Behind the Scenes of Take-Two Interactive's Latest Options Trends

Author: Benzinga Insights | October 23, 2025 01:01pm

Financial giants have made a conspicuous bullish move on Take-Two Interactive. Our analysis of options history for Take-Two Interactive (NASDAQ:TTWO) revealed 10 unusual trades.

Delving into the details, we found 50% of traders were bullish, while 10% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $305,010, and 6 were calls, valued at $359,608.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $200.0 to $265.0 for Take-Two Interactive over the recent three months.

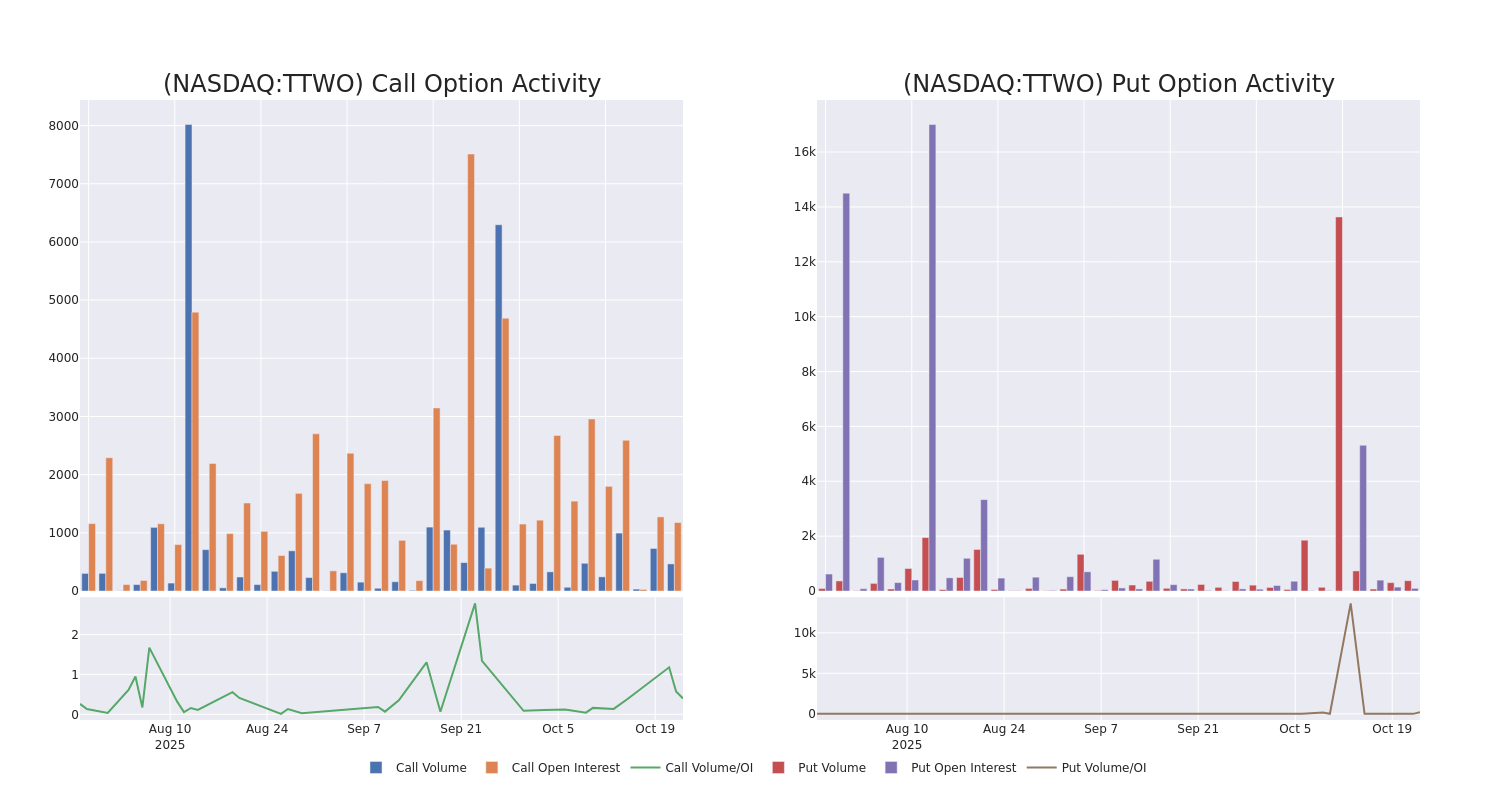

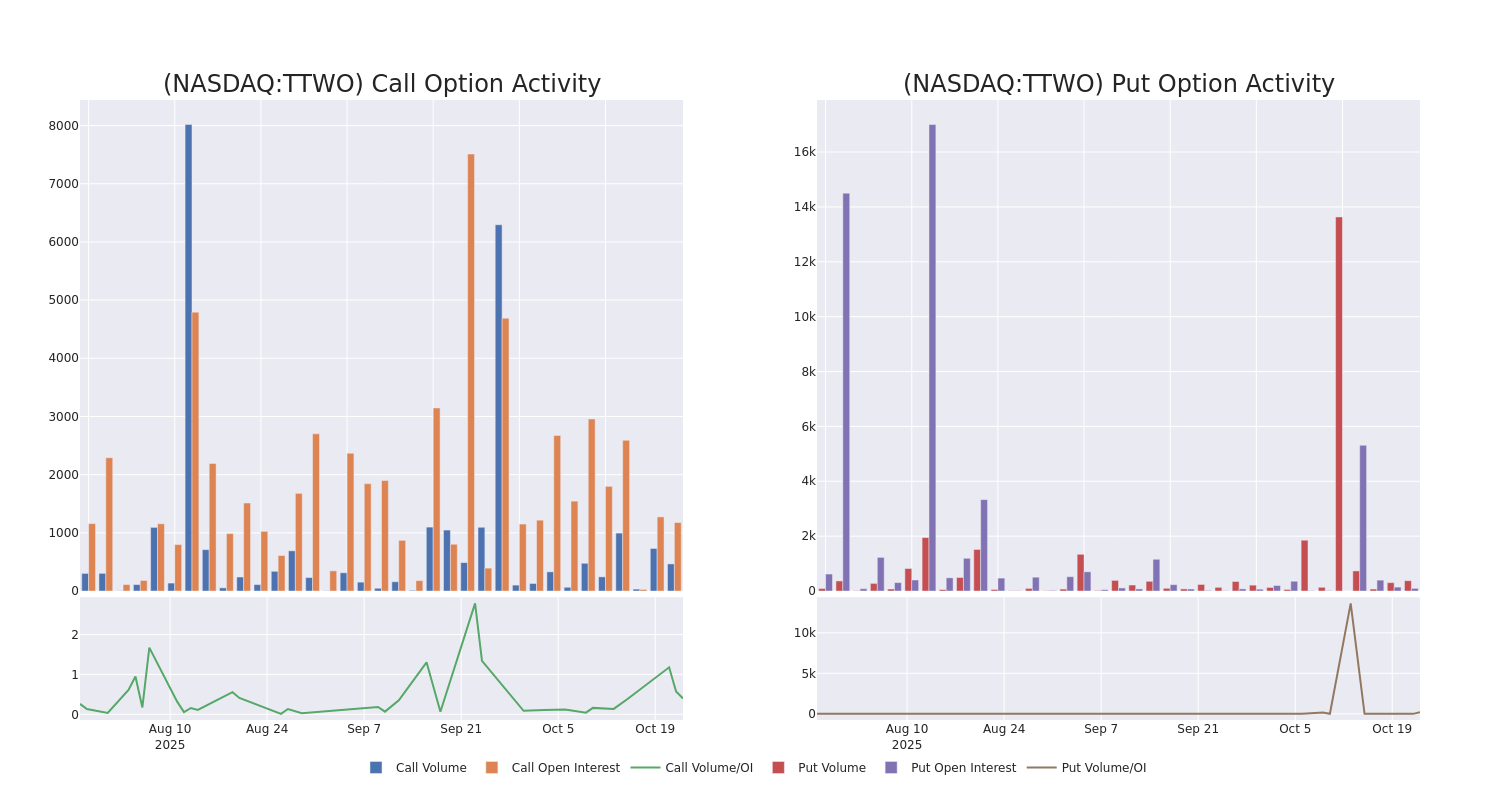

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Take-Two Interactive options trades today is 182.29 with a total volume of 843.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Take-Two Interactive's big money trades within a strike price range of $200.0 to $265.0 over the last 30 days.

Take-Two Interactive Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| TTWO |

CALL |

TRADE |

BEARISH |

11/07/25 |

$8.7 |

$8.2 |

$8.2 |

$262.50 |

$138.5K |

77 |

213 |

| TTWO |

PUT |

TRADE |

BULLISH |

11/07/25 |

$7.4 |

$6.8 |

$7.0 |

$247.50 |

$109.2K |

1 |

202 |

| TTWO |

PUT |

TRADE |

BULLISH |

03/20/26 |

$19.0 |

$18.0 |

$18.0 |

$250.00 |

$90.0K |

53 |

50 |

| TTWO |

PUT |

TRADE |

BULLISH |

11/07/25 |

$8.1 |

$7.6 |

$7.7 |

$250.00 |

$73.1K |

34 |

100 |

| TTWO |

CALL |

TRADE |

NEUTRAL |

01/16/26 |

$61.0 |

$58.2 |

$59.85 |

$200.00 |

$59.8K |

1.0K |

35 |

About Take-Two Interactive

