4 Analysts Have This To Say About Cognizant Tech Solns

Author: Benzinga Insights | October 21, 2025 10:01am

In the latest quarter, 4 analysts provided ratings for Cognizant Tech Solns (NASDAQ:CTSH), showcasing a mix of bullish and bearish perspectives.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

1 |

3 |

0 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

0 |

3 |

0 |

0 |

0 |

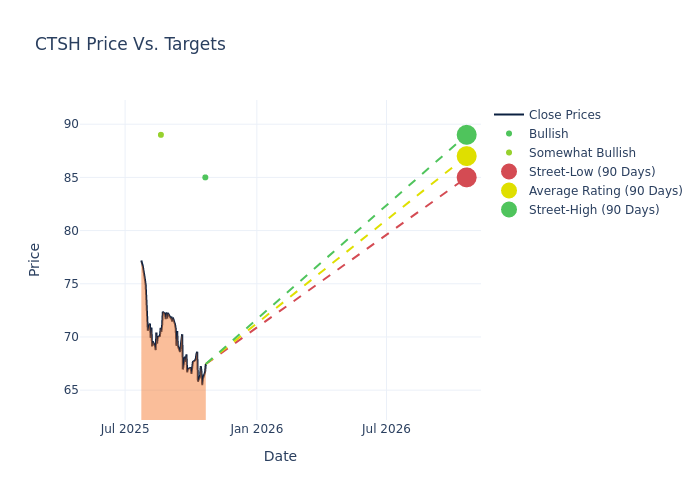

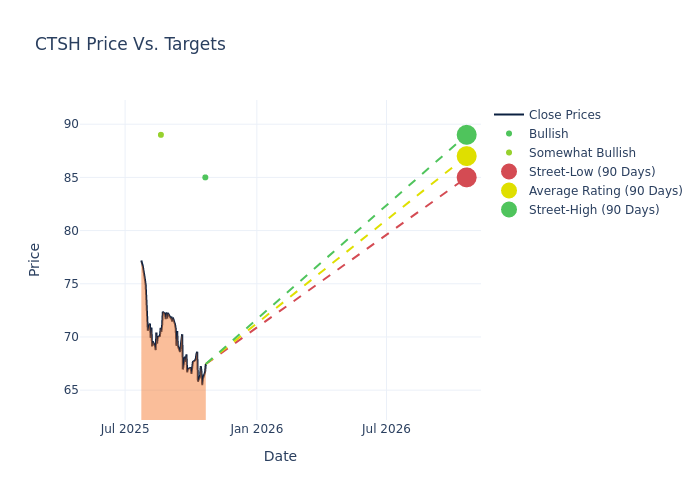

The 12-month price targets, analyzed by analysts, offer insights with an average target of $92.0, a high estimate of $101.00, and a low estimate of $85.00. This current average has decreased by 3.66% from the previous average price target of $95.50.

Analyzing Analyst Ratings: A Detailed Breakdown

A comprehensive examination of how financial experts perceive Cognizant Tech Solns is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Jonathan Lee |

Guggenheim |

Lowers |

Buy |

$85.00 |

$90.00 |

| Tien-Tsin Huang |

JP Morgan |

Lowers |

Overweight |

$89.00 |

$101.00 |

| Tien-Tsin Huang |

JP Morgan |

Raises |

Overweight |

$101.00 |

$93.00 |

| Tien-Tsin Huang |

JP Morgan |

Lowers |

Overweight |

$93.00 |

$98.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Cognizant Tech Solns. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Cognizant Tech Solns compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Cognizant Tech Solns's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

To gain a panoramic view of Cognizant Tech Solns's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Cognizant Tech Solns analyst ratings.

Unveiling the Story Behind Cognizant Tech Solns

Cognizant is a global IT services provider, offering consulting and outsourcing services to some of the world's largest enterprises spanning the financial services, media and communications, healthcare, natural resources, and consumer products industries. Cognizant employs nearly 350,000 people globally, roughly 70% of whom are in India, although the company's headquarters are in Teaneck, New Jersey.

Understanding the Numbers: Cognizant Tech Solns's Finances

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Revenue Growth: Cognizant Tech Solns displayed positive results in 3M. As of 30 June, 2025, the company achieved a solid revenue growth rate of approximately 8.14%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Cognizant Tech Solns's net margin is impressive, surpassing industry averages. With a net margin of 12.3%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Cognizant Tech Solns's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 4.27% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 3.21%, the company showcases effective utilization of assets.

Debt Management: With a below-average debt-to-equity ratio of 0.08, Cognizant Tech Solns adopts a prudent financial strategy, indicating a balanced approach to debt management.

Analyst Ratings: Simplified

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: CTSH