Examining the Future: Gentex's Earnings Outlook

Author: Benzinga Insights | October 23, 2025 10:01am

Gentex (NASDAQ:GNTX) will release its quarterly earnings report on Friday, 2025-10-24. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Gentex to report an earnings per share (EPS) of $0.47.

Gentex bulls will hope to hear the company announce they've not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

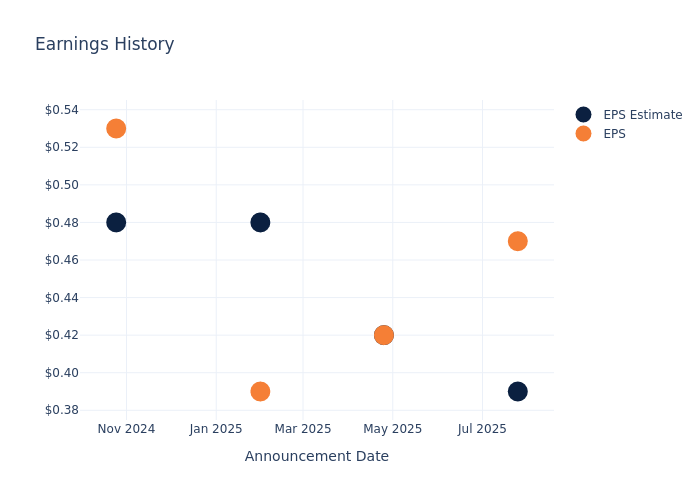

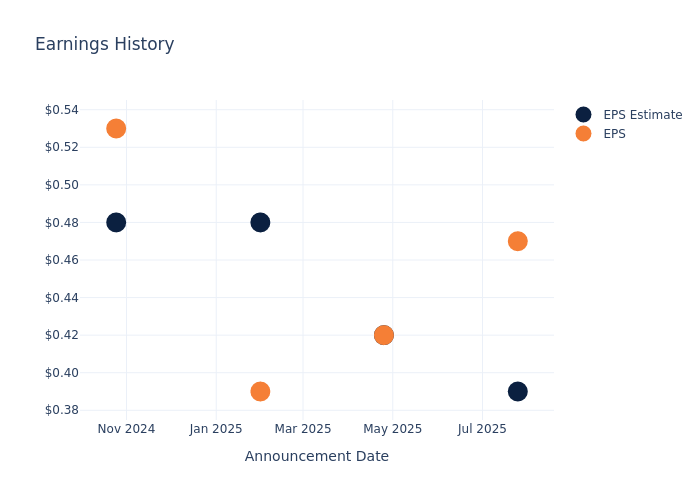

Performance in Previous Earnings

In the previous earnings release, the company beat EPS by $0.08, leading to a 0.0% drop in the share price the following trading session.

Here's a look at Gentex's past performance and the resulting price change:

| Quarter |

Q2 2025 |

Q1 2025 |

Q4 2024 |

Q3 2024 |

| EPS Estimate |

0.39 |

0.42 |

0.48 |

0.48 |

| EPS Actual |

0.47 |

0.42 |

0.39 |

0.53 |

| Price Change % |

16.00 |

-3.00 |

-8.00 |

5.00 |

Stock Performance

Shares of Gentex were trading at $26.21 as of October 22. Over the last 52-week period, shares are down 16.02%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Analyst Views on Gentex

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Gentex.

The consensus rating for Gentex is Neutral, derived from 5 analyst ratings. An average one-year price target of $30.2 implies a potential 15.22% upside.

Understanding Analyst Ratings Among Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of Lear, Dorman Products and Modine Manufacturing, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Lear, with an average 1-year price target of $114.71, suggesting a potential 337.66% upside.

- Analysts currently favor an Outperform trajectory for Dorman Products, with an average 1-year price target of $180.5, suggesting a potential 588.67% upside.

- Analysts currently favor an Outperform trajectory for Modine Manufacturing, with an average 1-year price target of $170.0, suggesting a potential 548.61% upside.

Summary of Peers Analysis

In the peer analysis summary, key metrics for Lear, Dorman Products and Modine Manufacturing are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company |

Consensus |

Revenue Growth |

Gross Profit |

Return on Equity |

| Gentex |

Neutral |

14.82% |

$225.29M |

3.86% |

| Lear |

Neutral |

-47.97% |

$439.10M |

3.39% |

| Dorman Products |

Outperform |

7.56% |

$219.51M |

4.29% |

| Modine Manufacturing |

Outperform |

3.22% |

$165.40M |

5.33% |

Key Takeaway:

Gentex is positioned in the middle among its peers for revenue growth. It ranks at the bottom for gross profit. For return on equity, Gentex is also in the middle.

Unveiling the Story Behind Gentex

Gentex was founded in 1974 to produce smoke-detection equipment. The company sold its first glare-control interior mirror in 1982 and its first model using electrochromic technology in 1987. Automotive revenue is about 98% of total revenue. The company is constantly developing new applications for the technology to remain on top. Sales in 2024 totaled about $2.3 billion with 47.7 million mirrors shipped. The unit mix breaks out as 63% interior and 37% exterior, versus 31% exterior in 2019. The company is based in Zeeland, Michigan.

Gentex: A Financial Overview

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Revenue Growth: Gentex's revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2025, the company achieved a revenue growth rate of approximately 14.82%. This indicates a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: Gentex's net margin is impressive, surpassing industry averages. With a net margin of 14.38%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 3.86%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 3.38%, the company showcases effective utilization of assets.

Debt Management: Gentex's debt-to-equity ratio is below the industry average at 0.0, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for Gentex visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: GNTX