Exploring ACM Research's Earnings Expectations

Author: Benzinga Insights | November 04, 2025 11:04am

ACM Research (NASDAQ:ACMR) is preparing to release its quarterly earnings on Wednesday, 2025-11-05. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect ACM Research to report an earnings per share (EPS) of $0.45.

Investors in ACM Research are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

Overview of Past Earnings

The company's EPS beat by $0.13 in the last quarter, leading to a 3.31% drop in the share price on the following day.

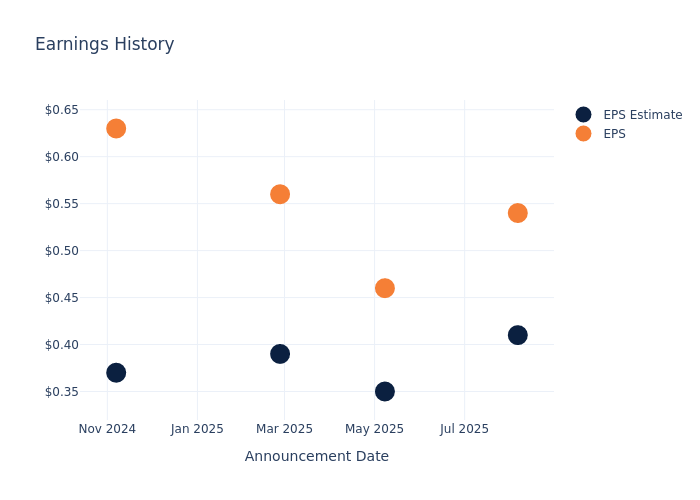

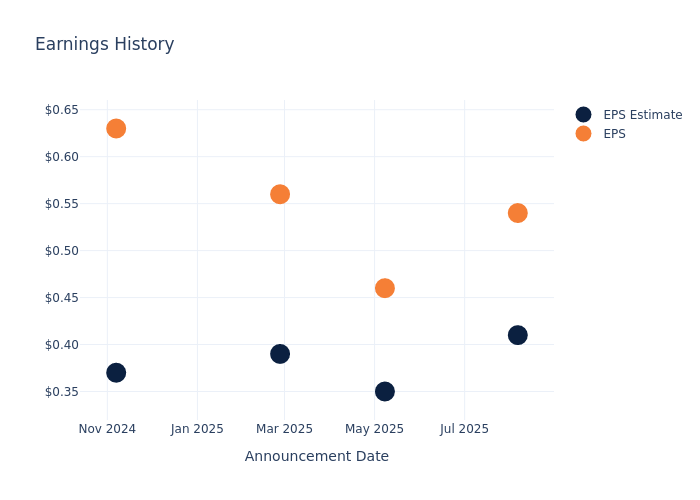

Here's a look at ACM Research's past performance and the resulting price change:

| Quarter |

Q2 2025 |

Q1 2025 |

Q4 2024 |

Q3 2024 |

| EPS Estimate |

0.41 |

0.35 |

0.39 |

0.37 |

| EPS Actual |

0.54 |

0.46 |

0.56 |

0.63 |

| Price Change % |

-3.00 |

-1.00 |

-6.00 |

-7.00 |

ACM Research Share Price Analysis

Shares of ACM Research were trading at $41.37 as of November 03. Over the last 52-week period, shares are up 108.18%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Views on ACM Research

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding ACM Research.

The consensus rating for ACM Research is Buy, derived from 1 analyst ratings. An average one-year price target of $50.0 implies a potential 20.86% upside.

Comparing Ratings with Competitors

The analysis below examines the analyst ratings and average 1-year price targets of and Axcelis Technologies, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for Axcelis Technologies, with an average 1-year price target of $98.75, suggesting a potential 138.7% upside.

Peer Metrics Summary

The peer analysis summary outlines pivotal metrics for and Axcelis Technologies, demonstrating their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company |

Consensus |

Revenue Growth |

Gross Profit |

Return on Equity |

| ACM Research |

Buy |

6.37% |

$104.46M |

3.08% |

| Axcelis Technologies |

Buy |

-24.16% |

$87.34M |

3.06% |

Key Takeaway:

ACM Research ranks higher than its peer in terms of revenue growth and gross profit. However, it lags behind in terms of return on equity. Overall, ACM Research is positioned in the middle compared to its peer based on the provided metrics.

Delving into ACM Research's Background

ACM Research Inc supplies advanced, innovative capital equipment developed for the world-wide semiconductor industry. Fabricators of advanced integrated circuits, or chips, can use its wet-cleaning and other front-end processing tools in numerous steps to improve product yield, even at increasingly advanced process nodes. It has designed these tools for use in fabricating foundry, logic and memory chips, including dynamic random-access memory, or DRAM, and 3D NAND-flash memory chips. The company also develops, manufactures and sells advanced packaging tools to wafer assembly and packaging customers.

Breaking Down ACM Research's Financial Performance

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: ACM Research displayed positive results in 3 months. As of 30 June, 2025, the company achieved a solid revenue growth rate of approximately 6.37%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: ACM Research's net margin excels beyond industry benchmarks, reaching 13.82%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): ACM Research's ROE excels beyond industry benchmarks, reaching 3.08%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): ACM Research's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 1.5%, the company may face hurdles in achieving optimal financial performance.

Debt Management: With a below-average debt-to-equity ratio of 0.29, ACM Research adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for ACM Research visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: ACMR