| Joao Pedro Soares |

Citigroup |

Lowers |

Buy |

$2700.00 |

$2850.00 |

| Marcelo Santos |

JP Morgan |

Lowers |

Neutral |

$2600.00 |

$2700.00 |

| Deepak Mathivanan |

Cantor Fitzgerald |

Raises |

Overweight |

$2900.00 |

$2700.00 |

| Joao Pedro Soares |

Citigroup |

Lowers |

Buy |

$2850.00 |

$2900.00 |

| Marcelo Santos |

JP Morgan |

Raises |

Neutral |

$2700.00 |

$2600.00 |

| Fawne Jiang |

Benchmark |

Maintains |

Buy |

$2875.00 |

$2875.00 |

| Deepak Mathivanan |

Cantor Fitzgerald |

Maintains |

Overweight |

$2700.00 |

$2700.00 |

| Josh Beck |

Raymond James |

Maintains |

Strong Buy |

$2750.00 |

$2750.00 |

| Scott Devitt |

Wedbush |

Lowers |

Outperform |

$2700.00 |

$2800.00 |

| John Colantuoni |

Jefferies |

Maintains |

Hold |

$2800.00 |

$2800.00 |

| John Choi |

Daiwa Capital |

Announces |

Buy |

$3000.00 |

- |

| Hector Maya |

Scotiabank |

Announces |

Sector Outperform |

$3500.00 |

- |

| Trevor Young |

Barclays |

Lowers |

Overweight |

$3000.00 |

$3100.00 |

| Tobias Stingelin |

Citigroup |

Lowers |

Buy |

$2900.00 |

$3000.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to MercadoLibre. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of MercadoLibre compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of MercadoLibre's stock. This analysis reveals shifts in analysts' expectations over time.

For valuable insights into MercadoLibre's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on MercadoLibre analyst ratings.

Delving into MercadoLibre's Background

MercadoLibre runs the largest e-commerce marketplace in Latin America, with more than 218 million active users and 1 million active sellers across 18 countries stitching into its commerce network or fintech solutions when last reported. The company operates a host of complementary businesses to its core online shop, with shipping solutions (Mercado Envios), a payment and financing operation (Mercado Pago and Mercado Credito), advertisements (Mercado Clics), classifieds, and a turnkey e-commerce solution (Mercado Shops) rounding out its arsenal. MercadoLibre generates revenue from final value fees, advertising royalties, payment processing, insertion fees, subscription fees, and interest income from consumer and small-business lending.

Key Indicators: MercadoLibre's Financial Health

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: MercadoLibre displayed positive results in 3M. As of 30 June, 2025, the company achieved a solid revenue growth rate of approximately 33.85%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Consumer Discretionary sector.

Net Margin: MercadoLibre's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 7.7%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 9.76%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.73%, the company showcases effective utilization of assets.

Debt Management: MercadoLibre's debt-to-equity ratio is notably higher than the industry average. With a ratio of 1.57, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

The Core of Analyst Ratings: What Every Investor Should Know

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: MELI