What to Expect from Textron's Earnings

Author: Benzinga Insights | October 22, 2025 01:01pm

Textron (NYSE:TXT) will release its quarterly earnings report on Thursday, 2025-10-23. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Textron to report an earnings per share (EPS) of $1.46.

Anticipation surrounds Textron's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

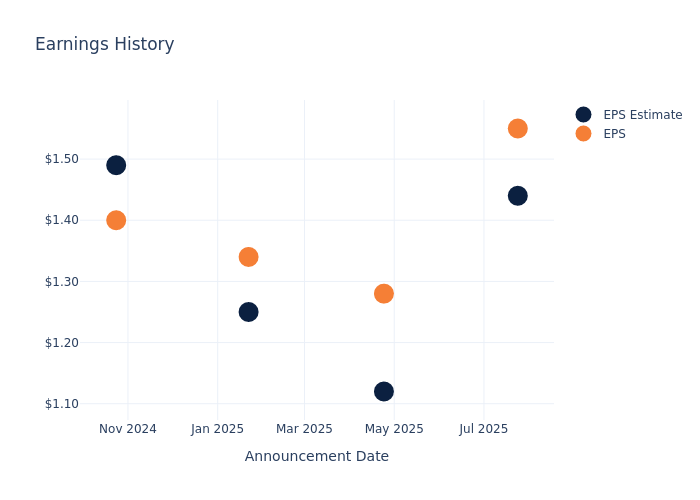

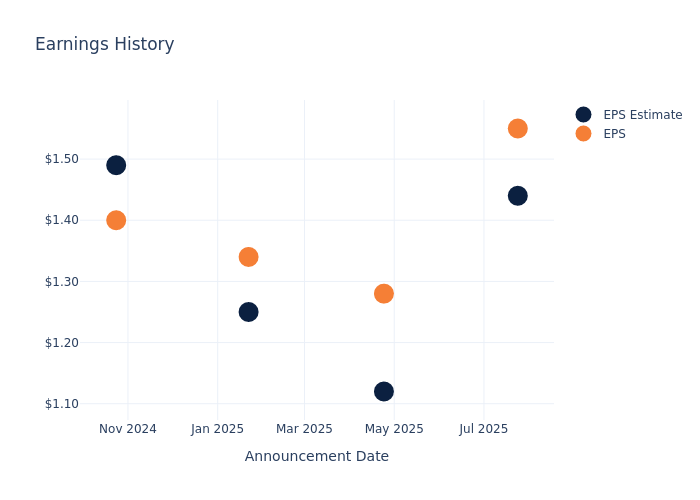

Earnings Track Record

The company's EPS beat by $0.11 in the last quarter, leading to a 1.77% drop in the share price on the following day.

Here's a look at Textron's past performance and the resulting price change:

| Quarter |

Q2 2025 |

Q1 2025 |

Q4 2024 |

Q3 2024 |

| EPS Estimate |

1.44 |

1.12 |

1.25 |

1.49 |

| EPS Actual |

1.55 |

1.28 |

1.34 |

1.40 |

| Price Change % |

-2.00 |

1.00 |

0.00 |

1.00 |

Tracking Textron's Stock Performance

Shares of Textron were trading at $83.02 as of October 21. Over the last 52-week period, shares are up 1.75%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analysts' Take on Textron

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Textron.

The consensus rating for Textron is Outperform, derived from 3 analyst ratings. An average one-year price target of $96.0 implies a potential 15.63% upside.

Understanding Analyst Ratings Among Peers

The following analysis focuses on the analyst ratings and average 1-year price targets of Woodward, Kratos Defense & Security and Carpenter Technology, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for Woodward, with an average 1-year price target of $285.0, suggesting a potential 243.29% upside.

- Analysts currently favor an Buy trajectory for Kratos Defense & Security, with an average 1-year price target of $92.64, suggesting a potential 11.59% upside.

- Analysts currently favor an Buy trajectory for Carpenter Technology, with an average 1-year price target of $400.0, suggesting a potential 381.81% upside.

Peers Comparative Analysis Summary

The peer analysis summary offers a detailed examination of key metrics for Woodward, Kratos Defense & Security and Carpenter Technology, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company |

Consensus |

Revenue Growth |

Gross Profit |

Return on Equity |

| Textron |

Outperform |

5.36% |

$709M |

3.33% |

| Woodward |

Outperform |

7.99% |

$249.16M |

4.51% |

| Kratos Defense & Security |

Buy |

17.13% |

$73.80M |

0.17% |

| Carpenter Technology |

Buy |

-5.38% |

$214M |

6.08% |

Key Takeaway:

Textron ranks in the middle for revenue growth among its peers. It is at the bottom for gross profit. For return on equity, Textron is at the bottom compared to its peers.

Unveiling the Story Behind Textron

Textron is a conglomerate that designs, manufactures, and services a range of specialty aircraft including small jets, propeller-driven airplanes, helicopters, and tilt-rotor aircraft. Textron Aviation manufactures and services Cessna and Beechcraft planes. Bell is a helicopter and tilt-rotor manufacturer and servicer for both commercial and military customers. Textron Systems produces uncrewed aircraft and armored vehicles for the military market as well as aircraft simulators and training for the commercial and military markets. Textron Industrial contains the Kautex business, which manufactures plastic fuel tanks for conventional and hybrid motor vehicles, and other subsidiaries that produce specialized vehicles such as golf carts and all-terrain vehicles.

Textron's Economic Impact: An Analysis

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Positive Revenue Trend: Examining Textron's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 5.36% as of 30 June, 2025, showcasing a substantial increase in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Textron's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 6.59% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Textron's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 3.33%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Textron's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.44%, the company showcases efficient use of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 0.5, Textron adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for Textron visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: TXT