A Glimpse of Cognizant Tech Solns's Earnings Potential

Author: Benzinga Insights | October 28, 2025 11:02am

Cognizant Tech Solns (NASDAQ:CTSH) is set to give its latest quarterly earnings report on Wednesday, 2025-10-29. Here's what investors need to know before the announcement.

Analysts estimate that Cognizant Tech Solns will report an earnings per share (EPS) of $1.30.

The announcement from Cognizant Tech Solns is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

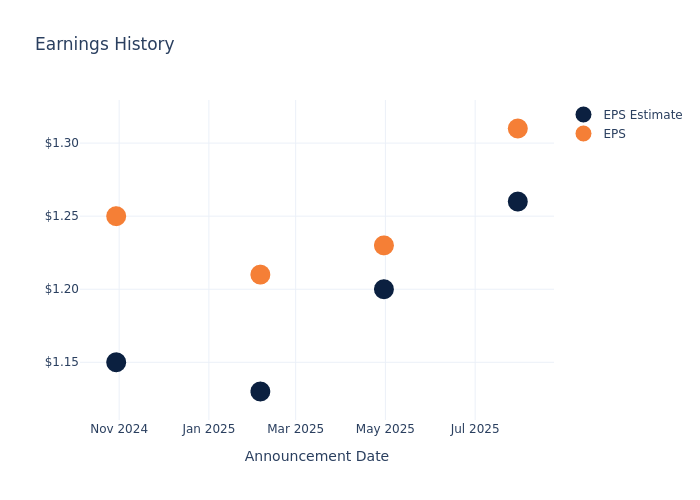

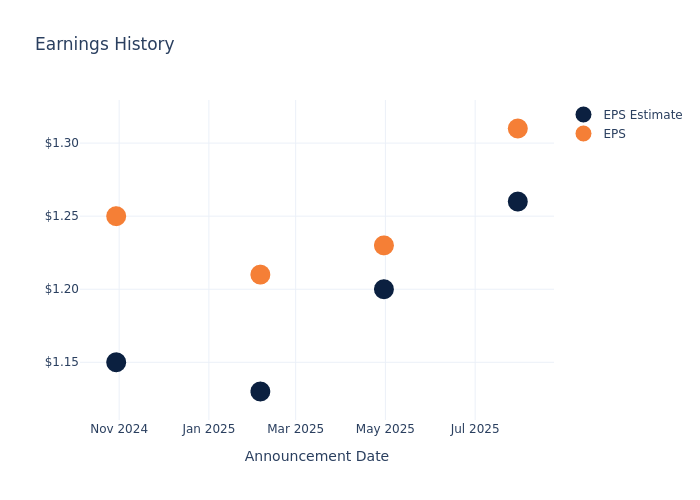

Earnings Track Record

During the last quarter, the company reported an EPS beat by $0.05, leading to a 2.41% drop in the share price on the subsequent day.

Here's a look at Cognizant Tech Solns's past performance and the resulting price change:

| Quarter |

Q2 2025 |

Q1 2025 |

Q4 2024 |

Q3 2024 |

| EPS Estimate |

1.26 |

1.20 |

1.13 |

1.15 |

| EPS Actual |

1.31 |

1.23 |

1.21 |

1.25 |

| Price Change % |

-2.00 |

2.00 |

4.00 |

0.00 |

Performance of Cognizant Tech Solns Shares

Shares of Cognizant Tech Solns were trading at $68.05 as of October 27. Over the last 52-week period, shares are down 8.35%. Given that these returns are generally negative, long-term shareholders are likely unhappy going into this earnings release.

Insights Shared by Analysts on Cognizant Tech Solns

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Cognizant Tech Solns.

A total of 5 analyst ratings have been received for Cognizant Tech Solns, with the consensus rating being Outperform. The average one-year price target stands at $86.4, suggesting a potential 26.97% upside.

Comparing Ratings with Peers

The following analysis focuses on the analyst ratings and average 1-year price targets of Gartner, EPAM Systems and Kyndryl Hldgs, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Gartner, with an average 1-year price target of $312.18, suggesting a potential 358.75% upside.

- Analysts currently favor an Neutral trajectory for EPAM Systems, with an average 1-year price target of $182.75, suggesting a potential 168.55% upside.

- Analysts currently favor an Neutral trajectory for Kyndryl Hldgs, with an average 1-year price target of $30.0, suggesting a potential 55.91% downside.

Key Findings: Peer Analysis Summary

The peer analysis summary presents essential metrics for Gartner, EPAM Systems and Kyndryl Hldgs, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company |

Consensus |

Revenue Growth |

Gross Profit |

Return on Equity |

| Cognizant Tech Solns |

Outperform |

8.14% |

$1.77B |

4.27% |

| Gartner |

Neutral |

5.73% |

$1.15B |

15.89% |

| EPAM Systems |

Neutral |

18.04% |

$389.43M |

2.41% |

| Kyndryl Hldgs |

Neutral |

0.11% |

$796M |

4.57% |

Key Takeaway:

Cognizant Tech Solns ranks first in revenue growth among its peers. It ranks lowest in gross profit and return on equity.

Delving into Cognizant Tech Solns's Background

Cognizant Technology Solutions is a multinational IT services provider that offers a range of consulting and business process outsourcing services. Originally founded in India, the company is headquartered in the US and serves enterprise customers spanning the financial services, healthcare, and resources industries. With most of its workforce located in India, Cognizant leverages a global delivery model that helps clients outsource their IT needs to offshore labor.

Key Indicators: Cognizant Tech Solns's Financial Health

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Positive Revenue Trend: Examining Cognizant Tech Solns's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 8.14% as of 30 June, 2025, showcasing a substantial increase in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: Cognizant Tech Solns's net margin is impressive, surpassing industry averages. With a net margin of 12.3%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Cognizant Tech Solns's ROE excels beyond industry benchmarks, reaching 4.27%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 3.21%, the company showcases effective utilization of assets.

Debt Management: Cognizant Tech Solns's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.08.

To track all earnings releases for Cognizant Tech Solns visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: CTSH