Take-Two is one of the largest global developers and publishers of video games, with labels including Rockstar, 2K, and Zynga. Grand Theft Auto is the firm's biggest franchise, accounting for about 30% of total sales for the past decade. NBA 2K is the industry's dominant basketball video game, with Take-Two releasing a new version annually. Other notable franchises include Red Dead Redemption, Borderlands, and Civilization. Typically, more than three quarters of the firm's sales are from in-game spending, with the remainder coming from initial game sales. Since acquiring Zynga in 2022, mobile makes up about half of total sales.

Having examined the options trading patterns of Take-Two Interactive, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Take-Two Interactive

- With a trading volume of 493,901, the price of TTWO is down by -0.14%, reaching $255.21.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 14 days from now.

What The Experts Say On Take-Two Interactive

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $287.25.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* In a cautious move, an analyst from CICC downgraded its rating to Outperform, setting a price target of $272.

* Maintaining their stance, an analyst from Wells Fargo continues to hold a Overweight rating for Take-Two Interactive, targeting a price of $277.

* An analyst from DA Davidson has decided to maintain their Buy rating on Take-Two Interactive, which currently sits at a price target of $300.

* Maintaining their stance, an analyst from Benchmark continues to hold a Buy rating for Take-Two Interactive, targeting a price of $300.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Take-Two Interactive options trades with real-time alerts from Benzinga Pro.

Posted In: TTWO