A Closer Look at Palantir Technologies's Options Market Dynamics

Author: Benzinga Insights | October 29, 2025 12:01pm

Whales with a lot of money to spend have taken a noticeably bullish stance on Palantir Technologies.

Looking at options history for Palantir Technologies (NASDAQ:PLTR) we detected 261 trades.

If we consider the specifics of each trade, it is accurate to state that 48% of the investors opened trades with bullish expectations and 36% with bearish.

From the overall spotted trades, 31 are puts, for a total amount of $1,573,793 and 230, calls, for a total amount of $27,259,591.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $80.0 to $380.0 for Palantir Technologies over the recent three months.

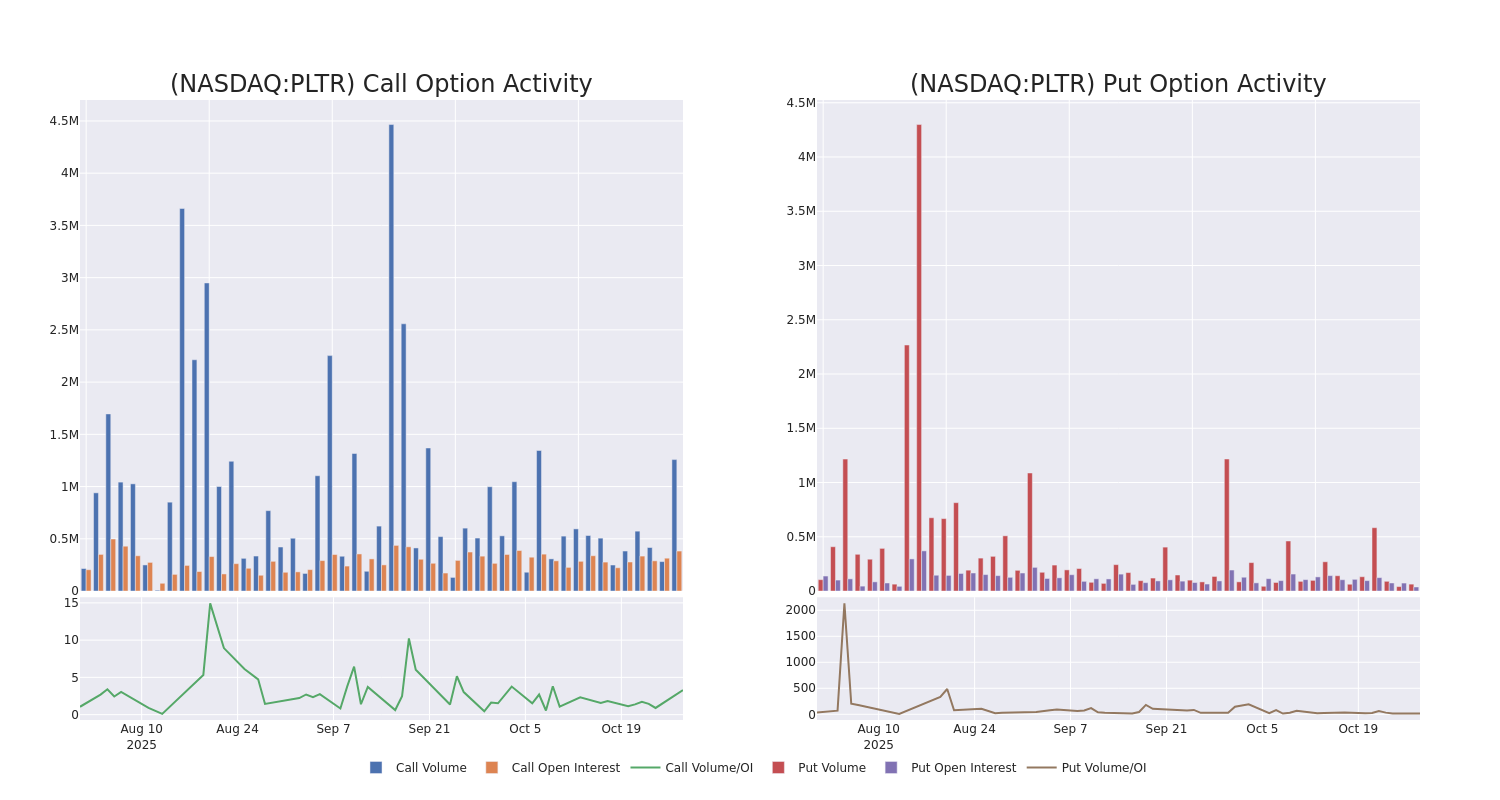

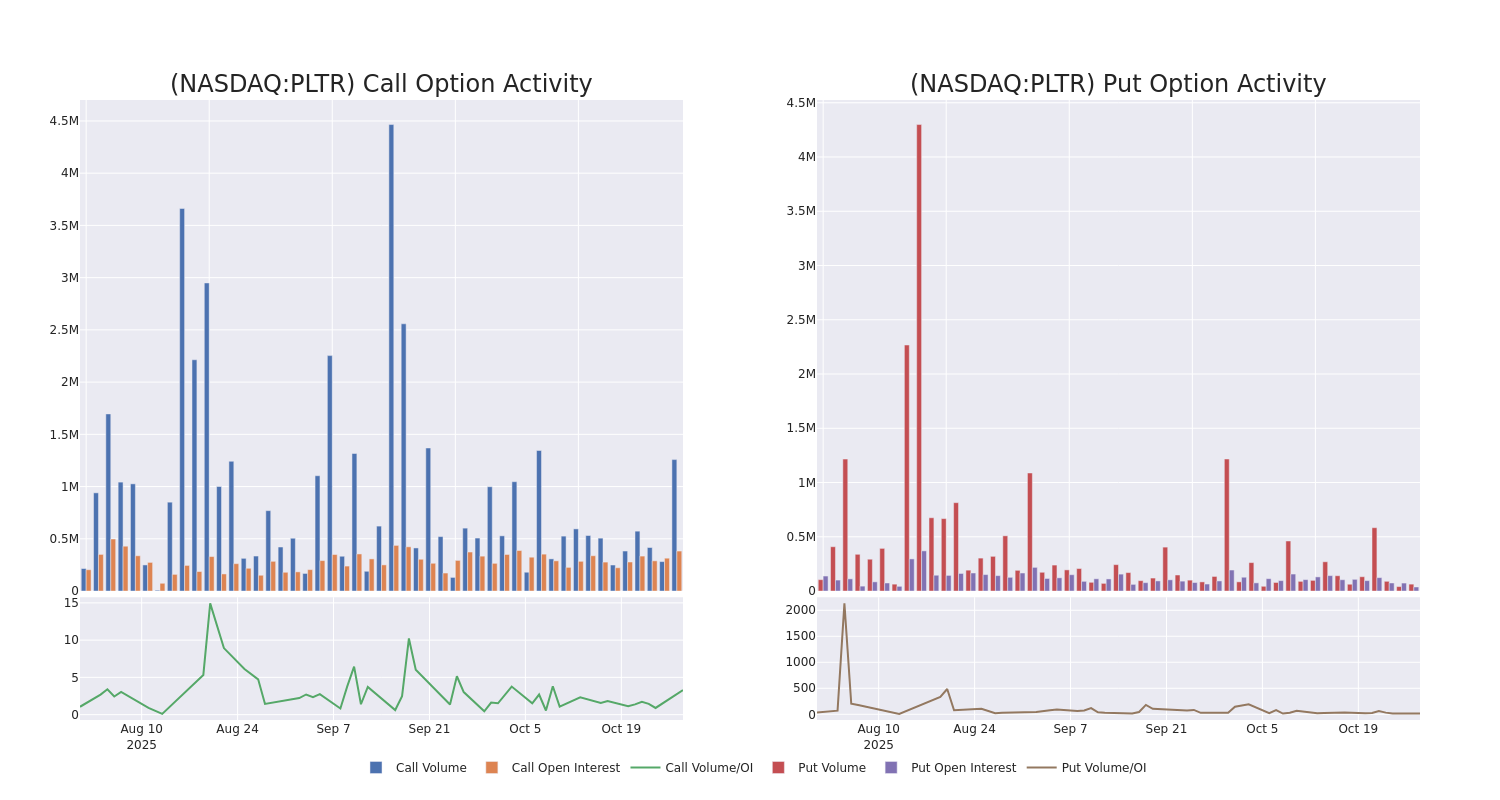

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Palantir Technologies options trades today is 6921.55 with a total volume of 2,950,217.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Palantir Technologies's big money trades within a strike price range of $80.0 to $380.0 over the last 30 days.

Palantir Technologies 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| PLTR |

CALL |

SWEEP |

BULLISH |

10/31/25 |

$2.54 |

$2.5 |

$2.53 |

$202.50 |

$632.4K |

19.4K |

19.0K |

| PLTR |

CALL |

SWEEP |

BULLISH |

11/21/25 |

$9.45 |

$9.3 |

$9.45 |

$210.00 |

$472.5K |

13.4K |

4.6K |

| PLTR |

CALL |

SWEEP |

BEARISH |

01/16/26 |

$112.85 |

$112.5 |

$112.65 |

$85.00 |

$360.4K |

2.0K |

223 |

| PLTR |

CALL |

SWEEP |

BEARISH |

01/16/26 |

