Assessing DLocal: Insights From 5 Financial Analysts

Author: Benzinga Insights | October 14, 2025 09:00am

Throughout the last three months, 5 analysts have evaluated DLocal (NASDAQ:DLO), offering a diverse set of opinions from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

3 |

0 |

2 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

1 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

1 |

0 |

0 |

| 3M Ago |

1 |

0 |

1 |

0 |

0 |

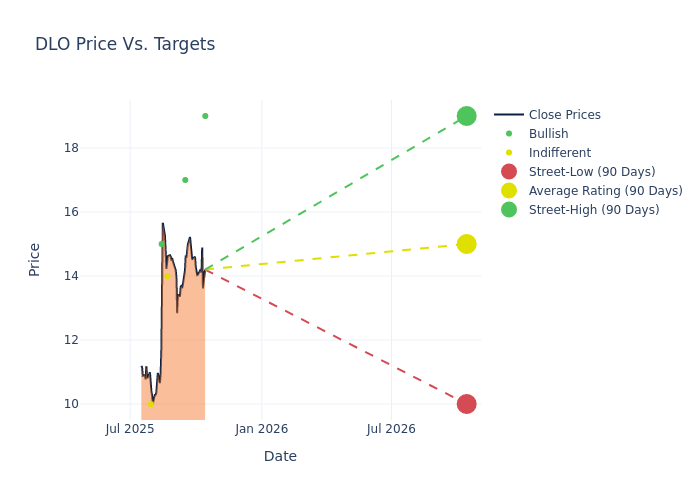

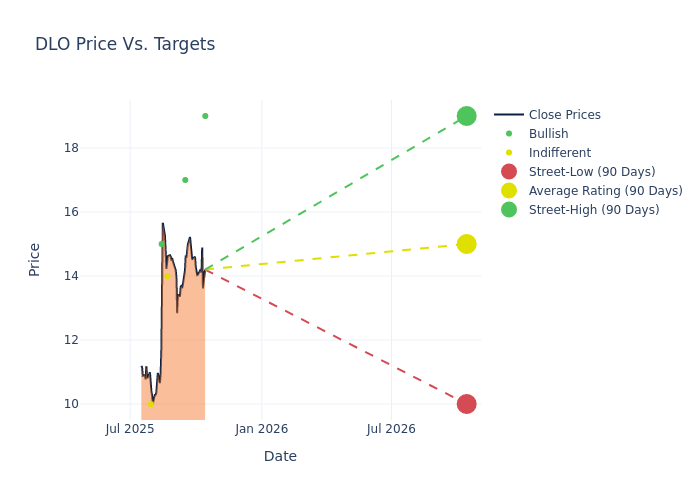

The 12-month price targets, analyzed by analysts, offer insights with an average target of $15.0, a high estimate of $19.00, and a low estimate of $10.00. Marking an increase of 26.9%, the current average surpasses the previous average price target of $11.82.

Diving into Analyst Ratings: An In-Depth Exploration

The analysis of recent analyst actions sheds light on the perception of DLocal by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Tito Labarta |

Goldman Sachs |

Raises |

Buy |

$19.00 |

$12.00 |

| Arnon Shirazi |

Citigroup |

Raises |

Buy |

$17.00 |

$14.60 |

| Matthew Coad |

Truist Securities |

Raises |

Hold |

$14.00 |

$12.00 |

| Neha Agarwala |

HSBC |

Raises |

Buy |

$15.00 |

$11.50 |

| Mariana Taddeo |

UBS |

Raises |

Neutral |

$10.00 |

$9.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to DLocal. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of DLocal compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for DLocal's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of DLocal's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on DLocal analyst ratings.

Unveiling the Story Behind DLocal

DLocal Ltd is focused on making the complex simple, redefining the online payment experience in emerging markets. Through its technology platform, One dLocal, the company enables world-wide enterprise merchants to get paid (pay-in) and to make payments (pay-out) online in a safe and efficient manner. The company earns revenue from fees charged to merchants in connection with payment processing services for cross-border and local payment transactions. The company's geographical segments include Latin America and Non-Latin America with a majority of its revenue being generated from Brazil in Latin America region.

DLocal's Economic Impact: An Analysis

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: DLocal's revenue growth over a period of 3M has been noteworthy. As of 30 June, 2025, the company achieved a revenue growth rate of approximately 49.73%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Financials sector.

Net Margin: DLocal's net margin excels beyond industry benchmarks, reaching 16.69%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): DLocal's ROE excels beyond industry benchmarks, reaching 8.62%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): DLocal's ROA excels beyond industry benchmarks, reaching 3.48%. This signifies efficient management of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 0.01, DLocal adopts a prudent financial strategy, indicating a balanced approach to debt management.

Analyst Ratings: What Are They?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: DLO