Bloom Energy Options Trading: A Deep Dive into Market Sentiment

Author: Benzinga Insights | October 28, 2025 11:02am

Deep-pocketed investors have adopted a bullish approach towards Bloom Energy (NYSE:BE), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in BE usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 54 extraordinary options activities for Bloom Energy. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 40% leaning bullish and 38% bearish. Among these notable options, 13 are puts, totaling $827,236, and 41 are calls, amounting to $3,302,124.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $25.0 to $180.0 for Bloom Energy over the last 3 months.

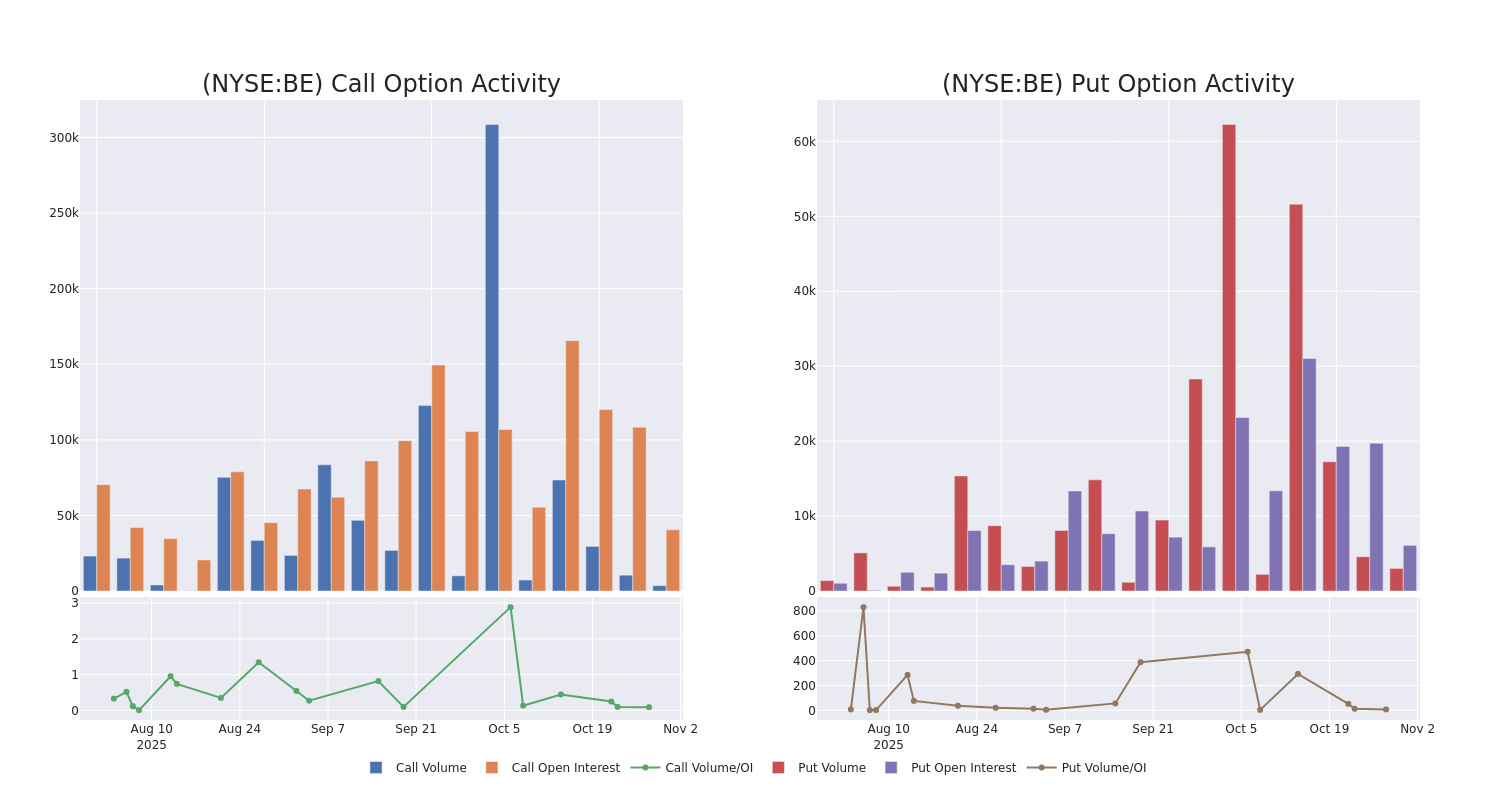

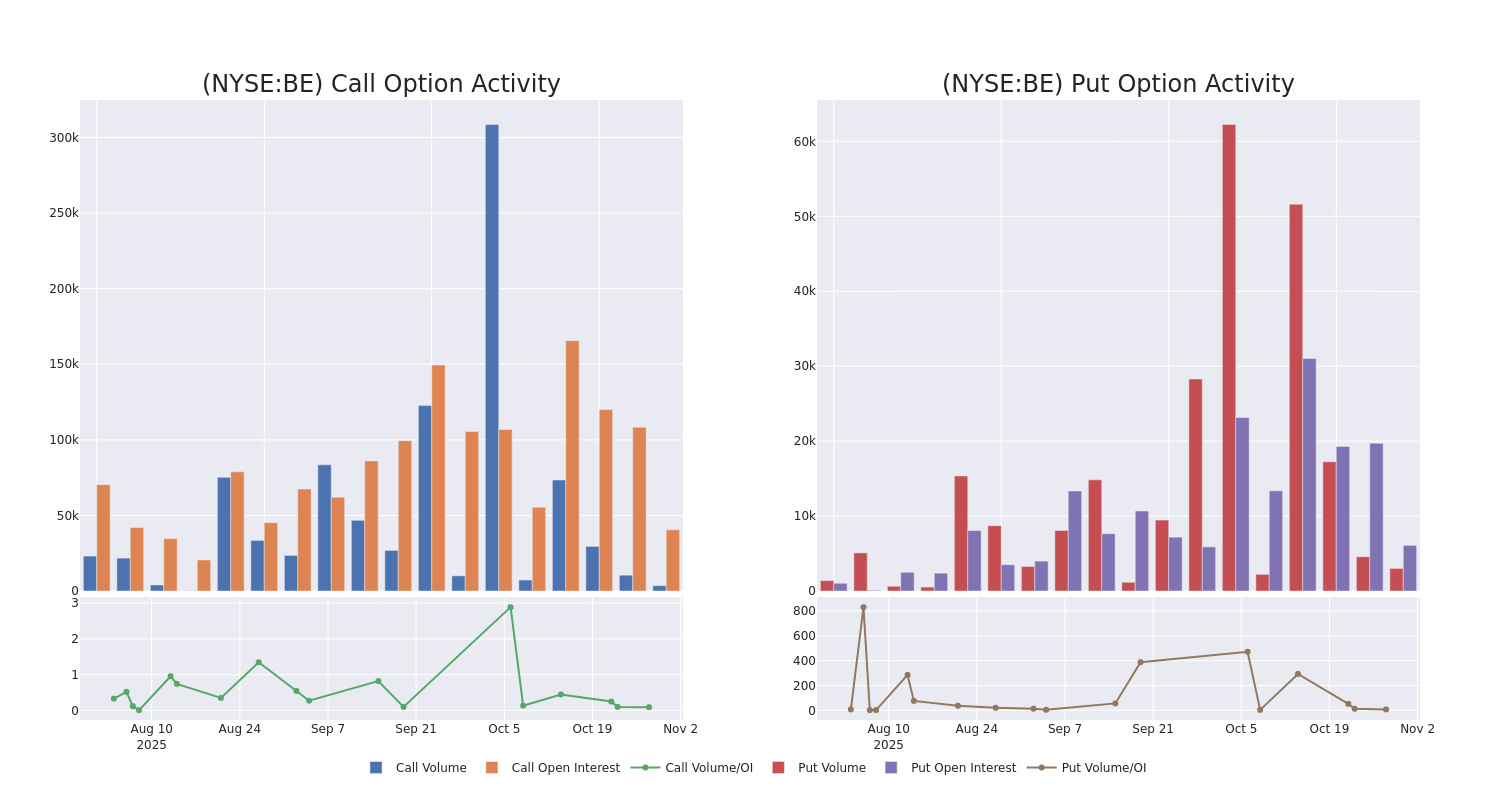

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Bloom Energy's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Bloom Energy's substantial trades, within a strike price spectrum from $25.0 to $180.0 over the preceding 30 days.

Bloom Energy Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| BE |

CALL |

SWEEP |

NEUTRAL |

03/20/26 |

$63.7 |

$60.8 |

$62.0 |

$50.00 |

$403.1K |

698 |

65 |

| BE |

CALL |

TRADE |

BULLISH |

03/20/26 |

$66.9 |

$66.9 |

$66.9 |

$45.00 |

$334.5K |

1.0K |

50 |

| BE |

PUT |

SWEEP |

NEUTRAL |

11/21/25 |

$12.3 |

$11.4 |

$11.85 |

$100.00 |

$237.0K |

1.7K |

822 |

| BE |

CALL |

TRADE |

BULLISH |

01/16/26 |

$18.4 |

$17.4 |

$18.0 |

$130.00 |

$180.0K |

1.4K |

101 |

| BE |

CALL |

TRADE |

BEARISH |