$107.95 |

$107.65 |

$107.83 |

$90.00 |

$344.8K |

4.0K |

242 |

| PLTR |

CALL |

TRADE |

BEARISH |

01/15/27 |

$54.3 |

$54.1 |

$54.1 |

$200.00 |

$265.0K |

3.3K |

739 |

About Palantir Technologies

Palantir is an analytical software company that focuses on leveraging data to create efficiencies in its clients' organizations. The firm serves commercial and government clients via its Foundry and Gotham platforms, respectively. Palantir works only with entities in Western-allied nations and reserves the right not to work with anyone that is antithetical to Western values. The Denver-based company was founded in 2003 and went public in 2020.

After a thorough review of the options trading surrounding Palantir Technologies, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Palantir Technologies Standing Right Now?

- Currently trading with a volume of 28,853,796, the PLTR's price is up by 3.69%, now at $196.6.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 5 days.

What Analysts Are Saying About Palantir Technologies

In the last month, 2 experts released ratings on this stock with an average target price of $195.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Piper Sandler continues to hold a Overweight rating for Palantir Technologies, targeting a price of $201.

* An analyst from Citigroup persists with their Neutral rating on Palantir Technologies, maintaining a target price of $190.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Palantir Technologies, Benzinga Pro gives you real-time options trades alerts.

Posted In: PLTR