Avantor's Earnings Outlook

Author: Benzinga Insights | October 28, 2025 11:02am

Avantor (NYSE:AVTR) will release its quarterly earnings report on Wednesday, 2025-10-29. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Avantor to report an earnings per share (EPS) of $0.23.

The market awaits Avantor's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

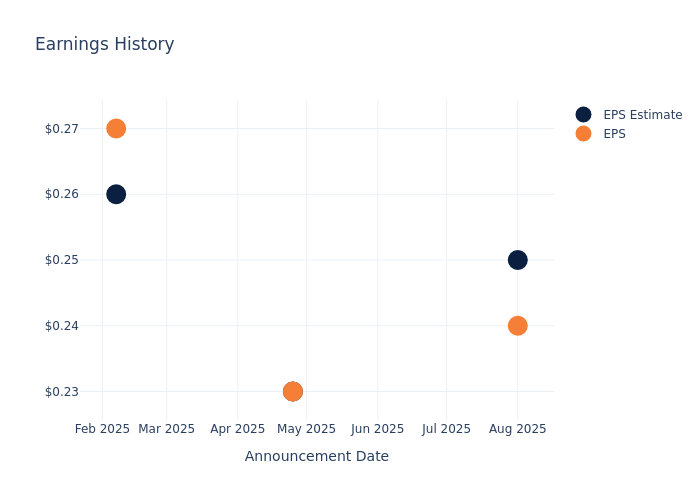

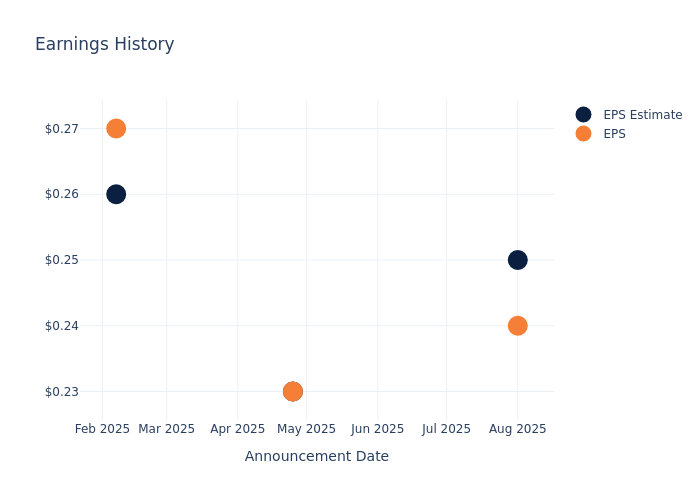

Earnings History Snapshot

During the last quarter, the company reported an EPS missed by $0.01, leading to a 0.0% drop in the share price on the subsequent day.

Here's a look at Avantor's past performance and the resulting price change:

| Quarter |

Q2 2025 |

Q1 2025 |

Q4 2024 |

Q3 2024 |

| EPS Estimate |

0.25 |

0.23 |

0.26 |

0.25 |

| EPS Actual |

0.24 |

0.23 |

0.27 |

0.26 |

| Price Change % |

-15.00 |

-17.00 |

-12.00 |

-4.00 |

Stock Performance

Shares of Avantor were trading at $15.11 as of October 27. Over the last 52-week period, shares are down 33.01%. Given that these returns are generally negative, long-term shareholders are likely a little upset going into this earnings release.

Analysts' Perspectives on Avantor

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Avantor.

A total of 12 analyst ratings have been received for Avantor, with the consensus rating being Outperform. The average one-year price target stands at $14.75, suggesting a potential 2.38% downside.

Analyzing Ratings Among Peers

This comparison focuses on the analyst ratings and average 1-year price targets of Qiagen, Bio-Techne and Charles River, three major players in the industry, shedding light on their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Qiagen, with an average 1-year price target of $51.5, suggesting a potential 240.83% upside.

- Analysts currently favor an Buy trajectory for Bio-Techne, with an average 1-year price target of $69.2, suggesting a potential 357.97% upside.

- Analysts currently favor an Neutral trajectory for Charles River, with an average 1-year price target of $182.71, suggesting a potential 1109.2% upside.

Key Findings: Peer Analysis Summary

In the peer analysis summary, key metrics for Qiagen, Bio-Techne and Charles River are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company |

Consensus |

Revenue Growth |

Gross Profit |

Return on Equity |

| Avantor |

Outperform |

-1.14% |

$554.10M |

1.04% |

| Qiagen |

Neutral |

7.49% |

$334.29M |

2.78% |

| Bio-Techne |

Buy |

3.55% |

$198.81M |

-0.90% |

| Charles River |

Neutral |

0.59% |

$357.07M |

1.60% |

Key Takeaway:

Avantor ranks at the top for Gross Profit and Return on Equity among its peers. It is in the middle for Revenue Growth.

Unveiling the Story Behind Avantor

Avantor Inc provider of products and services to customers in the biopharma, healthcare, education & government, and advanced technologies & applied materials industries. The company has three geographic segments: the Americas, Europe, and AMEA. The company's product group consists of Equipment & instrumentation, Services & specialty procurement, Proprietary materials & consumables, and Third-party materials & consumables. Materials & consumables include high-purity chemicals and reagents, lab products and supplies, specialized formulated silicone materials, customized excipients, customized single-use assemblies, process chromatography resins and columns, analytical sample prep kits, and education and microbiology and clinical trial kits, peristaltic pumps and fluid handling tips.

A Deep Dive into Avantor's Financials

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Challenges: Avantor's revenue growth over 3 months faced difficulties. As of 30 June, 2025, the company experienced a decline of approximately -1.14%. This indicates a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 3.84%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 1.04%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 0.52%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Avantor's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.67.

To track all earnings releases for Avantor visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: AVTR