01/16/26 |

$18.9 |

$17.6 |

$18.0 |

$130.00 |

$165.6K |

1.4K |

306 |

About Bloom Energy

Bloom Energy designs, manufactures, sells, and installs solid-oxide fuel cell systems ("Energy Servers") for on-site power generation. Bloom Energy Servers are fuel-flexible and can use natural gas, biogas, and hydrogen to create 24/7 electricity for stationary applications. Bloom primarily sells its systems in the United States and internationally.

Present Market Standing of Bloom Energy

- Currently trading with a volume of 1,893,392, the BE's price is down by -1.32%, now at $107.1.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 0 days.

What The Experts Say On Bloom Energy

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $94.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from JP Morgan has decided to maintain their Overweight rating on Bloom Energy, which currently sits at a price target of $90.

* An analyst from BMO Capital has decided to maintain their Market Perform rating on Bloom Energy, which currently sits at a price target of $97.

* An analyst from Mizuho downgraded its action to Neutral with a price target of $79.

* Consistent in their evaluation, an analyst from Susquehanna keeps a Positive rating on Bloom Energy with a target price of $105.

* An analyst from Evercore ISI Group has revised its rating downward to Outperform, adjusting the price target to $100.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Bloom Energy, Benzinga Pro gives you real-time options trades alerts.

Posted In: BE