Breaking Down CMS Energy: 4 Analysts Share Their Views

Author: Benzinga Insights | October 22, 2025 03:00pm

Ratings for CMS Energy (NYSE:CMS) were provided by 4 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

2 |

2 |

0 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

0 |

2 |

1 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

0 |

0 |

0 |

0 |

0 |

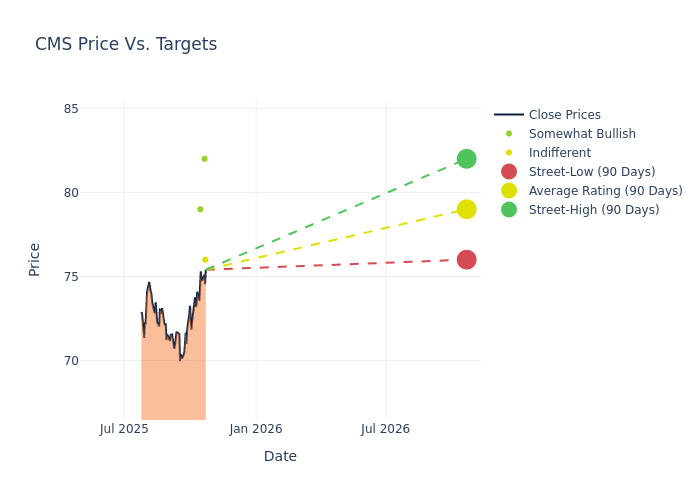

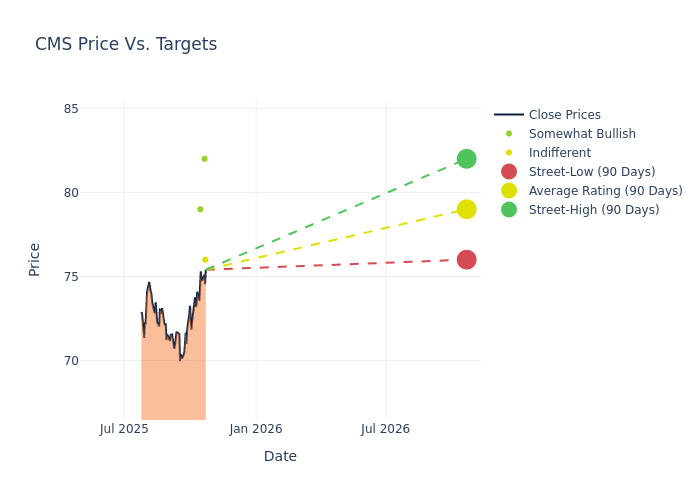

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $77.0, a high estimate of $82.00, and a low estimate of $71.00. Witnessing a positive shift, the current average has risen by 3.36% from the previous average price target of $74.50.

Breaking Down Analyst Ratings: A Detailed Examination

The analysis of recent analyst actions sheds light on the perception of CMS Energy by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Stephen Byrd |

Morgan Stanley |

Raises |

Equal-Weight |

$76.00 |

$71.00 |

| Nicholas Campanella |

Barclays |

Raises |

Overweight |

$82.00 |

$78.00 |

| Sophie Karp |

Keybanc |

Raises |

Overweight |

$79.00 |

$76.00 |

| Stephen Byrd |

Morgan Stanley |

Lowers |

Equal-Weight |

$71.00 |

$73.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to CMS Energy. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of CMS Energy compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for CMS Energy's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of CMS Energy's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on CMS Energy analyst ratings.

Unveiling the Story Behind CMS Energy

CMS Energy is an energy holding company with three principal businesses. Its regulated utility, Consumers Energy, provides regulated natural gas service to 1.8 million customers and electric service to 1.9 million customers in Michigan. NorthStar Clean Energy, formerly CMS Enterprises, is engaged in wholesale power generation, including contracted renewable energy. CMS sold EnerBank in October 2021.

CMS Energy's Economic Impact: An Analysis

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Positive Revenue Trend: Examining CMS Energy's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 14.37% as of 30 June, 2025, showcasing a substantial increase in top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Utilities sector.

Net Margin: CMS Energy's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 10.77% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 2.43%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): CMS Energy's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 0.54% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: CMS Energy's debt-to-equity ratio stands notably higher than the industry average, reaching 2.21. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

The Basics of Analyst Ratings

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: CMS