Looking At Merck & Co's Recent Unusual Options Activity

Author: Benzinga Insights | October 28, 2025 02:01pm

Financial giants have made a conspicuous bullish move on Merck & Co. Our analysis of options history for Merck & Co (NYSE:MRK) revealed 9 unusual trades.

Delving into the details, we found 55% of traders were bullish, while 44% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $268,018, and 5 were calls, valued at $429,832.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $65.0 to $90.0 for Merck & Co over the recent three months.

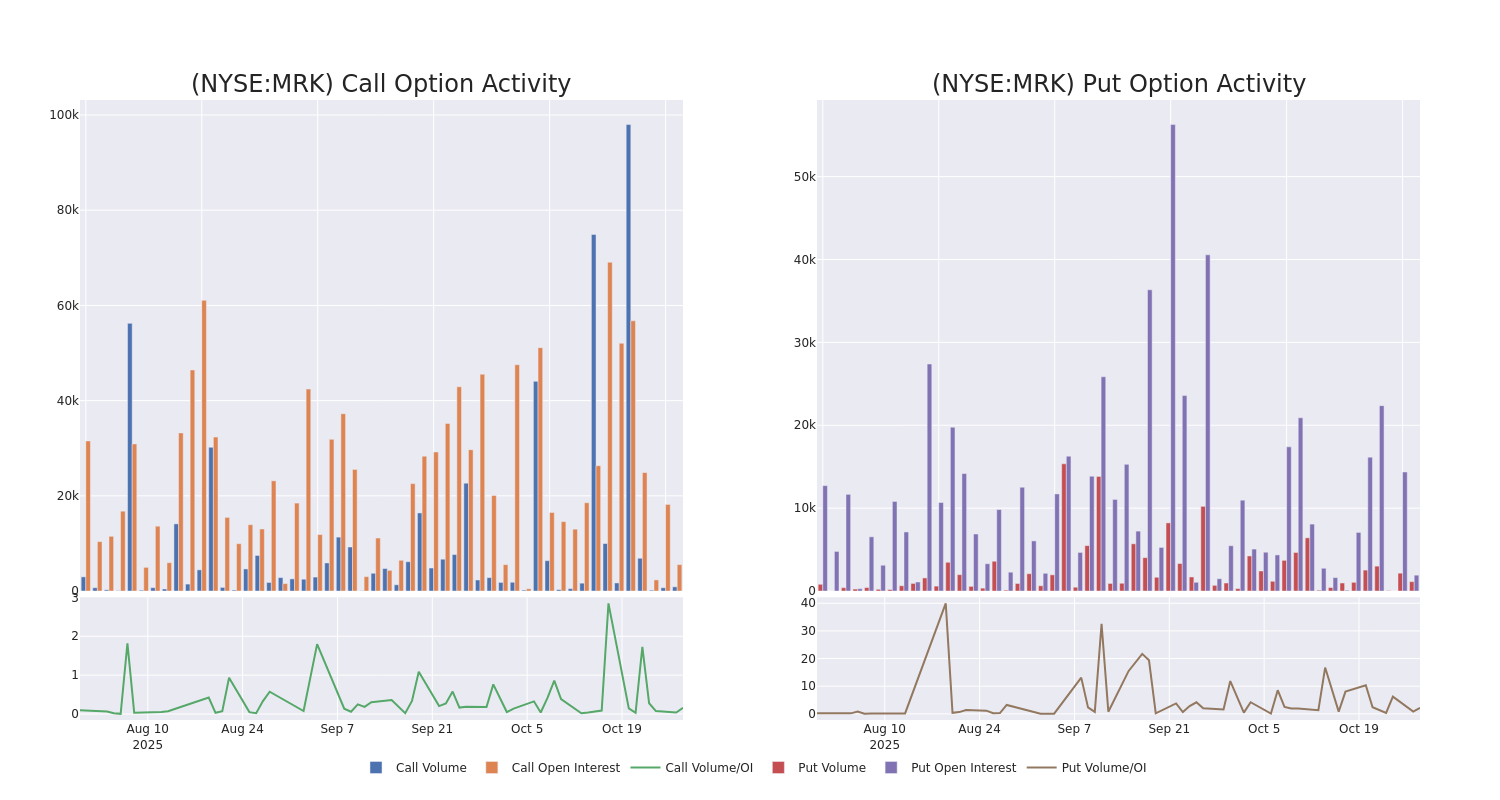

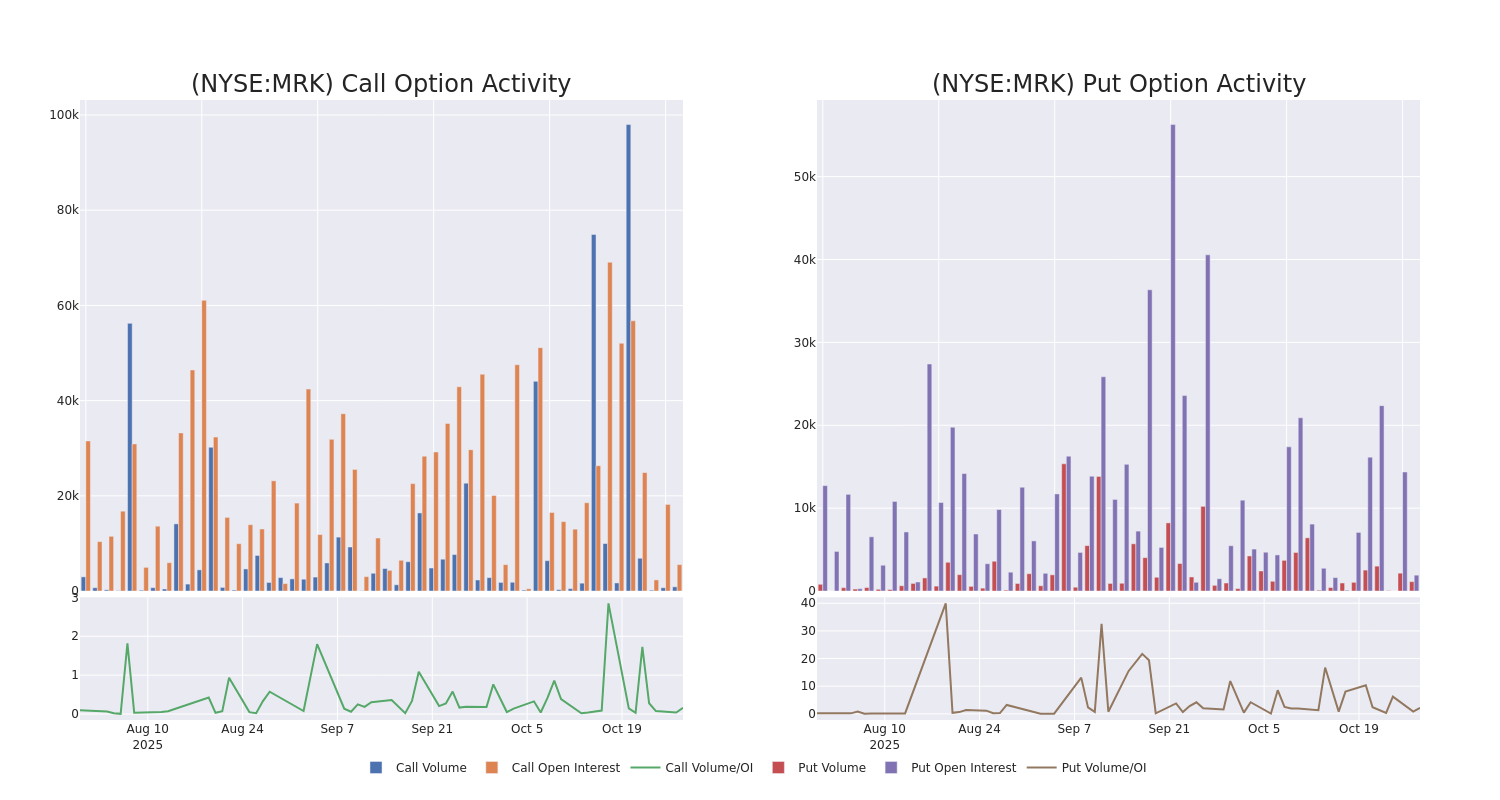

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Merck & Co's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Merck & Co's significant trades, within a strike price range of $65.0 to $90.0, over the past month.

Merck & Co 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| MRK |

CALL |

TRADE |

BEARISH |

04/17/26 |

$5.5 |

$5.2 |

$5.25 |

$90.00 |

$183.7K |

3.0K |

357 |

| MRK |

PUT |

SWEEP |

BULLISH |

09/18/26 |

$8.8 |

$7.65 |

$7.65 |

$85.00 |

$145.3K |

496 |

206 |

| MRK |

CALL |

TRADE |

BEARISH |

01/15/27 |

$25.05 |

$24.7 |

$24.7 |

$65.00 |

$123.5K |

133 |

64 |

| MRK |

CALL |

TRADE |

BULLISH |

12/19/25 |

$18.4 |

$18.25 |

$18.4 |

$70.00 |

$55.2K |

883 |

30 |

| MRK |

PUT |

SWEEP |

BEARISH |

10/31/25 |

$1.6 |

$1.6 |

$1.6 |

$87.00 |

$48.9K |

525 |

335 |

About Merck & Co

Merck makes pharmaceutical products to treat several conditions in a number of therapeutic areas, including cardiometabolic disease, cancer, and infections. Within cancer, the firm's immuno-oncology platform, led by Keytruda, is a major contributor to overall sales. The company also has a substantial vaccine business aimed at preventing pediatric diseases, as well as Gardasil for human papillomavirus. Additionally, Merck sells animal health-related drugs. From a geographical perspective, 47% of the company's sales are generated from US human health (pharmaceuticals and vaccines).

Current Position of Merck & Co

- With a trading volume of 3,711,859, the price of MRK is up by 0.17%, reaching $88.15.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 2 days from now.

What Analysts Are Saying About Merck & Co

1 market experts have recently issued ratings for this stock, with a consensus target price of $95.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Reflecting concerns, an analyst from Citigroup lowers its rating to Neutral with a new price target of $95.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Merck & Co, Benzinga Pro gives you real-time options trades alerts.

Posted In: MRK