Netflix Unusual Options Activity For October 15

Author: Benzinga Insights | October 15, 2025 01:01pm

Financial giants have made a conspicuous bullish move on Netflix. Our analysis of options history for Netflix (NASDAQ:NFLX) revealed 153 unusual trades.

Delving into the details, we found 24% of traders were bullish, while 20% showed bearish tendencies. Out of all the trades we spotted, 29 were puts, with a value of $1,711,500, and 124 were calls, valued at $12,080,062.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $10.0 and $1500.0 for Netflix, spanning the last three months.

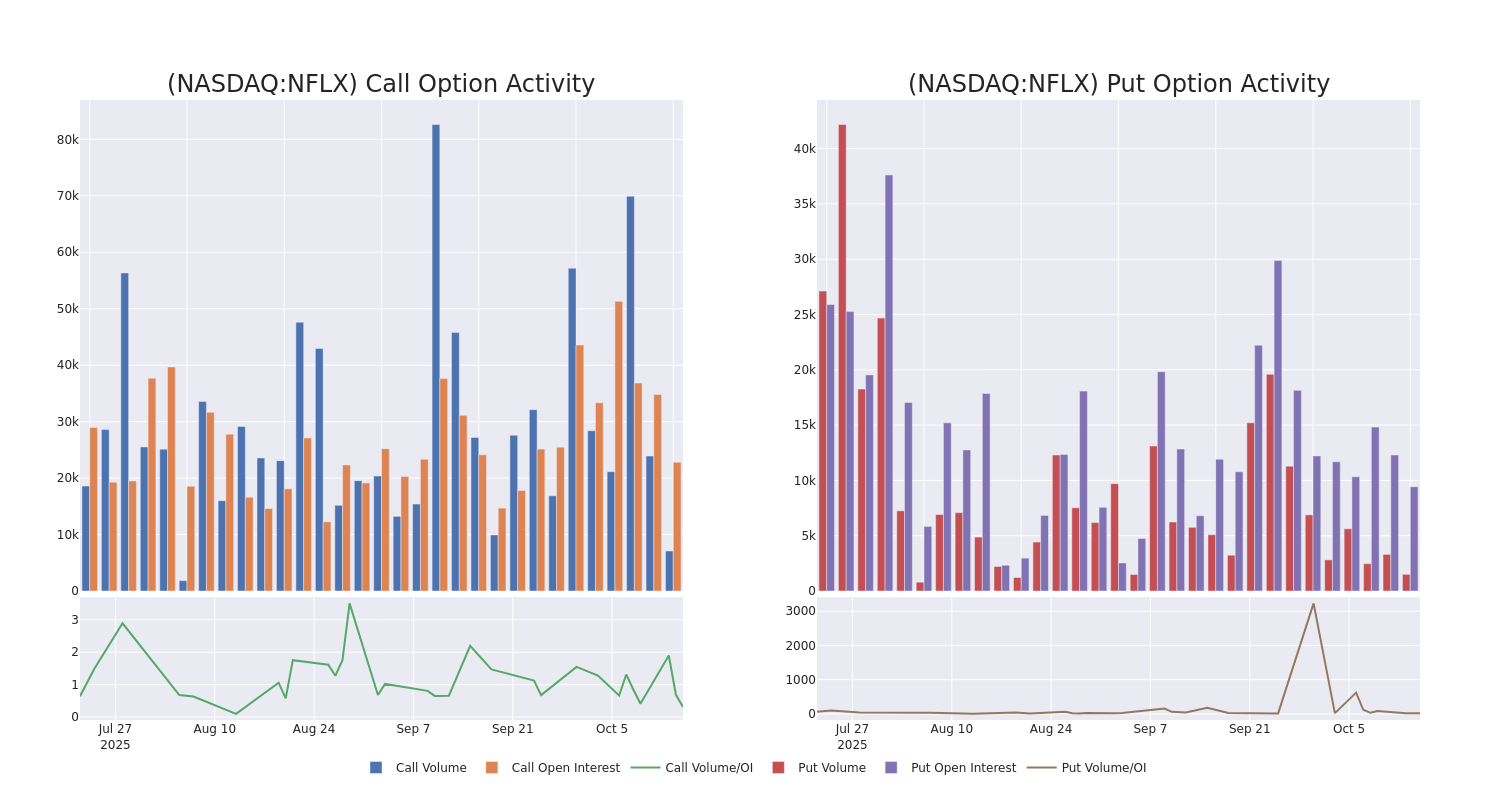

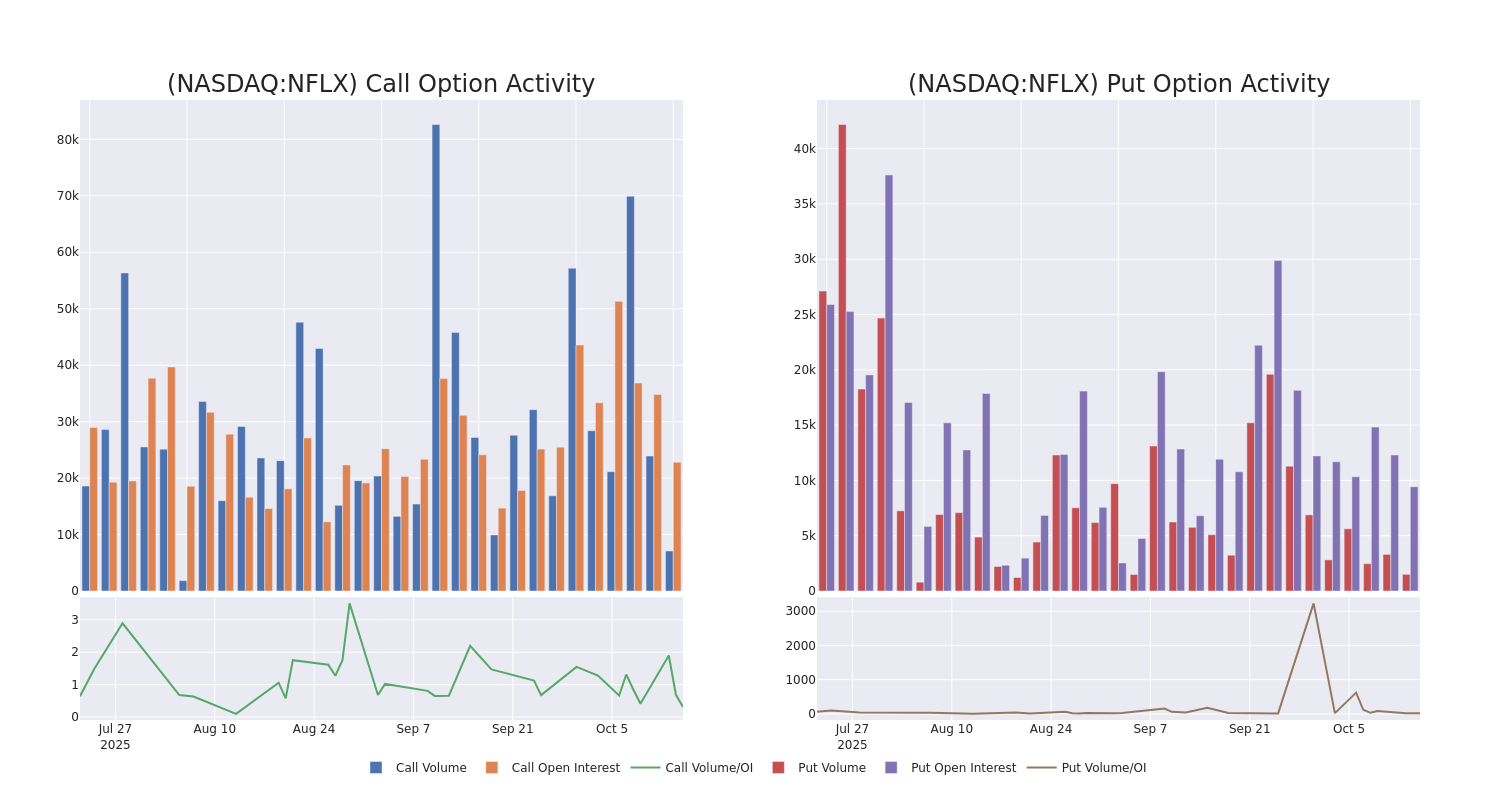

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Netflix options trades today is 501.12 with a total volume of 7,992.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Netflix's big money trades within a strike price range of $10.0 to $1500.0 over the last 30 days.

Netflix Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| NFLX |

CALL |

TRADE |

BULLISH |

12/19/25 |

$968.15 |

$960.6 |

$965.38 |

$250.00 |

$386.1K |

74 |

15 |

| NFLX |

CALL |

TRADE |

NEUTRAL |

12/19/25 |

$967.8 |

$959.8 |

$964.3 |

$250.00 |

$289.2K |

74 |

18 |

| NFLX |

CALL |

TRADE |

BULLISH |

12/19/25 |

$967.1 |

$959.8 |

$964.21 |

$250.00 |

$289.2K |

74 |

9 |

| NFLX |

CALL |

TRADE |

NEUTRAL |

12/19/25 |

$966.9 |

$960.25 |

$964.05 |

$250.00 |

$289.2K |

74 |

3 |

| NFLX |

CALL |

TRADE |

BULLISH |

12/19/25 |

$967.1 |

$959.85 |

$964.43 |

$250.00 |

$192.8K |

74 |

11 |

About Netflix

Netflix's relatively simple business model involves only one business, its streaming service. It has the biggest television entertainment subscriber base in both the United States and the collective international market, with more than 300 million subscribers globally. Netflix has exposure to nearly the entire global population outside of China. The firm has traditionally avoided a regular slate of live programming or sports content, instead focusing on on-demand access to episodic television, movies, and documentaries. The firm introduced ad-supported subscription plans in 2022, giving the firm exposure to the advertising market in addition to the subscription fees that have historically accounted for nearly all its revenue.

Netflix's Current Market Status

- Currently trading with a volume of 903,931, the NFLX's price is down by -0.19%, now at $1213.08.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 6 days.

What Analysts Are Saying About Netflix

A total of 4 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $1386.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Citigroup persists with their Neutral rating on Netflix, maintaining a target price of $1295.

* In a positive move, an analyst from Seaport Global has upgraded their rating to Buy and adjusted the price target to $1385.

* Showing optimism, an analyst from Loop Capital upgrades its rating to Buy with a revised price target of $1350.

* An analyst from Itau BBA has revised its rating downward to Outperform, adjusting the price target to $1514.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Netflix options trades with real-time alerts from Benzinga Pro.

Posted In: NFLX